Under Armour 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

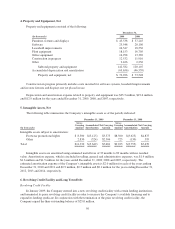

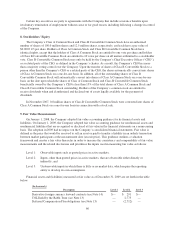

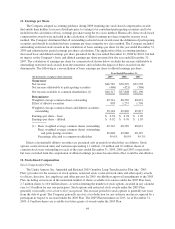

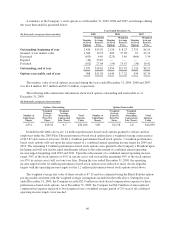

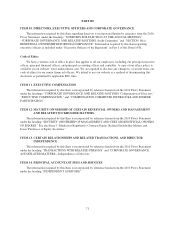

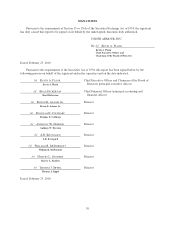

A summary of the Company’s stock options as of December 31, 2009, 2008 and 2007, and changes during

the years then ended is presented below:

(In thousands, except per share amounts)

Year Ended December 31,

2009 2008 2007

Number

of Stock

Options

Weighted

Average

Exercise

Price

Number

of Stock

Options

Weighted

Average

Exercise

Price

Number

of Stock

Options

Weighted

Average

Exercise

Price

Outstanding, beginning of year 2,456 $15.92 2,126 $ 8.23 2,755 $6.19

Granted, at fair market value 1,364 14.53 609 37.96 67 45.12

Exercised (853) 4.69 (225) 3.49 (660) 3.34

Expired (34) 33.87 — — — —

Forfeited (102) 27.04 (54) 13.67 (36) 10.42

Outstanding, end of year 2,831 $18.02 2,456 $15.92 2,126 $8.23

Options exercisable, end of year 908 $11.58 1,044 $ 7.22 639 $5.70

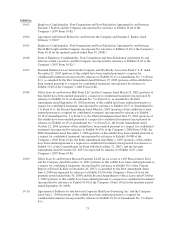

The intrinsic value of stock options exercised during the years ended December 31, 2009, 2008 and 2007

was $14.8 million, $6.7 million and $31.9 million, respectively.

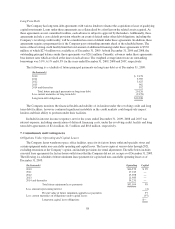

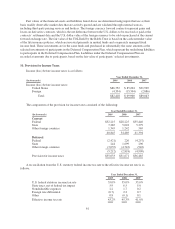

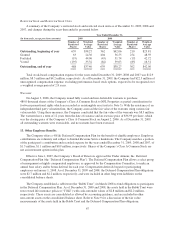

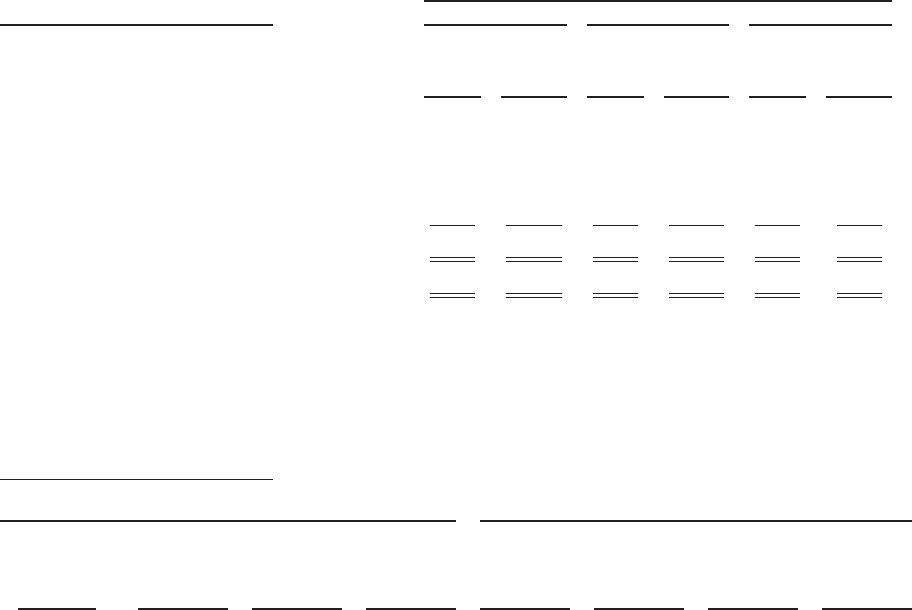

The following table summarizes information about stock options outstanding and exercisable as of

December 31, 2009:

(In thousands, except per share amounts)

Options Outstanding Options Exercisable

Number of

Underlying

Shares

Weighted

Average

Exercise

Price Per

Share

Weighted

Average

Remaining

Contractual

Life (Years)

Total

Intrinsic

Value

Number of

Underlying

Shares

Weighted

Average

Exercise

Price Per

Share

Weighted

Average

Remaining

Contractual

Life (Years)

Total

Intrinsic

Value

2,831 $18.02 6.7 $34,466 908 $11.58 2.6 $16,830

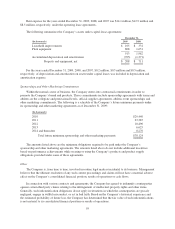

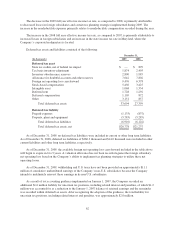

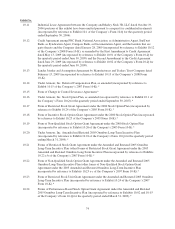

Included in the tables above are 1.4 million performance-based stock options granted to officers and key

employees under the 2005 Plan. These performance-based stock options have a weighted average exercise price

of $15.87 and a term of ten years. Of the 1.4 million performance-based stock options, 1.2 million performance-

based stock options will vest upon the achievement of a combined annual operating income target for 2009 and

2010. The remaining 0.2 million performance-based stock options were granted to the Company’s President upon

his hiring and will vest in four equal installments subject to the achievement of combined annual operating

income targets beginning with 2010 and 2011. Upon the achievement of a combined annual operating income

target, 50% of the stock options (or 45% in certain cases) will vest and the remaining 50% of the stock options

(or 45% in certain cases) will vest one year later. During the year ended December 31, 2009, the operating

income targets for the 0.2 million performance-based stock options were reduced to more closely align the

targets with the operating income targets for the 1.2 million performance-based stock options noted above.

The weighted average fair value of these awards is $7.13 and was estimated using the Black-Scholes option-

pricing model consistent with the weighted average assumptions included in the table above. During the year

ended December 31, 2009, the Company recorded $2.9 million in stock-based compensation expense for these

performance-based stock options. As of December 31, 2009, the Company had $6.9 million of unrecognized

compensation expense expected to be recognized over a weighted average period of 2.0 years if all combined

operating income targets were reached.

66