Under Armour 2009 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2009 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

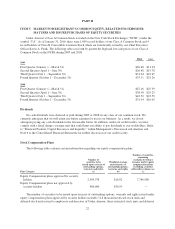

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

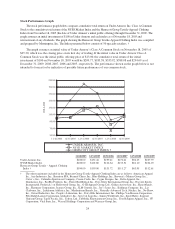

Under Armour’s Class A Common Stock is traded on the New York Stock Exchange (“NYSE”) under the

symbol “UA”. As of January 31, 2010, there were 1,009 record holders of our Class A Common Stock and 4

record holders of Class B Convertible Common Stock which are beneficially owned by our Chief Executive

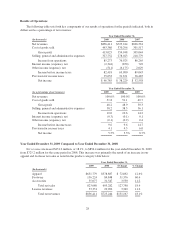

Officer Kevin A. Plank. The following table sets forth by quarter the high and low sale prices of our Class A

Common Stock on the NYSE during 2009 and 2008.

High Low

2009

First Quarter (January 1 – March 31) $26.48 $11.94

Second Quarter (April 1 – June 30) $26.48 $15.78

Third Quarter (July 1 – September 30) $31.24 $19.49

Fourth Quarter (October 1 – December 31) $33.31 $25.26

2008

First Quarter (January 1 – March 31) $47.16 $25.39

Second Quarter (April 1 – June 30) $38.90 $25.25

Third Quarter (July 1 – September 30) $43.52 $23.50

Fourth Quarter (October 1 – December 31) $31.94 $16.05

Dividends

No cash dividends were declared or paid during 2009 or 2008 on any class of our common stock. We

currently anticipate that we will retain any future earnings for use in our business. As a result, we do not

anticipate paying any cash dividends in the foreseeable future. In addition, under our credit facility, we must

comply with a fixed charge coverage ratio that could limit our ability to pay dividends to our stockholders. Refer

to “Financial Position, Capital Resources and Liquidity” within Management’s Discussion and Analysis and

Note 6 to the Consolidated Financial Statements for further discussion of our credit facility.

Stock Compensation Plans

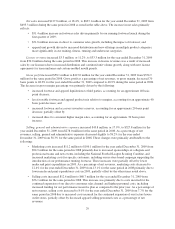

The following table contains certain information regarding our equity compensation plans.

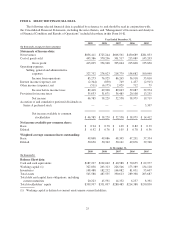

Plan Category

Number of

securities to be

issued upon exercise of

outstanding options,

warrants and rights

(a)

Weighted-average

exercise price of

outstanding options,

warrants and rights

(b)

Number of securities

remaining

available for future

issuance under equity

compensation plans

(excluding securities

reflected in column (a))

(c)

Equity Compensation plans approved by security

holders 2,905,978 $18.02 7,786,980

Equity Compensation plans not approved by

security holders 480,000 $36.99 —

The number of securities to be issued upon exercise of outstanding options, warrants and rights issued under

equity compensation plans approved by security holders includes 74.8 thousand restricted stock units and

deferred stock units issued to employees and directors of Under Armour; these restricted stock units and deferred

22