Under Armour 2009 Annual Report Download - page 46

Download and view the complete annual report

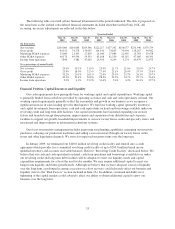

Please find page 46 of the 2009 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.other costs. These open purchase orders specify fixed or minimum quantities of products at determinable

prices. The reported amounts exclude product purchase liabilities included in accounts payable as of

December 31, 2009.

(4) Includes footwear promotional rights fees, sponsorships of individual athletes, sports teams and athletic

events and other marketing commitments in order to promote our brand. Some of these sponsorship

agreements provide for additional incentives based on performance achievements while wearing or using

our products. It is not possible to determine the amounts we may be required to pay under these agreements

as they are primarily subject to certain performance based variables. The amounts listed above are the fixed

minimum amounts required to be paid under these agreements.

The table above excludes a $3.5 million liability for uncertain tax positions, including the related interest and

penalties, recorded in accordance with applicable accounting guidance, as we are unable to reasonably estimate the timing

of settlement. Refer to Note 10 to the Consolidated Financial Statements for a further discussion on this guidance.

Off-Balance Sheet Arrangements

In connection with various contracts and agreements, we have agreed to indemnify counterparties against

certain third party claims relating to the infringement of intellectual property rights and other items. Generally,

such indemnification obligations do not apply in situations in which our counterparties are grossly negligent,

engage in willful misconduct, or act in bad faith. Based on our historical experience and the estimated probability

of future loss, we have determined that the fair value of such indemnifications is not material to our financial

position or results of operations.

Critical Accounting Policies and Estimates

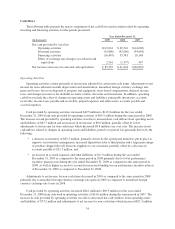

Our consolidated financial statements have been prepared in accordance with accounting principles

generally accepted in the United States. To prepare these financial statements, we must make estimates and

assumptions that affect the reported amounts of assets and liabilities. These estimates also affect our reported

revenues and expenses. Judgments must be made about the disclosure of contingent liabilities as well. Actual

results could be significantly different from these estimates. We believe that the following discussion addresses

the critical accounting policies that are necessary to understand and evaluate our reported financial results.

Revenue Recognition

Net revenues consist of both net sales and license revenues. Net sales are recognized upon transfer of

ownership, including passage of title to the customer and transfer of risk of loss related to those goods. Transfer

of title and risk of loss are based upon shipment under free on board shipping point for most goods or upon

receipt by the customer depending on the country of the sale and the agreement with the customer. In some

instances, transfer of title and risk of loss take place at the point of sale (e.g. at our factory house outlet and

specialty stores). We may also ship product directly from our supplier to the customer and recognize revenue

when the product is delivered to and accepted by the customer. License revenues are recognized based upon

shipment of licensed products sold by our licensees.

Sales Returns, Allowances, Markdowns and Discounts

We record reductions to revenue for estimated customer returns, allowances, markdowns and discounts. We

base our estimates on historical rates of customer returns and allowances as well as the specific identification of

outstanding returns, markdowns and allowances that have not yet been received by us. The actual amount of

customer returns and allowances, which is inherently uncertain, may differ from our estimates. If we determined

that actual or expected returns or allowances were significantly greater or lower than the reserves we had

established, we would record a reduction or increase, as appropriate, to net sales in the period in which we made

such a determination. Provisions for customer specific discounts based on contractual obligations with certain

major customers are recorded as reductions to net sales.

38