Porsche 2011 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2011 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Subscribed capital

Porsche SE’s subscribed capital totals €306.25 million (prior year: €175 million) and has been fully

paid in. It is divided into 153,125,000 ordinary shares and 153,125,000 non-voting preference shares (prior

year: 87,500,000 ordinary shares and 87,500,000 non-voting preference shares), which each represent a

notional share of the share capital of €1. The preference shares carry an additional dividend of 0.6 cents per

share in the event of there being net profit available for distribution and a corresponding resolution on a

distribution.

On 30 November 2010, the annual general meeting of Porsche SE adopted resolutions on a capital

increase in return for cash contributions, on the authorization to issue convertible bonds, participation rights,

participating bonds or a combination of these instruments, and on the creation of contingent capital and new

authorized capital. The resolutions were to prepare for a capital increase which was part of the concept agreed

in the basic agreement for the creation of an integrated automotive group of Porsche and Volkswagen.

The capital increase in return for cash contributions was performed in the period between 27 March

and 13 April 2011. With the entry of the implementation of the capital increase in the commercial register of

the Stuttgart district court on 13 April 2011, the company’s share capital was increased by €131,250,000.00

from €175,000,000.00 to €306,250,000.00 through the issuance of 65,625,000 new ordinary shares (no-par-

value shares) and 65,625,000 new preference shares (no-par-value shares), with each no-par-value share

representing a notional share of €1.00 in the share capital. Since then, Porsche SE’s subscribed capital has

comprised 153,125,000 ordinary shares and 153,125,000 preference shares.

A subscription price of €38.00 was set for each new ordinary or preference share. The new ordinary

shares and the new preference shares are each entitled to dividends as of 1 August 2010. The new preference

shares were admitted to stock exchange trading on 13 April 2011. Taking into account transaction costs of

€95 million, the net issue proceeds came to €4,893 million.

The annual general meeting on 17 June 2011 passed a resolution to cancel the authorization for the

issue of convertible bonds, participation rights, participating bonds or a combination of these instruments

which had been resolved at the annual general meeting on 30 November 2010, as well as the existing

contingent capital and the existing authorized capital. The cancellation of the contingent capital and authorized

capital became effective with the corresponding amendment of the articles of association on 20 July 2011.

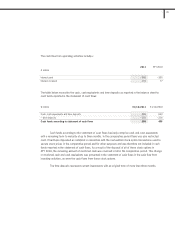

Capital reserves

The capital reserves increased by €4,762 million from €122 million to €4,884 million in fiscal year

2011 following the capital increase performed in return for cash contributions. The increase arose from the

share premiums of €4,857 million paid by the shareholders. It was reduced by transaction costs of €95 million

for costs directly associated with the capital increase, e.g., for banks, lawyers and auditors.

185

3