Under Armour 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009 UNDER ARMOUR

® ANNUAL REPORT

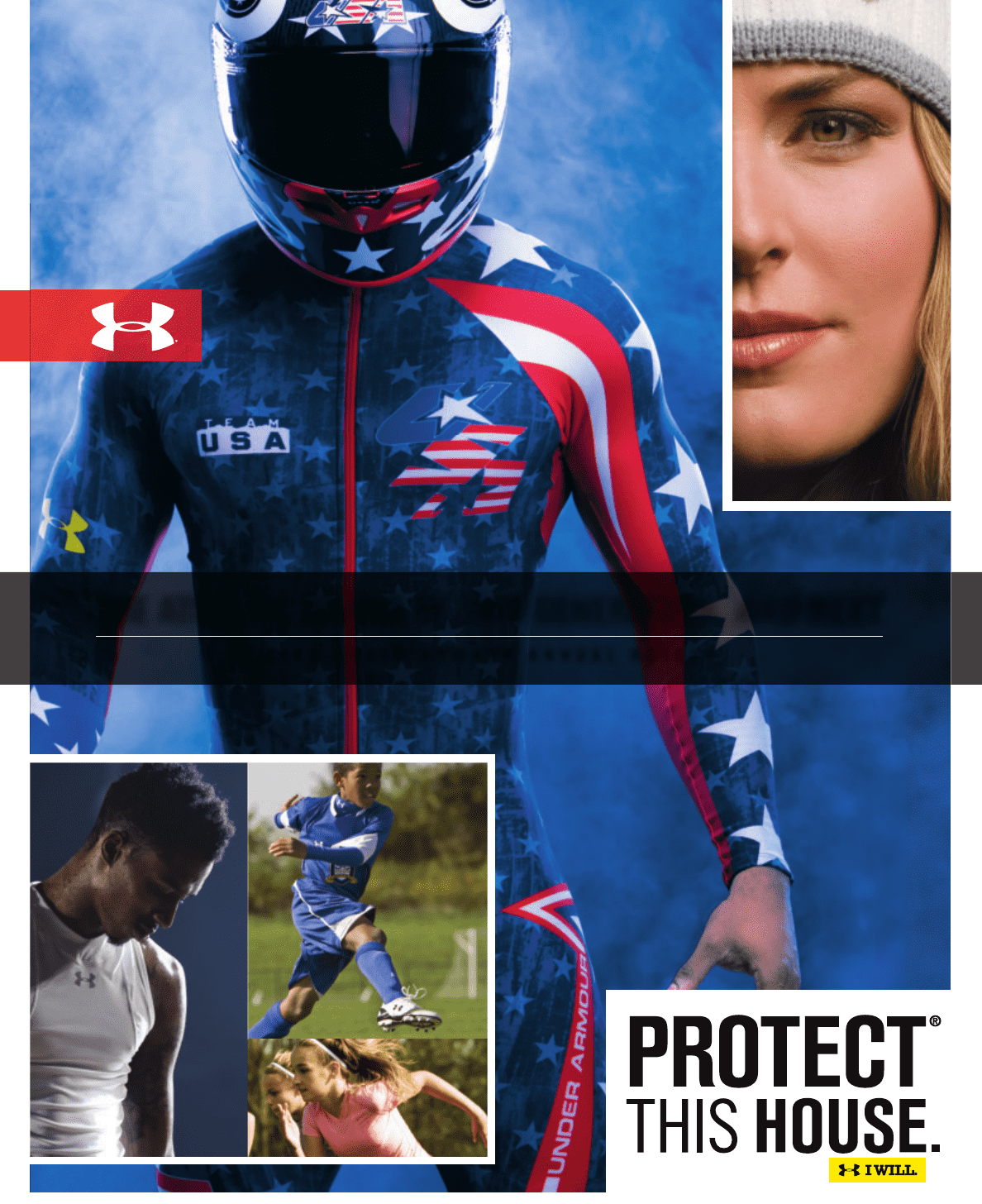

THE ATHLETIC BRAND OF THIS GENERATION. AND NEXT.

Table of contents

-

Page 1

THE ATHLETIC BRAND OF THIS GENERATION. AND NEXT. 2009 UNDER ARMOUR ANNUAL REPORT ® -

Page 2

...our Direct-to-Consumer sales channels, such as our Global Direct website, our Factory House outlet stores, and our four Specialty stores, we can ensure that the presentation and merchandising mix of our product is aligned with our growth strategy. By making our Direct-to-Consumer sales channel a key... -

Page 3

...forward. OUR DIRECT-TO-CONSUMER SALES CHANNEL GREW NEARLY 50% IN 2009 goal of making Under Armour a multi-billion dollar global brand. But we are not satisï¬ed. Whether it's innovating to help athletes perform their best, developing the team that will drive our growth, or moving our Brand into new... -

Page 4

DEZ BRYANT I WR -

Page 5

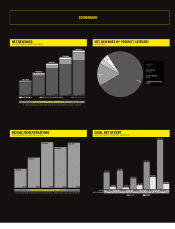

...205,181 2005 2006 2007 2008 2009 5-YEAR COMPOUND ANNUAL GROWTH RATE - 33.1% *5-Year Compound Annual Growth Rate based on ï¬scal year 2004 net revenues of $205,181 INCOME FROM OPERATIONS IN THOUSANDS; YEAR 2005-2009 $86,265 CASH, NET OF DEBT IN THOUSANDS; YEAR END 2005-2009 $187,297 $85,273... -

Page 6

LINDSEY VONN I US SKI TEAM -

Page 7

...,801,228 shares outstanding as of January 31, 2010 and Class B Convertible Common Stock, $.0003 1/3 par value, 12,500,000 shares outstanding as of January 31, 2009. DOCUMENTS INCORPORATED BY REFERENCE Portions of Under Armour, Inc.'s Proxy Statement for the Annual Meeting of Stockholders to be held... -

Page 8

...Marketing and Promotion ...Customers ...Product Licensing ...International Revenues ...Seasonality ...Product Design and Development ...Sourcing, Manufacturing and Quality Assurance ...Distribution and Inventory Management ...Intellectual Property ...Competition ...Employees ...Available Information... -

Page 9

... from the sale of our products through our direct to consumer sales channel, which includes sales through our factory house outlet and specialty stores, website and catalogs. Our products are offered in over twenty thousand retail stores worldwide. A large majority of our products are sold in North... -

Page 10

... that designs and produces most of our advertising campaigns. We seek to drive consumer demand for our products by building brand equity and awareness as a leading performance athletic brand. Sports Marketing Our marketing and promotion efforts begin with a strategy of selling our products to high... -

Page 11

.... We supply uniforms, sideline apparel and fan gear for these teams. In addition, we sell our products domestically to professional football teams and Division I men's and women's collegiate athletic teams. We also signed an agreement in 2006 to be an official supplier of footwear to the National... -

Page 12

... in various store sections. Customers Our products are offered in over twenty thousand retail stores worldwide, of which nearly sixteen thousand retail stores are in North America. We also sell our products directly to consumers through our own factory house outlet and specialty stores, website and... -

Page 13

... specialty stores, global website and catalog. The majority of our 35 factory house outlet stores are located at outlet centers on the East Coast of the United States. Through our specialty stores, consumers experience our brand first-hand and have full access to our performance products. We opened... -

Page 14

... license agreement with Dome Corporation, which produces, markets and sells our branded products in Japan. We work closely with this licensee to develop variations of our products for the different sizes, sports interests and preferences of the Japanese consumer. Our branded products are now sold in... -

Page 15

...high-profile athletes, leagues and teams. While the apparel products manufactured in the quick turn, Special Make-Up Shop represent an immaterial portion of our total net revenues, we believe the facility helps us to provide superior service to select customers. Distribution and Inventory Management... -

Page 16

...our factory house outlet stores and liquidation sales to third parties. Our practice, and the general practice in the apparel and footwear industries, is to offer retail customers the right to return defective or improperly shipped merchandise. Because of long lead-times for design and production of... -

Page 17

..., if retailers earn greater margins from our competitors' products, they may favor the display and sale of those products. We believe that we have been able to compete successfully because of our brand image and recognition, the performance and quality of our products and our selective distribution... -

Page 18

... our operating results; our ability to effectively market and maintain a positive brand image; the availability, integration and effective operation of management information systems and other technology; and our ability to attract and maintain the services of our senior management and key employees... -

Page 19

...our key markets or a continued decline in consumer purchases of sporting goods generally could have an adverse effect on the financial health of our retail customers, which could in turn have an adverse effect on our sales, our ability to collect on receivables and our financial condition. A decline... -

Page 20

... innovative, high-quality products. The failure to effectively introduce new products and enter into new product categories that are accepted by consumers could result in a decrease in net revenues and excess inventory levels, which could have a material adverse effect on our financial condition... -

Page 21

... and cash flow. We operate in a highly competitive market and the size and resources of some of our competitors may allow them to compete more effectively than we can, resulting in a loss of our market share and a decrease in our revenues and gross profit. The market for performance athletic apparel... -

Page 22

... advantages, including greater financial, distribution, marketing and other resources, longer operating histories, better brand recognition among consumers, and greater economies of scale. In addition, our competitors have long-term relationships with our key retail customers that are potentially... -

Page 23

... delays, interruption or increased costs in the supply of fabric or manufacture of our products could have an adverse effect on our ability to meet retail customer and consumer demand for our products and result in lower revenues and net income both in the short and long-term. We have occasionally... -

Page 24

... materially adversely affect our cost of goods sold, results of operations and financial condition. Our operating results are subject to seasonal and quarterly variations in our net revenues and net income, which could adversely affect the price of our Class A Common Stock. We have experienced, and... -

Page 25

..., such as the long-term loss of customers or an erosion of our brand image. In addition, our distribution capacity is dependent on the timely performance of services by third parties, including the shipping of product to and from our distribution facilities. If we encounter problems with our... -

Page 26

... to retain existing management, product creation, sales, marketing, operational and other support personnel that are critical to our success, which could result in harm to key customer relationships, loss of key information, expertise or know-how and unanticipated recruitment and training costs. If... -

Page 27

... harm our business and have a material adverse effect on our results of operations and financial condition. Our failure to protect our intellectual property rights could diminish the value of our brand, weaken our competitive position and reduce our revenues. We currently rely on a combination of... -

Page 28

..., general use, approximate size and lease term of our properties as of December 31, 2009, none of which is owned by us, are set forth below: Location Use Approximate Square Feet Lease End Date Baltimore, MD ...Amsterdam, The Netherlands ...Glen Burnie, MD ... Corporate headquarters 217,000 6,300... -

Page 29

... from 1982 to 2003, including Global Director of Sales and Retail Marketing for Brand Jordan, from 1999 to 2003. J. Scott Plank has been our Executive Vice President of Business Development since August 2009 focusing on domestic and international business development opportunities. Prior to that, he... -

Page 30

...to our stockholders. Refer to "Financial Position, Capital Resources and Liquidity" within Management's Discussion and Analysis and Note 6 to the Consolidated Financial Statements for further discussion of our credit facility. Stock Compensation Plans The following table contains certain information... -

Page 31

... for footwear promotional rights. Refer to Note 12 to the Consolidated Financial Statements for a further discussion on the warrants. Recent Sales of Unregistered Equity Securities From September 15, 2009 through January 31, 2010, we issued 105.3 thousand shares of Class A Common Stock upon the... -

Page 32

...Graph The stock performance graph below compares cumulative total return on Under Armour, Inc. Class A Common Stock to the cumulative total return of the NYSE Market Index and the Hemscott Group Textile-Apparel Clothing Index from November 18, 2005 (the date of Under Armour's initial public offering... -

Page 33

... Analysis of Financial Condition and Results of Operations" included elsewhere in this Form 10-K. 2009 (In thousands, except per share amounts) Year Ended December 31, 2008 2007 2006 2005 Statements of Income data: Net revenues Cost of goods sold Gross profit Operating expenses Selling, general and... -

Page 34

... of our apparel, footwear and accessories, expansion of our wholesale distribution, growth in our direct to consumer sales channel and expansion in international markets. Our direct to consumer sales channel includes sales through our factory house outlet and specialty stores, website, and catalog... -

Page 35

... of our direct to consumer sales channel costs, along with commissions paid to third parties. Product innovation and supply chain costs include our apparel, footwear and accessories product creation and development costs, distribution facility operating costs, and related payroll. Corporate services... -

Page 36

... The following table sets forth key components of our results of operations for the periods indicated, both in dollars and as a percentage of net revenues: (In thousands) Year Ended December 31, 2009 2008 2007 Net revenues Cost of goods sold Gross profit Selling, general and administrative expenses... -

Page 37

...incurred for the continued expansion of our direct to consumer sales channel and higher personnel costs, including increased funding for our performance incentive plan as compared to the prior year. As a percentage of net revenues, selling costs increased to 8.0% for the year ended December 31, 2009... -

Page 38

... lines, including increased funding for our performance incentive plan as compared to the prior year. In addition, this increase was due to higher distribution facilities operating and personnel costs to support our growth. As a percentage of net revenues, product innovation and supply chain costs... -

Page 39

... average apparel selling prices driven primarily by a higher percentage of direct to consumer sales in the current year period versus the prior year period; and product introductions subsequent to December 31, 2007 in multiple product categories, most significantly in our training, golf, basketball... -

Page 40

... distribution facilities operating and personnel costs to support our growth and higher personnel costs for the design and sourcing of our expanding footwear and apparel lines. As a percentage of net revenues, product innovation and supply chain costs increased to 8.5% for the year ended December... -

Page 41

... to our new factory house outlet and specialty stores, and investment and improvements in information technology systems. Our focus on inventory management includes improving our planning capabilities, managing our inventory purchases, reducing our production lead times and selling excess inventory... -

Page 42

... foreign currency exchange rate gains and losses, losses on disposals of property and equipment, stock-based compensation, deferred income taxes and changes in reserves for doubtful accounts, returns, discounts and inventories. In addition, operating cash flows include the effect of changes... -

Page 43

... expense relating to information technology initiatives, branded concept shops and the improvements to our distribution facilities, unrealized foreign currency exchange rate losses during 2008 as compared to unrealized foreign currency exchange rate gains during 2007, higher stock based compensation... -

Page 44

... prior revolving credit facility, we repaid the then outstanding balance of $25.0 million. From time to time, we may borrow under the revolving credit facility to increase our cash position. The revolving credit facility has a term of three years and provides for a committed revolving credit line of... -

Page 45

... on long term debt obligations. (2) Includes the minimum payments for operating lease obligations. (3) We generally place orders with our manufacturers at least three to four months in advance of expected future sales. The amounts listed for product purchase obligations primarily represent our open... -

Page 46

... product purchase liabilities included in accounts payable as of December 31, 2009. (4) Includes footwear promotional rights fees, sponsorships of individual athletes, sports teams and athletic events and other marketing commitments in order to promote our brand. Some of these sponsorship agreements... -

Page 47

...results, changes in business plans, or changes in anticipated cash flows. When factors indicate that an asset should be evaluated for possible impairment, we review long-lived assets to assess recoverability from future operations using undiscounted cash flows. Impairments are recognized in earnings... -

Page 48

... the performance target is deemed probable, which requires management judgment. As a result, if factors change and we use different assumptions, our stock-based compensation expense could be materially different in the future. Refer to Note 2 and Note 12 to the Consolidated Financial Statements for... -

Page 49

... in Canada and Europe. The reporting currency for our consolidated financial statements is the U.S. dollar. To date, net revenues generated outside of the United States have not been significant. However, as our net revenues generated outside of the United States increase, our results of operations... -

Page 50

... our financial position or results of operations to date, a high rate of inflation in the future may have an adverse effect on our ability to maintain current levels of gross margin and selling, general and administrative expenses as a percentage of net revenues if the selling prices of our products... -

Page 51

... LLP, an independent registered public accounting firm, as stated in their report which appears herein. /s/ KEVIN A. PLANK Kevin A. Plank Chief Executive Officer and Chairman of the Board of Directors /s/ BRAD DICKERSON Brad Dickerson Chief Financial Officer Dated: February 25, 2010 43 -

Page 52

Report of Independent Registered Public Accounting Firm To the Board of Directors and Stockholders of Under Armour, Inc.: In our opinion, the consolidated financial statements listed in the index appearing under Item 15(a)(1) present fairly, in all material respects, the financial position of Under ... -

Page 53

... long term assets Total assets Liabilities and Stockholders' Equity Current liabilities Revolving credit facility Accounts payable Accrued expenses Current maturities of long term debt Current maturities of capital lease obligations Other current liabilities Total current liabilities Long term debt... -

Page 54

..., Inc. and Subsidiaries Consolidated Statements of Income (In thousands, except per share amounts) Year Ended December 31, 2009 2008 2007 Net revenues Cost of goods sold Gross profit Operating expenses Selling, general and administrative expenses Income from operations Interest income (expense... -

Page 55

... Armour, Inc. and Subsidiaries Consolidated Statements of Stockholders' Equity and Comprehensive Income (In thousands) Accumulated Other Class B CompreClass A Convertible Additional hensive CompreTotal Common Stock Common Stock Paid-In Retained Unearned Compen- Income hensive Stockholders' Shares... -

Page 56

...) in cash and cash equivalents Cash and cash equivalents Beginning of year End of year Non-cash financing and investing activities Fair market value of shares withheld in consideration of employee tax obligations relative to stock-based compensation Purchase of property and equipment through certain... -

Page 57

... to the Audited Consolidated Financial Statements 1. Description of the Business Under Armour, Inc. is a developer, marketer and distributor of branded performance apparel, footwear and accessories. These products are sold worldwide and worn by athletes at all levels, from youth to professional on... -

Page 58

...to the effective tax rate. The Company recognizes accrued interest and penalties related to unrecognized tax benefits in the provision for income taxes on the consolidated statements of income. Property and Equipment Property and equipment are stated at cost, including the cost of internal labor for... -

Page 59

...be recoverable. These factors may include a significant deterioration of operating results, changes in business plans, or changes in anticipated cash flows. When factors indicate that an asset should be evaluated for possible impairment, the Company reviews long-lived assets to assess recoverability... -

Page 60

...customer. License revenues are recognized based upon shipment of licensed products sold by the Company's licensees. Sales taxes imposed on the Company's revenues from product sales are presented on a net basis on the consolidated statements of income and therefore do not impact net revenues or costs... -

Page 61

... in the financial statements. In addition, this guidance requires that excess tax benefits related to stock-based compensation awards be reflected as financing cash flows. The Company uses the Black-Scholes option-pricing model to estimate the fair market value of stock-based compensation awards. As... -

Page 62

...that date represents the date the financial statements were issued or were available to be issued. This guidance was effective for fiscal years and interim periods ending after June 15, 2009. The adoption of this guidance did not have any impact on the Company's consolidated financial statements. In... -

Page 63

...It was effective for business combinations for which the acquisition date was on or after the start of the fiscal year beginning after December 15, 2008. The adoption of this guidance in the first quarter of 2009 did not have any impact on the Company's consolidated financial statements. In December... -

Page 64

... the years ending December 31, 2010 and 2011 and $0.9 million, $0.5 million and $0.1 million for the years ending December 31, 2012, 2013 and 2014, respectively. 6. Revolving Credit Facility and Long Term Debt Revolving Credit Facility In January 2009, the Company entered into a new revolving credit... -

Page 65

...base, even if the Company is in compliance with all conditions of the revolving credit facility, upon a material adverse change to the business, properties, assets, financial condition or results of operations of the Company. The revolving credit facility contains a number of restrictions that limit... -

Page 66

... costs, under the revolving credit facility and long term debt agreements of $2.4 million, $1.5 million and $0.8 million, respectively. 7. Commitments and Contingencies Obligations Under Operating and Capital Leases The Company leases warehouse space, office facilities, space for its factory house... -

Page 67

..., from time to time, involved in routine legal matters incidental to its business. Management believes that the ultimate resolution of any such current proceedings and claims will not have a material adverse effect on the Company's consolidated financial position, results of operations or cash flows... -

Page 68

... are entitled to 10 votes per share on all matters submitted to a stockholder vote. Class B Convertible Common Stock may only be held by the Company's Chief Executive Officer ("CEO"), or a related party of the CEO, as defined in the Company's charter. As a result, the Company's CEO has more than... -

Page 69

...life insurance policies, which are invested primarily in mutual funds and a separately managed fixed income fund. These investments are in the same funds and purchased in substantially the same amounts as the selected investments of participants in the Deferred Compensation Plan, which represent the... -

Page 70

... in the 2008 full year effective income tax rate, as compared to 2007, is primarily attributable to increased losses in foreign subsidiaries and an increase in the state income tax rate in Maryland, where the Company's corporate headquarters is located. Deferred tax assets and liabilities consisted... -

Page 71

... and penalties, respectively. For each of the years ended December 31, 2009, 2008 and 2007, the Company recorded $0.2 million for the accrual of interest and penalties in its consolidated statement of income. The Company files income tax returns in the U.S. federal jurisdiction and various state... -

Page 72

... Plans The Under Armour, Inc. Amended and Restated 2005 Omnibus Long-Term Incentive Plan (the "2005 Plan") provides for the issuance of stock options, restricted stock, restricted stock units and other equity awards to officers, directors, key employees and other persons. In 2009, stockholders... -

Page 73

The Company's 2000 Stock Option Plan (the "2000 Plan") provided for the issuance of stock options, restricted stock and other equity awards to officers, directors, key employees and other persons. The 2000 Plan was terminated and superseded by the 2005 Plan upon the Company's initial public offering... -

Page 74

... and key employees under the 2005 Plan. These performance-based stock options have a weighted average exercise price of $15.87 and a term of ten years. Of the 1.4 million performance-based stock options, 1.2 million performancebased stock options will vest upon the achievement of a combined annual... -

Page 75

... Stock are not an investment option in this plan. Effective June 1, 2007, the Company's Board of Directors approved the Under Armour, Inc. Deferred Compensation Plan (the "Deferred Compensation Plan"). The Deferred Compensation Plan allows a select group of management or highly compensated employees... -

Page 76

... the credit quality of these financial institutions and considers the risk of counterparty default to be minimal. 15. Related Party Transactions In 2005, the Company entered into an agreement to license a software system with a vendor whose Co-CEO is a director of the Company. During the years ended... -

Page 77

... Company operates exclusively in the consumer products industry in which the Company develops, markets, and distributes branded performance apparel, footwear and accessories. Based on the nature of the financial information that is received by the chief operating decision maker, the Company operates... -

Page 78

... are effective in ensuring that information required to be disclosed in our Exchange Act reports is (1) recorded, processed, summarized and reported in a timely manner and (2) accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as... -

Page 79

... 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE The information required by this Item regarding directors is incorporated herein by reference from the 2010 Proxy Statement, under the headings "NOMINEES FOR ELECTION AT THE ANNUAL MEETING," "CORPORATE GOVERNANCE AND RELATED MATTERS: Audit... -

Page 80

... of this Form 10-K: 1. Financial Statements: Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets as of December 31, 2009 and 2008 Consolidated Statements of Income for the Years Ended December 31, 2009, 2008 and 2007 Consolidated Statements of Stockholders' Equity and... -

Page 81

... by reference to Exhibit 10.1 of the Current Report on Form 8-K filed on May 22, 2007), and the Seventh Amendment dated November 20, 2007 (incorporated by reference to Exhibit 10.07 of the Company's 2007 Form 10-K). Office lease by and between Beason Properties LLLP (as successor to 1450 Beason... -

Page 82

... 10.26 of the Company's 2005 Form 10-K).* Under Armour, Inc. Amended and Restated 2005 Omnibus Long-Term Incentive Plan (incorporated by reference to Exhibit 10.01 of the Company's Form 10-Q for the quarterly period ending March 31, 2009).* Forms of Restricted Stock Grant Agreement under the Amended... -

Page 83

... Under Armour, Inc. 2006 Non-Employee Director Compensation Plan (incorporated by reference to Exhibit 10.1 of the Current Report on Form 8-K filed April 13, 2006) and Forms of Grant Award Agreement and Notice- Non-Employee Director Initial Restricted Stock Unit Grant, Annual Restricted Stock Unit... -

Page 84

..., this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the date indicated. /s/ KEVIN A. PLANK Kevin A. Plank Chief Executive Officer and Chairman of the Board of Directors (principal executive officer) Chief Financial Officer (principal... -

Page 85

..., 2009 For the year ended December 31, 2008 For the year ended December 31, 2007 Allowance for doubtful accounts For the year ended December 31, 2009 For the year ended December 31, 2008 For the year ended December 31, 2007 Sales returns, markdowns and allowances For the year ended December 31, 2009... -

Page 86

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 87

GEORGES ST-PIERRE I MMA -

Page 88

RYAN ZIMMERMAN I 3B -

Page 89

-

Page 90

MICHAEL PHELPS I US SWIM TEAM -

Page 91

... CHAIRMAN OF THE BOARD OF DIRECTORS THE ROUSE COMPANY ADAM PEAKE JAMES E. CALO CHIEF SUPPLY CHAIN OFFICER VICE PRESIDENT, APPAREL SALES J. SCOTT PLANK BRAD DICKERSON CHIEF FINANCIAL OFFICER EXECUTIVE VICE PRESIDENT, BUSINESS DEVELOPMENT A.B. KRONGARD FORMER CHIEF EXECUTIVE OFFICER AND CHAIRMAN OF... -

Page 92

UNDER ARMOUR, INC. 1020 HULL STREET BALTIMORE, MARYLAND 21230 WWW.UNDERARMOUR.COM 1.888.4ARMOUR TO LEARN MORE ABOUT UNDER ARMOUR, GO TO WWW.UNDERARMOUR.COM