Under Armour 2009 Annual Report Download - page 40

Download and view the complete annual report

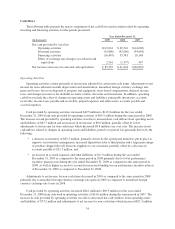

Please find page 40 of the 2009 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Product innovation and supply chain costs increased $11.9 million to $61.5 million for the year ended

December 31, 2008 from $49.6 million for the same period in 2007 primarily due to higher distribution

facilities operating and personnel costs to support our growth and higher personnel costs for the design

and sourcing of our expanding footwear and apparel lines. As a percentage of net revenues, product

innovation and supply chain costs increased to 8.5% for the year ended December 31, 2008 from 8.2%

for the same period in 2007 primarily due to the items noted above.

• Corporate services costs increased $10.5 million to $65.5 million for the year ended December 31,

2008 from $55.0 million for the same period in 2007. This increase was attributable primarily to higher

company-wide stock-based compensation, higher allowances for bad debts related to the current

economic conditions and post-implementation consulting costs and depreciation expense related to our

new warehouse management system and other information technology initiatives. As a percentage of

net revenues, corporate services costs decreased slightly to 9.0% for the year ended December 31, 2008

from 9.1% for the same period in 2007.

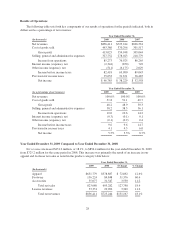

Income from operations decreased $9.4 million, or 10.8%, to $76.9 million for the year ended December 31,

2008 from $86.3 million for the same period in 2007. Income from operations as a percentage of net revenues

decreased to 10.6% for the year ended December 31, 2008 from 14.2% for the same period in 2007. This

decrease was a result of an increase in selling, general and administrative expenses and a decrease in gross profit

as a percentage of net revenues as discussed above.

Interest income (expense), net decreased $1.6 million to ($0.9) million for the year ended December 31,

2008 from $0.7 million for the same period in 2007. This decrease was primarily due to lower interest income

earned on cash and cash equivalents as our investments were lower yielding in 2008 than in 2007 and higher

interest expense due to increased borrowings on our revolving credit and long term debt facilities during 2008 as

compared to 2007.

Other income (expense), net decreased $8.2 million to ($6.2) million for the year ended December 31, 2008

from $2.0 million for the same period in 2007. This change was primarily due to losses on foreign currency

exchange rate changes on transactions primarily denominated in the Euro, partially offset by gains on derivative

financial instruments.

Provision for income taxes decreased $4.8 million to $31.7 million for the year ended December 31, 2008

from $36.5 million for the same period in 2007. For the year ended December 31, 2008, our effective tax rate

was 45.3% compared to 41.0% for the same period in 2007. The increase in the 2008 full year effective tax rate

was primarily attributable to losses in foreign subsidiaries, partially caused by foreign currency exchange rate

losses, which resulted in a larger proportion of our consolidated taxable income earned in the United States,

which has higher tax rates than in our foreign jurisdictions. In addition, the 2008 effective tax rate increase was

also driven by an increase in the state income tax rate in Maryland, where our corporate headquarters is located.

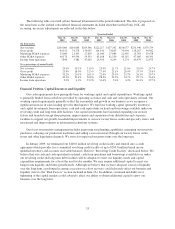

Seasonality

Historically, we have recognized a significant portion of our income from operations in the last two quarters

of the year, driven by increased sales volume of our products during the fall selling season, reflecting our

historical strength in fall sports, and the seasonality of our higher priced COLDGEAR®line. During 2009 and

2008, a larger portion of our income from operations was in the last two quarters of the year partially due to the

shift in the timing of marketing investments to the first two quarters of the year as compared to prior years. The

majority of our net revenues were generated during the last two quarters in each of 2009, 2008 and 2007. The

level of our working capital generally reflects the seasonality and growth in our business. We generally expect

inventory, accounts payable and certain accrued expenses to be higher in the second and third quarters in

preparation for the fall selling season.

32