Under Armour 2009 Annual Report Download - page 49

Download and view the complete annual report

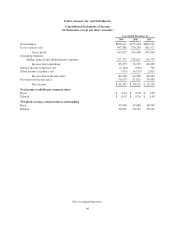

Please find page 49 of the 2009 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In June 2008, the FASB issued accounting guidance requiring that unvested stock-based compensation

awards that contain non-forfeitable rights to dividends or dividend equivalents (whether paid or unpaid) should

be classified as participating securities and should be included in the computation of earnings per share pursuant

to the two-class method. The provisions of this guidance were required for fiscal years beginning after

December 15, 2008. We have adopted this guidance for current period computations of earnings per share, and

have updated prior period computations of earnings per share as directed by this guidance. The adoption of this

guidance did not have a material impact on our computation of earnings per share. Refer to Note 2 and Note 11

of the consolidated financial statements for further discussion on this accounting guidance.

In June 2008, the FASB issued accounting guidance addressing the determination of whether provisions that

introduce adjustment features (including contingent adjustment features) would prevent treating a derivative

contract or an embedded derivative on a company’s own stock as indexed solely to the company’s stock. This

guidance was effective for fiscal years beginning after December 15, 2008. The adoption of this guidance in the

first quarter of 2009 did not have any impact on our consolidated financial statements.

In March 2008, the FASB issued accounting guidance intended to improve financial reporting about

derivative instruments and hedging activities by requiring enhanced disclosures to enable investors to better

understand their effects on an entity’s financial position, financial performance, and cash flows. This guidance

was effective for the fiscal years and interim periods beginning after November 15, 2008. The adoption of this

guidance in the first quarter of 2009 did not have any impact on our consolidated financial statement.

In December 2007, the FASB issued replacement guidance that requires the acquirer of a business to

recognize and measure the identifiable assets acquired, the liabilities assumed, and any non-controlling interest in

the acquired entity at fair value. This replacement guidance requires transaction costs related to the business

combination to be expensed as incurred. It was effective for business combinations for which the acquisition date

was on or after the start of the fiscal year beginning after December 15, 2008. The adoption of this guidance in

the first quarter of 2009 did not have any impact on our consolidated financial statements.

In December 2007, the FASB issued accounting guidance that establishes accounting and reporting

standards for the non-controlling interest in a subsidiary and for the deconsolidation of a subsidiary. This

guidance was effective for fiscal years beginning after December 15, 2008. The adoption of this guidance in the

first quarter of 2009 did not have any impact on our consolidated financial statements.

In September 2006, the FASB issued accounting guidance which defines fair value, establishes a framework

for measuring fair value in accordance with generally accepted accounting principles and expands disclosures

about fair value measurements. This guidance was effective for fiscal years beginning after November 15, 2007,

however the FASB delayed the effective date to fiscal years beginning after November 15, 2008 for nonfinancial

assets and nonfinancial liabilities, except those items recognized or disclosed at fair value on an annual or more

frequent basis. The adoption of this guidance for nonfinancial assets and liabilities in the first quarter of 2009 did

not have any impact on our consolidated financial statements.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK

Foreign Currency Exchange and Foreign Currency Risk Management and Derivatives

We currently generate a small amount of our consolidated net revenues in Canada and Europe. The

reporting currency for our consolidated financial statements is the U.S. dollar. To date, net revenues generated

outside of the United States have not been significant. However, as our net revenues generated outside of the

United States increase, our results of operations could be adversely impacted by changes in foreign currency

exchange rates. For example, if we recognize international revenues in local foreign currencies (as we currently

do in Canada and Europe) and if the U.S. dollar strengthens, it could have a negative impact on our international

revenues upon translation of those results into the U.S. dollar upon consolidation of our financial statements. In

41