Under Armour 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.considers historical levels of credit losses and significant economic developments within the retail environment

that could impact the ability of its customers to pay outstanding balances and makes judgments about the

creditworthiness of significant customers based on ongoing credit evaluations. Because the Company cannot

predict future changes in the financial stability of its customers, actual future losses from uncollectible accounts

may differ from estimates. If the financial condition of customers were to deteriorate, resulting in their inability

to make payments, a larger reserve might be required. In the event the Company determines that a smaller or

larger reserve is appropriate, it would record a benefit or charge to selling, general and administrative expense in

the period in which such a determination was made. As of December 31, 2009 and 2008, the allowance for

doubtful accounts was $5.2 million and $4.2 million, respectively.

Inventories

Inventories consist of finished goods, raw materials and work-in-process. Costs of finished goods

inventories include all costs incurred to bring inventory to its current condition, including inbound freight, duties

and other costs. The Company values its inventory at standard cost which approximates landed cost, using the

first-in, first-out method of cost determination. Market value is estimated based upon assumptions made about

future demand and retail market conditions. If the Company determines that the estimated market value of its

inventory is less than the carrying value of such inventory, it provides a reserve for such difference as a charge to

cost of goods sold to reflect the lower of cost or market. If actual market conditions are more or less favorable

than those projected by the Company, further adjustments may be required that would decrease or increase the

cost of goods sold in the period in which such a determination was made.

Income Taxes

Income taxes are accounted for under the asset and liability method. Deferred income tax assets and

liabilities are established for temporary differences between the financial reporting basis and the tax basis of the

Company’s assets and liabilities at tax rates expected to be in effect when such assets or liabilities are realized or

settled. Deferred income tax assets are reduced by a valuation allowance if, in the judgment of the Company’s

management, it is more likely than not that such assets will not be realized.

Income taxes include the largest amount of tax benefit for an uncertain tax position that is more likely than

not to be sustained upon audit based on the technical merits of the tax position. Settlements with tax authorities,

the expiration of statutes of limitations for particular tax positions, or obtaining new information on particular tax

positions may cause a change to the effective tax rate. The Company recognizes accrued interest and penalties

related to unrecognized tax benefits in the provision for income taxes on the consolidated statements of income.

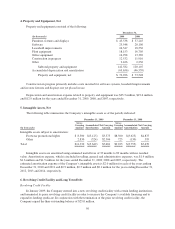

Property and Equipment

Property and equipment are stated at cost, including the cost of internal labor for software customized for

internal use, less accumulated depreciation and amortization. Property and equipment is depreciated using the

straight-line method over the estimated useful lives of the assets: 3 to 7 years for furniture, office equipment,

software and plant equipment. Leasehold improvements are amortized over the shorter of the lease term or the

estimated useful lives of the assets. The cost of in-store apparel and footwear fixtures and displays are

capitalized, included in furniture, fixtures and displays, and depreciated over 3 to 5 years.

The Company capitalizes the cost of interest for long term property and equipment projects based on the

Company’s weighted average borrowing rates in place while the projects are in progress. Capitalized interest was

$0.6 million and $0.4 million for the years ended December 31, 2009 and 2008, respectively. No interest was

capitalized during the year ended December 31, 2007.

Upon retirement or disposition of property and equipment, the cost and accumulated depreciation are

removed from the accounts and any resulting gain or loss is reflected in selling, general and administrative

expenses for that period. Major additions and betterments are capitalized to the asset accounts while maintenance

and repairs, which do not improve or extend the lives of assets, are expensed as incurred.

50