Porsche 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

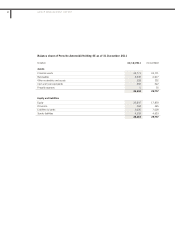

Results of operations, financial

position and net assets

Porsche SE functions as a holding company

for its investments in the operating companies Por-

sche Zwischenholding GmbH and Volkswagen AG.

Following the change of the fiscal year at Porsche SE

in 2010, the fiscal year now runs concurrently with

the calendar year. The present consolidated financial

statements of Porsche SE therefore cover the period

from 1 January to 31 December 2011. The compara-

tive period, the short fiscal year 2010, ran from

1 August to 31 December 2010, covering a five-

month period. Due to the different durations of the

two fiscal years, the financial position and results of

operations of the fiscal year 2011 are not fully com-

parable to the financial position and results of opera-

tions of the comparative period.

Results of operations

In the period from 1 January to 31 Decem-

ber 2011, the Porsche SE group generated a profit

for the year of 59 million euro, following a profit for

the year of 1,286 million euro recorded in SFY 2010.

The company presents a positive result from invest-

ments accounted for at equity of 4,660 million euro

(SFY 2010: 1,075 million euro). However, this was

largely compensated by a non-cash special effect

recognized in income from the adjustment of the

valuation of the put and call options for the shares in

Porsche Zwischenholding GmbH remaining with Por-

sche SE totaling minus 4,372 million euro (SFY 2010:

minus 389 million euro). The main parameters for the

valuation of the put and call options in the fiscal year

2011 were above all the theoretical probability of

exercise of the options as well as the enterprise

value of Porsche Zwischenholding GmbH. The enter-

prise value of Porsche Zwischenholding GmbH in turn

depends to a large extent on the underlying planning

and the cost of capital derived as of the respective

valuation date.

As the merger was not achieved within the

framework and timeframe of the basic agreement,

the valuation of the put and call options as of 31

December 2011 was to be based on a theoretical

probability of 100 percent that the options will be

exercised. Since the theoretical probability was still

50 percent as of 31 December 2010, the increase to

100 percent placed a considerable burden on earn-

ings (we refer to our statements under “No merger of

Porsche SE into Volkswagen AG within the framework

and timeframe of the basic agreement – aim to

achieve integrated automotive group with Volks-

wagen unchanged” in the “Significant events” section

of this management report). Furthermore, an update

of the corporate planning of Porsche Zwischenhold-

ing GmbH and the additional model series planned in

the sporty off-roader segment (Macan) resulted in an

increase in the enterprise value and in a negative

impact on earnings due to the valuation of the put

and call options at fair value.

The increase in the cost of capital used for

valuation purposes compared to the prior fiscal year

end had an opposite effect on the valuation of the

put and call options. However, this increase only

partially compensated for the increase in the enter-

prise value and the theoretical probability of the

exercise of the options and, in turn, the net valuation

result.

Other operating income for the fiscal year

2011 of 12 million euro (SFY 2010: 269 million euro)

chiefly comprises income from the reversal of provi-

sions. In the comparative period, other operating

income contained in particular income from stock

price hedging (102 million euro) and income from the

valuation of the put option for the remaining shares

held by Porsche SE in Porsche Zwischenholding

GmbH (158 million euro).

The Porsche SE group’s other operating ex-

penses of 4,445 million euro (SFY 2010: 590 million

euro) essentially contain the effect described from

the valuation of the put and call options for the

shares in Porsche Zwischenholding GmbH remaining

with Porsche SE at fair value totaling minus 4,372

million euro (SFY 2010: expenses from the valuation

of the call option of 547 million euro).

55

2