Under Armour 2009 Annual Report Download - page 62

Download and view the complete annual report

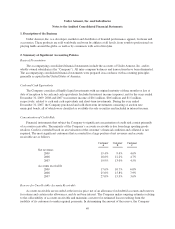

Please find page 62 of the 2009 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company issues new shares of Class A Common Stock upon exercise of stock options, grant of

restricted stock or share unit conversion. Refer to Note 12 for further details on stock-based compensation.

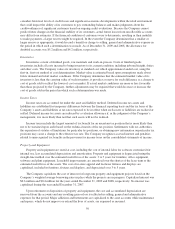

Management Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the

United States of America requires management to make estimates, including estimates relating to assumptions

that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the

date of the consolidated financial statements and the reported amounts of revenues and expenses during the

reporting period. Actual results could differ from these estimates.

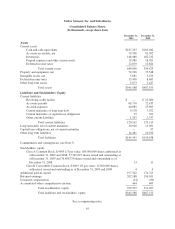

Fair Value of Financial Instruments

The carrying amounts shown for the Company’s cash and cash equivalents, accounts receivable and

accounts payable approximate fair value because of the short term maturity of those instruments. The fair value

of the long term debt approximates its carrying value based on the variable nature of interest rates and current

market rates available to the Company.

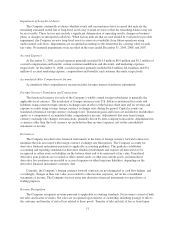

Recently Issued Accounting Standards

In June 2009, the Financial Accounting Standards Board (“FASB”) issued an amendment to the accounting

and disclosure requirements for the consolidation of variable interest entities (“VIEs”). This amendment requires

an enterprise to perform a qualitative analysis when determining whether or not it must consolidate a VIE. The

amendment also requires an enterprise to continuously reassess whether it must consolidate a VIE. Finally, an

enterprise will be required to disclose significant judgments and assumptions used to determine whether or not to

consolidate a VIE. This amendment is effective for financial statements issued for annual periods beginning after

November 15, 2009, and for interim periods within the first annual period. The Company is currently evaluating

the impact of this amendment on its consolidated financial statements.

Recently Adopted Accounting Standards

In June 2009, the FASB issued the FASB Accounting Standards Codification (“Codification”). The

Codification has become the single source of authoritative generally accepted accounting principles (“GAAP”)

recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the SEC

under authority of federal securities laws are also sources of authoritative U.S. GAAP for SEC registrants. The

Codification was effective for financial statements issued for interim and annual periods ending after

September 15, 2009. The Codification superseded all existing non-SEC accounting and reporting standards. All

other non-grandfathered non-SEC accounting literature not included in the Codification is non-authoritative. The

adoption of the Codification did not have any impact on the Company’s consolidated financial statements.

In May 2009, the FASB issued accounting guidance that establishes accounting and reporting standards for

events that occur after the balance sheet date but before financial statements are issued or are available to be

issued. In addition, entities must disclose the date through which subsequent events have been evaluated and the

basis for selecting that date, that is, whether that date represents the date the financial statements were issued or

were available to be issued. This guidance was effective for fiscal years and interim periods ending after June 15,

2009. The adoption of this guidance did not have any impact on the Company’s consolidated financial

statements.

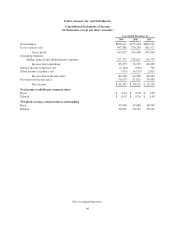

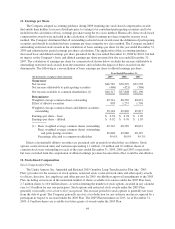

In June 2008, the FASB issued accounting guidance requiring that unvested stock-based compensation

awards that contain non-forfeitable rights to dividends or dividend equivalents (whether paid or unpaid) should

be classified as participating securities and should be included in the computation of earnings per share pursuant

54