Under Armour 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

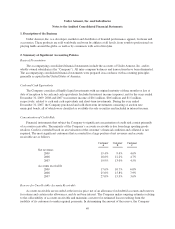

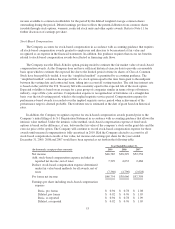

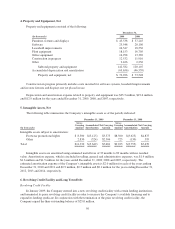

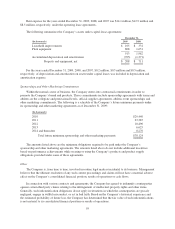

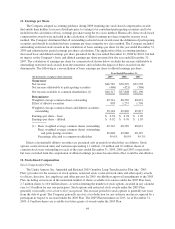

4. Property and Equipment, Net

Property and equipment consisted of the following:

(In thousands)

December 31,

2009 2008

Furniture, fixtures and displays $ 43,538 $ 37,245

Software 25,548 20,106

Leasehold improvements 24,347 18,536

Plant equipment 18,153 16,705

Office equipment 16,298 13,369

Construction in progress 12,532 11,910

Other 2,166 2,236

Subtotal property and equipment 142,582 120,107

Accumulated depreciation and amortization (69,656) (46,559)

Property and equipment, net $ 72,926 $ 73,548

Construction in progress primarily includes costs incurred for software systems, leasehold improvements

and in-store fixtures and displays not yet placed in use.

Depreciation and amortization expense related to property and equipment was $25.3 million, $19.6 million

and $12.9 million for the years ended December 31, 2009, 2008, and 2007, respectively.

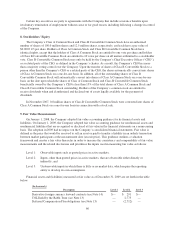

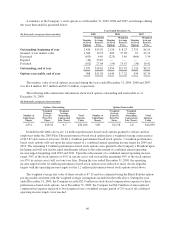

5. Intangible Assets, Net

The following table summarizes the Company’s intangible assets as of the periods indicated:

(In thousands)

December 31, 2009 December 31, 2008

Gross

Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

Gross

Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

Intangible assets subject to amortization:

Footwear promotional rights $ 8,500 $(5,125) $3,375 $8,500 $(3,625) $4,875

Other 2,830 (524) $2,306 725 (130) 595

Total $11,330 $(5,649) $5,681 $9,225 $(3,755) $5,470

Intangible assets are amortized using estimated useful lives of 33 months to 89 months with no residual

value. Amortization expense, which is included in selling, general and administrative expenses, was $1.9 million,

$1.6 million and $1.5 million for the years ended December 31, 2009, 2008 and 2007, respectively. The

estimated amortization expense of the Company’s intangible assets is $2.0 million for each of the years ending

December 31, 2010 and 2011 and $0.9 million, $0.5 million and $0.1 million for the years ending December 31,

2012, 2013 and 2014, respectively.

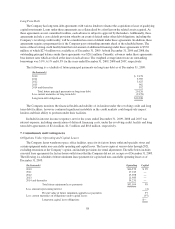

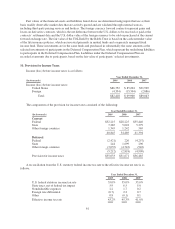

6. Revolving Credit Facility and Long Term Debt

Revolving Credit Facility

In January 2009, the Company entered into a new revolving credit facility with certain lending institutions,

and terminated its prior revolving credit facility in order to increase the Company’s available financing and to

expand its lending syndicate. In conjunction with the termination of the prior revolving credit facility, the

Company repaid the then outstanding balance of $25.0 million.

56