Under Armour 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

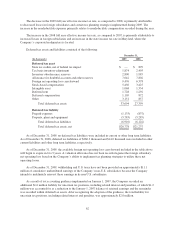

The decrease in the 2009 full year effective income tax rate, as compared to 2008, is primarily attributable

to decreased losses in foreign subsidiaries and certain tax planning strategies implemented during 2009. The

increase in the nondeductible expenses primarily relates to nondeductible compensation recorded during the year.

The increase in the 2008 full year effective income tax rate, as compared to 2007, is primarily attributable to

increased losses in foreign subsidiaries and an increase in the state income tax rate in Maryland, where the

Company’s corporate headquarters is located.

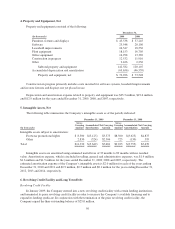

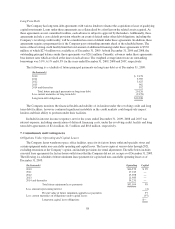

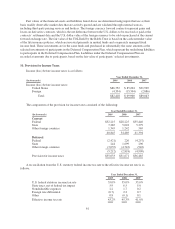

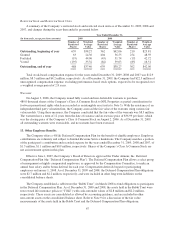

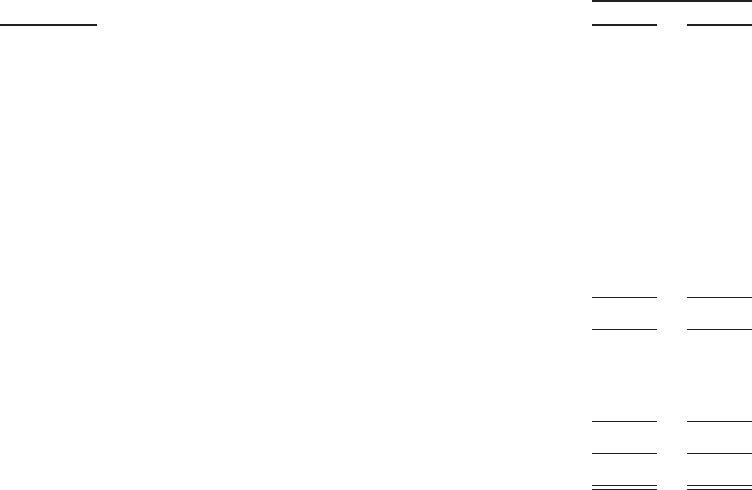

Deferred tax assets and liabilities consisted of the following:

December 31,

(In thousands) 2009 2008

Deferred tax asset

State tax credits, net of federal tax impact $ — $ 899

Tax basis inventory adjustment 1,874 2,495

Inventory obsolescence reserves 2,800 1,985

Allowance for doubtful accounts and other reserves 7,042 7,802

Foreign net operating loss carryforward 9,476 6,378

Stock-based compensation 5,450 3,425

Intangible asset 1,068 1,354

Deferred rent 1,728 1,292

Deferred compensation 1,105 872

Other 3,151 857

Total deferred tax assets 33,694 27,359

Deferred tax liability

Prepaid expenses (1,133) (837)

Property, plant and equipment (5,783) (5,285)

Total deferred tax liabilities (6,916) (6,122)

Total deferred tax assets, net $26,778 $21,237

As of December 31, 2009, no deferred tax liabilities were included in current or other long term liabilities.

As of December 31, 2008, deferred tax liabilities of $260.3 thousand and $14.0 thousand were included in other

current liabilities and other long term liabilities, respectively.

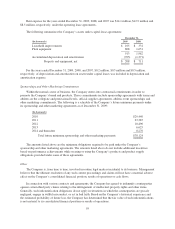

As of December 31, 2009, the available foreign net operating loss carryforward included in the table above

will begin to expire in 6 to 9 years. A valuation allowance has not been recorded against the foreign subsidiary

net operating loss based on the Company’s ability to implement tax planning strategies to utilize these net

operating losses.

As of December 31, 2009, withholding and U.S. taxes have not been provided on approximately $11.1

million of cumulative undistributed earnings of the Company’s non-U.S. subsidiaries because the Company

intends to indefinitely reinvest these earnings in its non-U.S. subsidiaries.

As a result of tax accounting guidance implemented on January 1, 2007, the Company recorded an

additional $1.6 million liability for uncertain tax positions, including related interest and penalties, of which $1.2

million was accounted for as a reduction to the January 1, 2007 balance of retained earnings and the remainder

was recorded within deferred tax assets. After recognizing the adoption of the guidance, the total liability for

uncertain tax positions, including related interest and penalties, was approximately $2.0 million.

62