Porsche 2011 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2011 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240

|

|

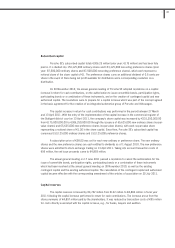

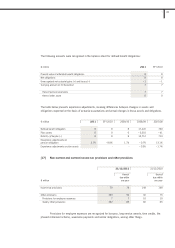

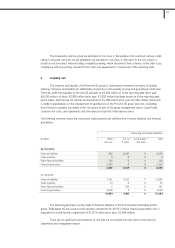

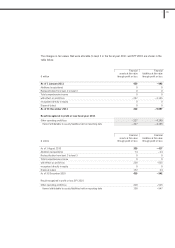

Liabilities to banks are recognized at amortized cost. The cash inflow from the capital increase

performed in spring 2011 in return for cash contributions and additional available cash were used to repay

liabilities to banks in a nominal amount of €5,000 million.

In October 2011, Porsche SE concluded a new syndicated loan agreement that replaces the previous

syndicated loan. The refinancing was executed on 31 October 2011. The new syndicated loan has a volume of

up to €3.5 billion and comprises a loan tranche of €2.0 billion as well as a revolving credit line of up to €1.5

billion that was unutilized as of the reporting date. The loan matures on 30 November 2013, however, the

company has two options to extend it such that under certain circumstances the maturity date may be

prolonged until 30 June 2015 in two steps. In connection with the refinancing of the syndicated loan, the

collateral provided by Porsche SE was also restructured. In particular, the number of pledged shares in

Volkswagen AG held by Porsche SE was reduced to 70 million VW ordinary shares. For further changes in

collateral, please refer to notes [11] and [12].

Financial liabilities to joint ventures are due to companies in the Porsche Zwischenholding GmbH group.

These are counterbalanced by other loan receivables of €4,016 million (prior year: €4,016 million) and other

receivables of €14 million (prior year: €11 million) disclosed under other receivables and assets. Please refer

to note [12] for details of offsetting permitted.

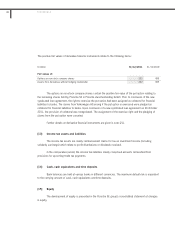

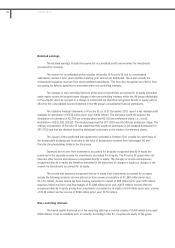

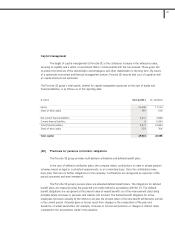

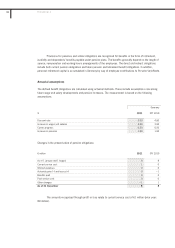

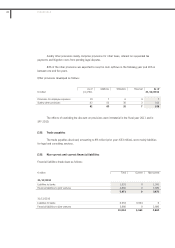

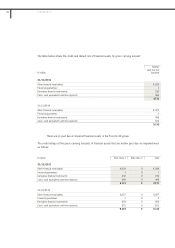

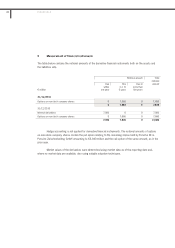

[20] Non-current and current other liabilities

As of the reporting date, other liabilities break down as follows:

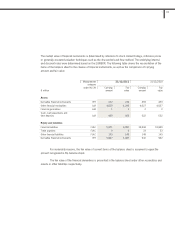

The item derivative financial instruments includes Volkswagen AG’s call option for the remaining shares

in Porsche Zwischenholding GmbH held by Porsche SE. In the comparative period, this item also contained

interest hedges.

€ million 31/12/2011 31/12/2010

Derivative financial instruments 5,087 942

Sundry liabilities 150 151

5,237 1,093

thereof non-current 5,087 1,088

thereof current 150 5

191

3