Under Armour 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

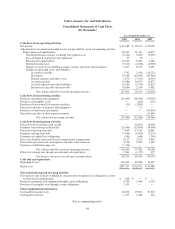

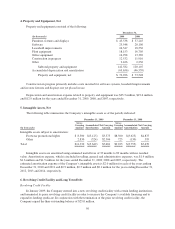

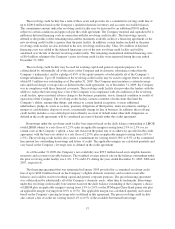

Long Term Debt

The Company has long term debt agreements with various lenders to finance the acquisition or lease of qualifying

capital investments. Loans under these agreements are collateralized by a first lien on the related assets acquired. As

these agreements are not committed facilities, each advance is subject to approval by the lenders. Additionally, these

agreements include a cross default provision whereby an event of default under other debt obligations, including the

Company’s revolving credit facility, will be considered an event of default under these agreements. In addition, these

agreements require a prepayment fee if the Company pays outstanding amounts ahead of the scheduled terms. The

terms of the revolving credit facility limit the total amount of additional financing under these agreements to $35.0

million, of which $27.4 million was available as of December 31, 2009. At both December 31, 2009 and 2008, the

outstanding principal balance under these agreements was $20.1 million. Currently, advances under these agreements

bear interest rates which are fixed at the time of each advance. The weighted average interest rate on outstanding

borrowings was 5.9%, 6.1% and 6.5% for the years ended December 31, 2009, 2008 and 2007, respectively.

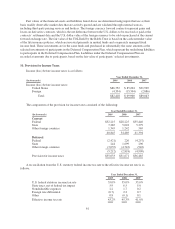

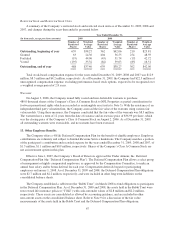

The following is a schedule of future principal payments on long term debt as of December 31, 2009:

(In thousands)

2010 $ 9,178

2011 5,769

2012 3,625

2013 962

2014 and thereafter 592

Total future principal payments on long term debt 20,126

Less current maturities of long term debt (9,178)

Long term debt obligations $10,948

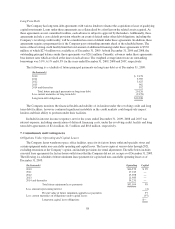

The Company monitors the financial health and stability of its lenders under the revolving credit and long

term debt facilities, however continued significant instability in the credit markets could negatively impact

lenders and their ability to perform under their facilities.

Included in interest income (expense), net for the years ended December 31, 2009, 2008 and 2007 was

interest expense, including amortization of deferred financing costs, under the revolving credit facility and long

term debt agreements of $2.4 million, $1.5 million and $0.8 million, respectively.

7. Commitments and Contingencies

Obligations Under Operating and Capital Leases

The Company leases warehouse space, office facilities, space for its factory house outlet and specialty stores and

certain equipment under non-cancelable operating and capital leases. The leases expire at various dates through 2021,

excluding extensions at the Company’s option, and include provisions for rental adjustments. The table below includes

executed lease agreements for factory house outlet stores that the Company did not yet occupy as of December 31, 2009.

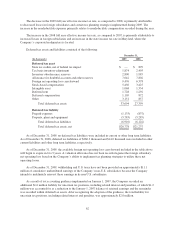

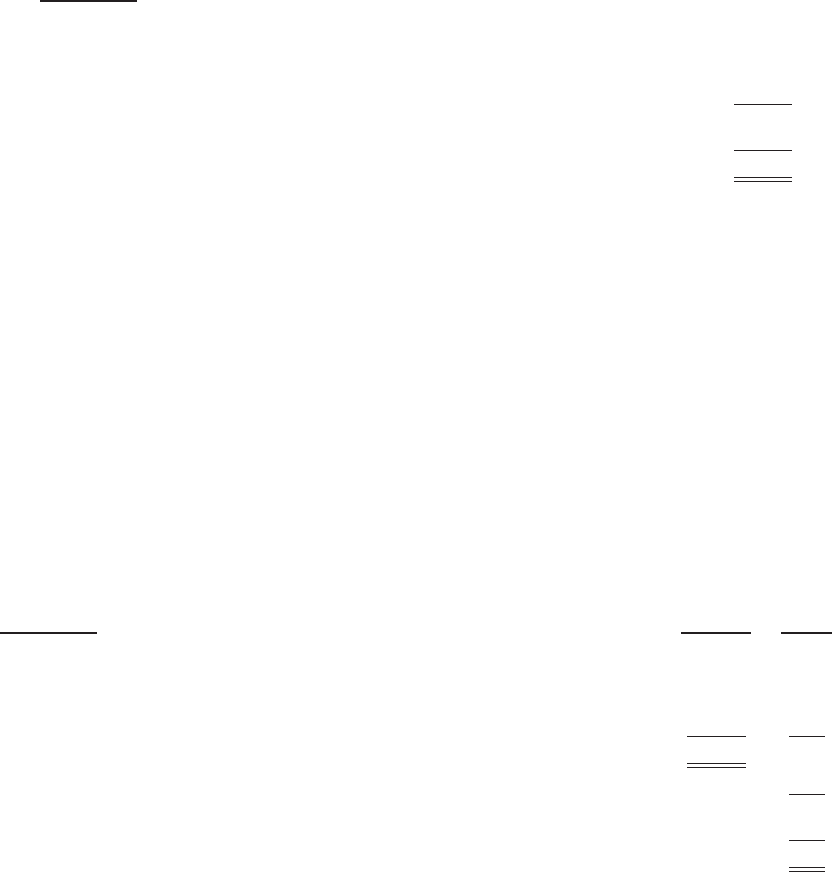

The following is a schedule of future minimum lease payments for capital and non-cancelable operating leases as of

December 31, 2009:

(In thousands) Operating Capital

2010 $16,579 $ 99

2011 17,013 —

2012 13,698 —

2013 11,983 —

2014 and thereafter 34,231 —

Total future minimum lease payments $93,504 99

Less amount representing interest (2)

Present value of future minimum capital lease payments 97

Less current maturities of obligations under capital leases (97)

Long term capital lease obligations $—

58