Under Armour 2009 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2009 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHAIRMAN’S 2009 LETTER TO SHAREHOLDERS

To Our Shareholders,

Under Armour® was born in a moment on the athletic fi eld. It wasn’t

a great athletic achievement, it was instead a promise that we would

make athletes better and improve their performance by providing a

superior product. On that promise, we have built our Brand.

In 2009, we once again delivered on that promise and proved that

we remain a growth company. And more so than ever, we showed

that we could deliver growth while investing in the foundation needed

for a multi-billion dollar global brand. Today our company is stronger

from both a brand and fi nancial perspective and we are improving our

operational capabilities and better positioning ourselves for continued

long-term growth.

Our achievements this past year were many:

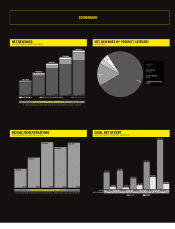

• We grew Net Revenues 18 percent, as we demonstrated our

ability to grow in any environment;

• Net Income increased 22 percent, a strong indicator that we are

bringing more fi nancial discipline to our organization;

• We maintained our leadership position in core compression

apparel;

• We grew our market share outside the compression category,

which is important for our long-term apparel revenue story;

• We continued to build our team, developing a higher level of

operational excellence as we execute our growth strategy;

• And most importantly, we continued to bring new consumers into

the Under Armour Brand with new strength in our categories and

even greater on-fi eld authenticity at every level.

We believe strongly that this authenticity on the fi eld, the growing

strength of our Brand and our capacity to innovate provide us with

opportunities unlike any other company in our business. Since becoming

a public company in 2005, we have consistently said that the successful

development of our fi ve key growth drivers – Men’s & Women’s Apparel,

Footwear, International and Direct-to-Consumer – will shape our

company’s future. Our continued consistent investment in each of

these fi ve areas positions us well for 2010 and beyond.

We made signifi cant progress in each of our fi ve growth drivers in 2009.

Our Apparel net revenues were up 13 percent for the year. We saw

strong growth in Men’s Apparel in categories such as Basketball and

Mountain, further evidence that our Brand is resonating outside of the

core and that we are building equity with new consumers. We’ve added

depth to our Women’s team across all functions and will continue to

bring the right fi t, the right colors and cohesive merchandising to our

Women’s line moving forward into 2010.

Our business outside North America continues to grow steadily. With

the continued expansion of our Brand in Japan, through our licensee

Dome, and in Europe, our International revenues increased nearly 50

percent in 2009.

In 2009, net revenues from our Direct-to-Consumer sales channel grew

nearly 50 percent. As we continue to expand our Brand’s access to

new consumers, it’s critical that we strategically grow the avenues

through which our Brand is available to the consumer. Through our

Direct-to-Consumer sales channels, such as our Global Direct website,

our Factory House outlet stores, and our four Specialty stores, we can

ensure that the presentation and merchandising mix of our product is

aligned with our growth strategy. By making our Direct-to-Consumer

sales channel a key part of our growth plans, we help ensure these

direct communications with consumers will inform our strategy as we

continue to grow.

Our Footwear net revenues showed the largest dollar increase of our

growth drivers in 2009, which speaks to the long-term opportunity we