Porsche 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

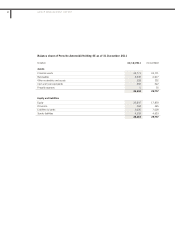

Personnel expenses in the period from

1 January to 31 December 2011 came to 14 million

euro in the Porsche SE group (SFY 2010: 11 million

euro).

Profit from investments accounted for at

equity comes to 4,660 million euro (SFY 2010:

1,075 million euro). 395 million euro (SFY 2010: 106

million euro) is attributable to the Porsche Zwischen-

holding GmbH group and 4,265 million euro (SFY

2010: 969 million euro) to the Volkswagen group.

Porsche SE benefited from the increased profits of

its significant investments. In addition to the original

profit contributions of both investments, the profit of

investments accounted for at equity includes effects

of amortization of the purchase price allocations

performed at the time of inclusion of Porsche

Zwischenholding GmbH as a joint venture and Volks-

wagen AG as an associate. The profit/loss from

investments accounted for at equity – and therefore

the Porsche SE group’s profit for the year – was

reduced by 165 million euro in total (SFY 2010: 206

million euro) by the effects of the subsequent meas-

urement of the purchase price allocations for the

Porsche Zwischenholding GmbH group and the Volks-

wagen group, i.e., the amortization of hidden re-

serves and burdens identified in the process.

In the reporting period, the financial result,

which essentially contains income and expenses from

loans, came to minus 185 million euro (SFY 2010:

104 million euro).

In the fiscal year 2011, the Porsche SE

group achieved a profit before tax of 28 million euro

(SFY 2010: 639 million euro). Taking into considera-

tion income from income taxes of 31 million euro

(SFY 2010: income of 647 million euro), the profit for

the year of the Porsche SE group comes to 59 mil-

lion euro (SFY 2010: 1,286 million euro).

Financial position

The cash flow from operating activities of the

Porsche SE group came to 43 million euro in the

fiscal year 2011 (SFY 2010: minus 325 million euro).

This comprises, on the one hand, the positive effect

from dividends received from Volkswagen AG of 243

million euro (SFY 2010: 0 million euro) and from

Porsche Zwischenholding GmbH of 128 million euro

(SFY 2010: 198 million euro). In addition, there was

an inflow from income tax refunds of 176 million euro

(SFY 2010: 7 million euro) in the fiscal year 2011. On

the other hand, there was a cash outflow from in-

come taxes paid of 278 million euro (SFY 2010: 370

million euro) in the fiscal year 2011. Interest paid in

the fiscal year 2011 came to 366 million euro (SFY

2010: 205 million euro); interest received came to

191 million euro (SFY 2010: 77 million euro).

There was a cash inflow from investment ac-

tivities of 115 million euro (SFY 2010: 222 million

euro) in the fiscal year 2011. This cash inflow per-

tains to released time deposits with an original term

of more than three months (SFY 2010: 100 million

euro). In SFY 2010, the cash flow from investing

activities also contained changes in the cash-settled

options relating to shares in Volkswagen AG, which

were disposed of in full during SFY 2010, as well as

the associated effect of the originally restricted cash

being released.

There was a cash outflow from financing ac-

tivities of 196 million euro (SFY 2010: 28 million

euro) in the fiscal year 2011. The cash flow from

financing activities in the fiscal year 2011 contains in

particular the gross issue proceeds of 4,988 million

euro from the capital increase in April 2011, less all

related transaction costs of 85 million euro incurred

in 2011. Transaction costs of 10 million euro were

already paid in SFY 2010. In addition, the cash flow

from financing activities includes the cash paid for

the repayment of the bank liabilities totaling 7,000

million euro, cash received from taking out liabilities

to banks incurred in connection with the refinancing

performed in October 2011 in the amount of 2,000

million euro as well as the dividend payments to the

shareholders of Porsche SE and its hybrid capital

investors. In SFY 2010, the cash flow from financing

activities contained only dividends paid to the share-

holders of Porsche SE and its hybrid capital investors.

Compared to 31 December 2010, cash

funds decreased by 38 million euro to 368 million

euro.

GROUP MANAGEMENT REPORT56