Under Armour 2009 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2009 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

bore interest based on the daily balance outstanding at our choice of LIBOR plus an applicable margin (varying

from 1.0% to 2.0%) or the JP Morgan Chase Bank prime rate plus an applicable margin (varying from 0.0% to

0.5%). The applicable margin was calculated quarterly and varied based on our pricing leverage ratio as defined

in this agreement. This revolving credit facility also carried a line of credit fee varying from 0.1% to 0.5% of the

available but unused borrowings.

Long Term Debt

We have long term debt agreements with various lenders to finance the acquisition of or lease of qualifying

capital investments. Loans under these agreements are collateralized by a first lien on the related assets acquired.

As these agreements are not committed facilities, each advance is subject to approval by the lenders.

Additionally, these agreements include a cross default provision whereby an event of default under other debt

obligations, including our revolving credit facility, will be considered an event of default under these agreements.

In addition, these agreements require a prepayment fee if we pay outstanding amounts ahead of the scheduled

terms. The terms of our revolving credit facility limit the total amount of additional financing under these

agreements to $35.0 million, of which $27.4 million was available as of December 31, 2009. At both

December 31, 2009 and 2008, the outstanding principal balance under these agreements was $20.1 million.

Currently, advances under these agreements bear interest rates which are fixed at the time of each advance. The

weighted average interest rate on outstanding borrowings was 5.9%, 6.1% and 6.5% for the years ended

December 31, 2009, 2008 and 2007, respectively.

We monitor the financial health and stability of our lenders under the revolving credit and long term debt

facilities, however continuing significant instability in the credit markets could negatively impact lenders and

their ability to perform under their facilities.

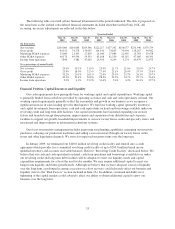

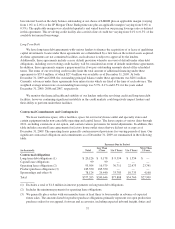

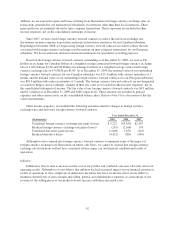

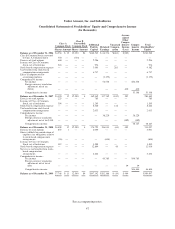

Contractual Commitments and Contingencies

We lease warehouse space, office facilities, space for our factory house outlet and specialty stores and

certain equipment under non-cancelable operating and capital leases. The leases expire at various dates through

2021, excluding extensions at our option, and contain various provisions for rental adjustments. In addition, this

table includes executed lease agreements for factory house outlet stores that we did not yet occupy as of

December 31, 2009. The operating leases generally contain renewal provisions for varying periods of time. Our

significant contractual obligations and commitments as of December 31, 2009 are summarized in the following

table:

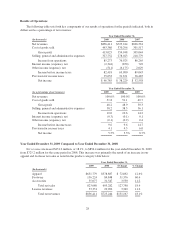

(in thousands)

Payments Due by Period

Total

Less Than

1 Year 1 to 3 Years 3 to 5 Years

More Than

5 Years

Contractual obligations

Long term debt obligations (1) $ 20,126 $ 9,178 $ 9,394 $ 1,554 $ —

Capital lease obligations 99 99 — — —

Operating lease obligations (2) 93,504 16,579 30,711 22,473 23,741

Product purchase obligations (3) 185,350 185,350 — — —

Sponsorships and other (4) 78,124 29,440 33,783 10,733 4,168

Total $377,203 $240,646 $73,888 $34,760 $27,909

(1) Excludes a total of $1.6 million in interest payments on long term debt obligations.

(2) Includes the minimum payments for operating lease obligations.

(3) We generally place orders with our manufacturers at least three to four months in advance of expected

future sales. The amounts listed for product purchase obligations primarily represent our open production

purchase orders for our apparel, footwear and accessories, including expected inbound freight, duties and

37