3M 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

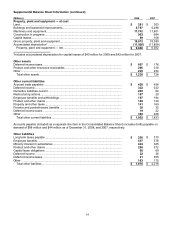

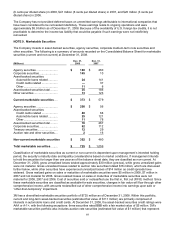

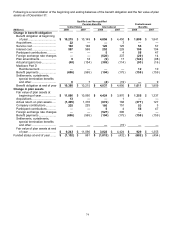

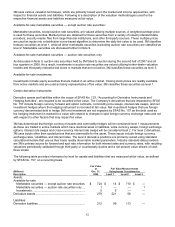

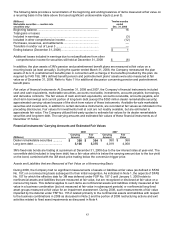

Following is a reconciliation of the beginning and ending balances of the benefit obligation and the fair value of plan

assets as of December 31:

Qualified and Non-qualified

Pension Benefits Postretirement

United States International Benefits

(Millions) 2008 2007 2008 2007 2008 2007

Change in benefit obligation

Benefit obligation at beginning

of year ................................... $ 10,215 $ 10,149 $ 4,856 $ 4,450

$ 1,809 $ 1,841

Acquisitions............................... 22 —

—

3 — —

Service cost .............................. 192 192 120 125

53 57

Interest cost .............................. 597 568 252 228

100 104

Participant contributions ........... — — 5

4

56 47

Foreign exchange rate changes — — (620 ) 337

(20 ) 14

Plan amendments..................... 9

18 (9 ) 17

(148 ) (98 )

Actuarial (gain) loss .................. (40 ) (154 ) (369 ) (114 ) (93 ) (16 )

Medicare Part D

Reimbursement..................... — — — —

12 10

Benefit payments...................... (606 ) (565 ) (194 ) (175 ) (158 ) (159 )

Settlements, curtailments,

special termination benefits

and other ............................... 6

7

(4 ) (19 ) — 9

Benefit obligation at end of year $ 10,395 $ 10,215 $ 4,037 $ 4,856

$ 1,611 $ 1,809

Change in plan assets

Fair value of plan assets at

beginning of year................... $ 11,096 $ 10,060 $ 4,424 $ 3,970

$ 1,355 $ 1,337

Acquisitions............................... 13 — — 1 — —

Actual return on plan assets ..... (1,495 ) 1,376 (872 ) 188

(377 ) 127

Company contributions............. 235 225 186 151

53 3

Participant contributions ........... — — 5

4

56 47

Foreign exchange rate changes — — (527 ) 300 — —

Benefit payments...................... (606 ) (565 ) (194 ) (175 ) (158 ) (159 )

Settlements, curtailments,

special termination benefits

and other ............................... — — —

(15 ) — —

Fair value of plan assets at end

of year ................................... $ 9,243 $ 11,096 $ 3,022 $ 4,424

$ 929 $ 1,355

Funded status at end of year ....... $ (1,152 ) $ 881 $ (1,015 ) $ (432 ) $ (682 ) $ (454 )