3M 2008 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

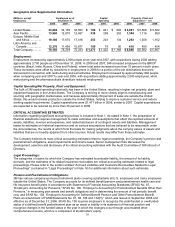

Industrial and Transportation continues to invest in innovative new products along with complementary gap-fill

acquisitions, evidenced by the closing of eight acquisitions in 2008, with some of the larger acquisitions summarized

as follows. In July 2008, 3M acquired K&H Surface Technologies Pty. Ltd., an Australian-based manufacturing

company specializing in a range of repair products for the professional do-it-yourself automotive refinish markets. In

August 2008, 3M acquired Polyfoam Products Inc., a structural adhesives company specializing in foam adhesives

for tile roofing and other adhesive products for the building industry. In October 2008, 3M completed its acquisition of

EMFI S.A. and SAPO S.A.S., manufacturers of polyurethane-based structural adhesives and sealants headquartered

in Haguenau, France. In October 2008, 3M also completed its acquisition of Meguiar’s Inc., a 100-year-old business

that manufactures the leading Meguiar’s brand of car care products for cleaning and protecting automotive surfaces,

which is headquartered in Irvine, California.

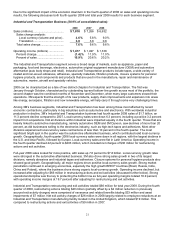

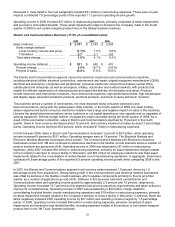

In 2007, local-currency sales increased 5.8 percent, including 1.8 percent growth from acquisitions. Sales growth

was broad-based, led by industrial adhesives and tapes, automotive aftermarket, abrasives and automotive OEM

businesses. All geographic areas contributed positively to growth. Significant manufacturing investments were made

in emerging economies such as India, China and Poland to simplify the supply chain and get closer to local

customers. Good operational discipline helped deliver operating income growth of 11.9 percent, with operating

income margins of 20.6 percent. Operating income in 2007 included $9 million in restructuring and other exit activity

expenses, primarily comprised of severance and related benefits. Operating income in 2006 included $15 million in

restructuring expenses, primarily comprised of asset impairments and severance and related benefits.

In March 2005, 3M’s automotive business completed the purchase of 19 percent of TI&M Beteiligungsgesellschaft

mbH (TI&M) for approximately $55 million. TI&M is the parent company of I&T Innovation Technology

Entwicklungsund Holding Aktiengesellschaft (I&T), an Austrian maker of flat flexible cable and circuitry. Pursuant to a

Shareholders Agreement, 3M marketed the firm’s flat flexible wiring systems for automotive interior applications to

the global automotive market. I&T filed a petition for bankruptcy protection in August 2006. As part of its agreement

to purchase the shares of TI&M, the Company was granted a put option, which gave the Company the right to sell

back its entire ownership interest in TI&M to the other investors from whom 3M acquired its 19 percent interest. The

put option became exercisable January 1, 2007. The Company exercised the put option and recovered

approximately $25 million of its investment from one of the investors based in Belgium in February 2007. The other

two TI&M investors have filed a bankruptcy petition in Austria. The Company is pursuing recovery of the balance of

its investment both through the Austrian bankruptcy proceedings and pursuant to the terms of the Share Purchase

Agreement. The Company received approximately $6 million of its investment back in the fourth quarter of 2008. The

Company believes collection of its remaining investment is probable and, as a result, no impairment reserve has

been recorded.

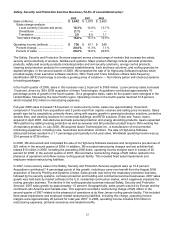

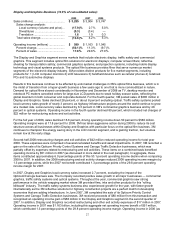

Health Care Business (17.0% of consolidated sales):

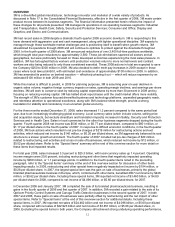

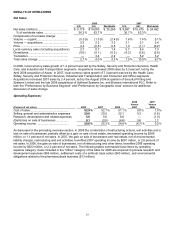

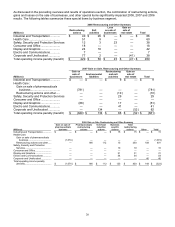

2008 2007 2006

Sales (millions)........................................ $ 4,293 $ 3,968 $ 4,011

Sales change analysis:

Local currency (volume and price)... 6.8 % 18.3 % 6.0 %

Divestitures ...................................... (0.1 ) (23.7 ) —

Translation ....................................... 1.5 4.3 0.7

Total sales change............................... 8.2 % (1.1 )% 6.7 %

Operating income (millions) .................... $ 1,173 $ 1,882 $ 1,845

Percent change.................................... (37.7)% 2.0 % 65.6 %

Percent of sales ................................... 27.3 % 47.4 % 46.0 %

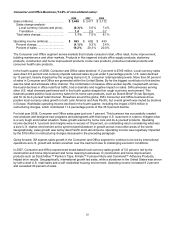

The Health Care segment serves markets that include medical clinics and hospitals, pharmaceuticals, dental and

orthodontic practitioners, and health information systems. Products and services provided to these and other markets

include medical and surgical supplies, skin health and infection prevention products, drug delivery systems, dental

and orthodontic products, health information systems and anti-microbial solutions. As discussed in Note 2, the global

branded pharmaceuticals business was sold in December 2006 and January 2007.

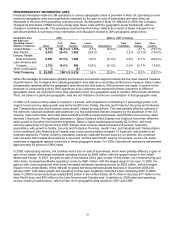

In the fourth quarter of 2008, Health Care sales topped $1 billion, despite a nearly 7 percentage point penalty from

currency translation. In local-currency terms, sales rose 4.5 percent, including 2.2 percent from acquisitions. 3M saw

solid local-currency growth in the medical products area, specifically in core infection prevention and skin and wound

care products. Geographically, the U.S. and Asia Pacific led sales growth. Operating income margins of 24.0 percent

in the fourth quarter of 2008 were the highest in the Company, which includes the impact of $50 million in

restructuring and exit activity charges that reduced operating income margins by 4.9 percentage points. This is a