Under Armour 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

income available to common stockholders for the period by the diluted weighted average common shares

outstanding during the period. Diluted earnings per share reflects the potential dilution from common shares

issuable through stock options, warrants, restricted stock units and other equity awards. Refer to Note 11 for

further discussion of earnings per share.

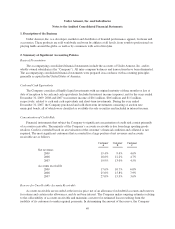

Stock-Based Compensation

The Company accounts for stock-based compensation in accordance with accounting guidance that requires

all stock-based compensation awards granted to employees and directors to be measured at fair value and

recognized as an expense in the financial statements. In addition, this guidance requires that excess tax benefits

related to stock-based compensation awards be reflected as financing cash flows.

The Company uses the Black-Scholes option-pricing model to estimate the fair market value of stock-based

compensation awards. As the Company does not have sufficient historical exercise data to provide a reasonable

basis upon which to estimate the expected life due to the limited period of time its shares of Class A Common

Stock have been publicly traded, it uses the “simplified method” as permitted by accounting guidance. The

“simplified method” calculates the expected life of a stock option equal to the time from grant to the midpoint

between the vesting date and contractual term, taking into account all vesting tranches. The risk free interest rate

is based on the yield for the U.S. Treasury bill with a maturity equal to the expected life of the stock option.

Expected volatility is based on an average for a peer group of companies similar in terms of type of business,

industry, stage of life cycle and size. Compensation expense is recognized net of forfeitures on a straight-line

basis over the total vesting period, which is the implied requisite service period. Compensation expense for

performance-based awards is recorded over the implied requisite service period when achievement of the

performance target is deemed probable. The forfeiture rate is estimated at the date of grant based on historical

rates.

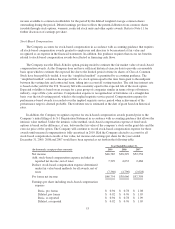

In addition, the Company recognizes expense for stock-based compensation awards granted prior to the

Company’s initial filing of its S-1 Registration Statement in accordance with accounting guidance that allows the

intrinsic value method. Under the intrinsic value method, stock-based compensation expense of fixed stock

options is based on the difference, if any, between the fair value of the company’s stock on the grant date and the

exercise price of the option. The Company will continue to record stock-based compensation expense for these

awards until unearned compensation is fully amortized in 2010. Had the Company elected to account for all

stock-based compensation awards at fair value, net income and earnings per share for the years ended

December 31, 2009, 2008 and 2007 would have been reported as set forth in the following table:

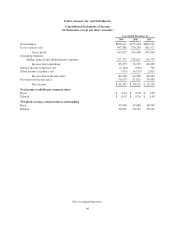

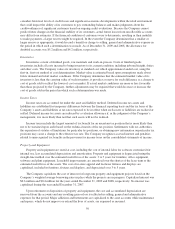

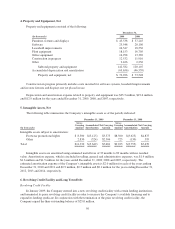

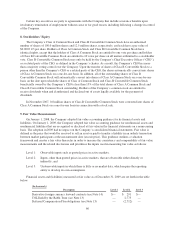

(In thousands, except per share amounts)

Year Ended December 31,

2009 2008 2007

Net income $46,785 $38,229 $52,558

Add: stock-based compensation expense included in

reported net income, net of taxes 7,329 4,633 2,468

Deduct: stock-based compensation expense determined

under fair value based methods for all awards, net of

taxes (7,360) (4,796) (2,628)

Pro forma net income $46,754 $38,066 $52,398

Earnings per share including stock-based compensation

expense

Basic, pro forma $ 0.94 $ 0.78 $ 1.08

Diluted, pro forma $ 0.92 $ 0.76 $ 1.05

Basic, as reported $ 0.94 $ 0.78 $ 1.09

Diluted, as reported $ 0.92 $ 0.76 $ 1.05

53