Porsche 2011 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2011 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

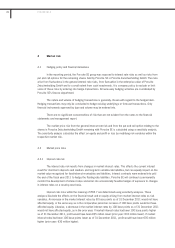

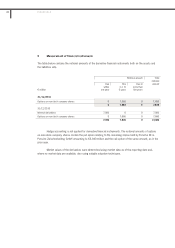

4 Market risk

4.1 Hedging policy and financial derivatives

In the reporting period, the Porsche SE group was exposed to interest rate risks as well as risks from

put and call options for the remaining shares held by Porsche SE in Porsche Zwischenholding GmbH. The risks

arise from fluctuations in the general interest rate risks, from fluctuation in the enterprise value of Porsche

Zwischenholding GmbH and to a small extent from cash investments. It is company policy to exclude or limit

some of these risks by entering into hedge transactions. All necessary hedging activities are coordinated by

Porsche SE’s finance department.

The nature and volume of hedging transactions is generally chosen with regard to the hedged item.

Hedging transactions may only be concluded to hedge existing underlyings or forecast transactions. Only

financial instruments approved by type and volume may be entered into.

There are no significant concentrations of risk that are not evident from the notes to the financial

statements and management report.

The market price risk from the general interest rate risk and from the put and call option relating to the

shares in Porsche Zwischenholding GmbH remaining with Porsche SE is calculated using a sensitivity analysis.

The sensitivity analysis calculates the effect on equity and profit or loss by modifying risk variables within the

respective market risk.

4.2 Market price risks

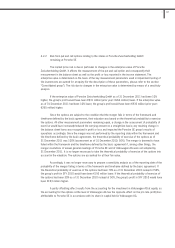

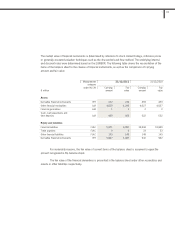

4.2.1 Interest rate risk

The interest rate risk results from changes in market interest rates. This affects the current interest

result for short-term deposits and medium- and long-term variable-rate liabilities, but can equally impact on the

market value recognized for fixed-interest receivables and liabilities. Interest contracts were entered into until

the end of the fiscal year 2011 to hedge the floating-rate liabilities. Porsche SE will continue to permanently

monitor the development of interest rates and enter into economically feasible hedges of exposure to changes

in interest rates on a case-by-case basis.

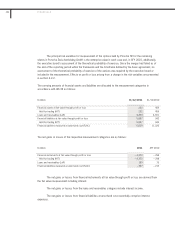

Interest rate risks within the meaning of IFRS 7 are determined using sensitivity analyses. These

analyses illustrate the effects on the financial result and on equity arising from market interest rates as risk

variables. An increase in the market interest rates by 50 base points as of 31 December 2011 would not have

affected equity, in the same way as in the comparative period an increase of 100 base points would not have

affected equity. Likewise, a decrease in the market interest rates by 100 base points as of 31 December 2011

would not have affected equity, as in the prior year. If market interest rates had been 100 base points higher

as of 31 December 2011, profit would have been €35 million lower (prior year: €33 million lower). If market

interest rates had been 100 base points lower as of 31 December 2011, profit would have been €35 million

higher (prior year: €30 million higher).

196 FINANCIALS