Under Armour 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.shipment under free on board shipping point for most goods or upon receipt by the customer depending on the

country of the sale and the agreement with the customer. In some instances, transfer of title and risk of loss takes

place at the point of sale (e.g. at the Company’s retail stores). The Company may also ship product directly from

its supplier to the customer and recognize revenue when the product is delivered to and accepted by the customer.

License revenues are recognized based upon shipment of licensed products sold by the Company’s licensees.

Sales taxes imposed on the Company’s revenues from product sales are presented on a net basis on the

consolidated statements of income and therefore do not impact net revenues or costs of goods sold.

Sales Returns, Allowances, Markdowns and Discounts

The Company records reductions to revenue for estimated customer returns, allowances, markdowns and

discounts. The Company bases its estimates on historical rates of customer returns and allowances as well as the

specific identification of outstanding returns, markdowns and allowances that have not yet been received by the

Company. The actual amount of customer returns and allowances, which is inherently uncertain, may differ from

the Company’s estimates. If the Company determined that actual or expected returns or allowances were

significantly greater or lower than the reserves it had established, it would record a reduction or increase, as

appropriate, to net sales in the period in which such a determination was made. Provisions for customer specific

discounts based on contractual obligations with certain major customers are recorded as reductions to net sales.

Reserves for returns, allowances, certain markdowns and certain discounts are recorded as an offset to

accounts receivable as settlements are made through offsets to outstanding customer invoices. The majority of

discounts earned by customers in the period are recorded as liabilities within accrued expenses as they stipulate

settlements to be made through the Company’s cash disbursements. In addition, certain markdowns expected to

be paid to customers through cash disbursements are recorded as liabilities within accrued expenses.

Advertising Costs

Advertising costs are charged to selling, general and administrative expenses. Advertising production costs

are expensed the first time an advertisement related to such production costs is run. Media (television, print and

radio) placement costs are expensed in the month during which the advertisement appears. In addition,

advertising costs include sponsorship expenses. Accounting for sponsorship payments is based upon specific

contract provisions and the payments are generally expensed uniformly over the term of the contract after giving

recognition to periodic performance compliance provisions of the contracts. Advertising expense, including

amortization of in-store marketing fixtures and displays, was $106.1 million, $94.9 million and $71.2 million for

the years ended December 31, 2009, 2008 and 2007, respectively. At December 31, 2009 and 2008, prepaid

advertising costs were $1.4 million and $0.9 million, respectively.

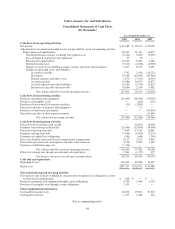

Shipping and Handling Costs

The Company charges certain customers shipping and handling fees. These fees are recorded in net

revenues. The Company includes the majority of outbound shipping and handling costs as a component of

selling, general and administrative expenses. Outbound shipping and handling costs include costs associated with

shipping goods to customers and certain costs to operate the Company’s distribution facilities. These costs,

included within selling, general and administrative expenses, were $21.4 million, $17.2 million and $13.7 million

for the years ended December 31, 2009, 2008, and 2007, respectively.

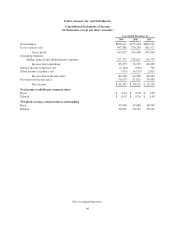

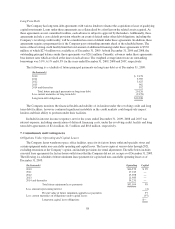

Earnings per Share

Basic earnings per common share is computed by dividing net income available to common stockholders for

the period by the weighted average number of common shares outstanding during the period. Any stock-based

compensation awards that are determined to be participating securities are included in the calculation of basic

earnings per share using the two class method. Diluted earnings per common share is computed by dividing net

52