Porsche 2011 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2011 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

An impairment test is carried out whenever there is any indication in accordance with IAS 39 that the

entire carrying amount of the investment is impaired. Where the carrying amount of the investment exceeds its

recoverable amount determined in accordance with IAS 36, an impairment loss is recognized in profit or loss to

account for the difference. Value in use is determined on the basis of the estimated future cash flows expected

to be generated by the investment accounted for at equity in accordance with IAS 28.33a. Where an impairment

loss was recognized in prior periods, it is assessed at least once a year whether there is any indication that the

reason for a previously recognized impairment loss no longer exists or has decreased. If this is the case, the

recoverable amount is recalculated and an impairment previously recognized that no longer exists is reversed.

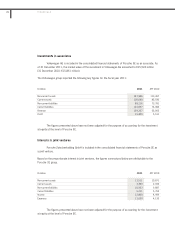

An impairment test was carried out in the reporting period for both the investment in Volkswagen AG

and the investment in Porsche Zwischenholding GmbH. The recoverable amount was determined for both

investments using the discounted cash flow method. The most recent five-year corporate planning approved

by the management of the equity investments was used as a basis in each case. One integral component of

the corporate planning for the Porsche Zwischenholding GmbH group is the increase in the annual sales

volume to around 200,000 vehicles by 2018 and a return on sales of 15%. The corporate planning of the

Volkswagen group includes reaching a sustainable return on sales before taxes of 8% or more in the medium

term. A growth rate of 1% was used to extrapolate the cash flow beyond the detailed planning phase. The

sustainable EBIT margin was determined conservatively, taking into account the EBIT margins generated in

the past and used for detailed planning purposes. A weighted average cost of capital of 7.0% or 7.7% (prior

year: 6.6% or 7.2%) was used to discount cash flows. This was derived from a peer group for each equity

investment to reflect a return on capital that is appropriate for the risks involved in the respective business

operations. When selecting the two peer groups, the special aspects of the multi-brand strategy pursued by

the Volkswagen group (Volkswagen AG and its subsidiaries) as well as of those of the sports car business of

the Porsche Zwischenholding GmbH group (Porsche Zwischenholding GmbH and its subsidiaries) were taken

into consideration.

Even an isolated decrease in the sustainable EBIT margin by 20% or a growth rate of 0%, or an

isolated increase in the weighted average cost of capital by 20% would not lead to an impairment of the

carrying amounts of either equity investment.

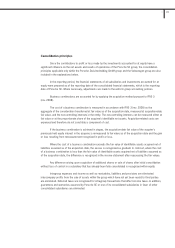

Currency translation

Foreign currency items in the financial statements of the entities included in the consolidated financial

statements are measured at the spot exchange rates on the date of the transaction. Monetary assets and

liabilities denominated in foreign currencies are translated into the functional currency at the closing rate. Non-

monetary items denominated in a foreign currency measured at historical cost are translated using the

exchange rate on the date of the initial transaction. Non-monetary items measured at fair value in a foreign

currency are translated using the exchange rate prevailing on the date when the fair value was determined.

Exchange rate gains and losses as of the reporting date are recorded in profit or loss.

155

3