Office Depot 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

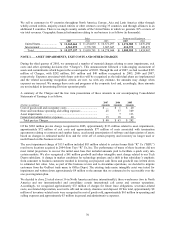

Third quarter of 2006: We completed the acquisition of Papirius s.r.o, one of the largest business-to-business

suppliers of office products and services in Eastern Europe. Papirius has sales in the Czech Republic, Lithuania,

Hungary, and Slovakia.

Fourth quarter of 2006: We acquired a majority stake in AsiaEC, one of the largest suppliers of office products

and services in China.

The size of these acquisitions is not material to periods presented and therefore pro forma financial information has

not been provided.

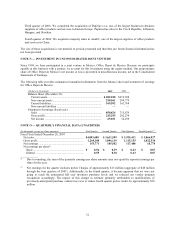

NOTE N — INVESTMENT IN UNCONSOLIDATED JOINT VENTURE

Since 1994, we have participated in a joint venture in Mexico, Office Depot de Mexico. Because we participate

equally in this business with a partner, we account for this investment using the equity method. Our proportionate

share of Office Depot de Mexico’s net income or loss is presented in miscellaneous income, net in the Consolidated

Statements of Earnings.

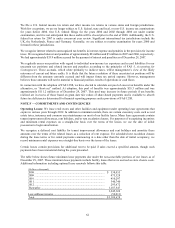

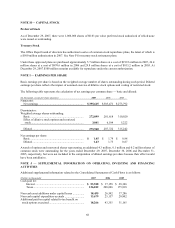

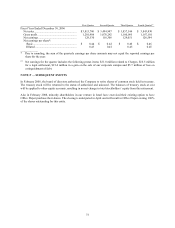

The following table provides summarized unaudited information from the balance sheet and statement of earnings

for Office Depot de Mexico:

(Dollars in thousands) 2007 2006

Balance Sheet (December 31):

Current assets ........................................................................... $ 202,188 $ 219,388

Non-current assets.................................................................... 250,561 209,779

Current liabilities...................................................................... 169,592 163,768

Non-current liabilities .............................................................. — —

Statement of earnings (fiscal year):

Sales ......................................................................................... 850,824 715,679

Gross profit............................................................................... 245,295 202,274

Net income ............................................................................... 69,651 54,250

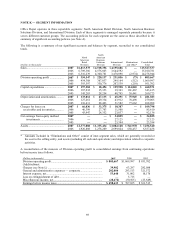

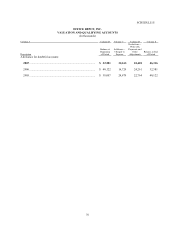

NOTE O — QUARTERLY FINANCIAL DATA (UNAUDITED)

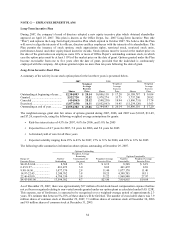

(In thousands, except per share amounts) First Quarter Second Quarter Third Quarter Fourth Quarter(1)

Fiscal Year Ended December 29, 2007

Net sales....................................................................

.

$4,093,600 $ 3,631,599 $ 3,935,411 $ 3,866,927

Gross profit...............................................................

.

1,269,108 1,096,119 1,115,135 1,022,536

Net earnings..............................................................

.

153,771 105,582 117,488 18,774

Net earnings per share*:

Basic .....................................................................

.

$ 0.56 $ 0.39 $ 0.43 $ 0.07

Diluted ..................................................................

.

0.55 0.38 0.43 0.07

____________

* Due to rounding, the sum of the quarterly earnings per share amounts may not equal the reported earnings per

share for the year.

(1) Net earnings for the quarter includes pretax Charges of approximately $15 million (aggregate of $40 million

through the four quarters of 2007). Additionally, in the fourth quarter, it became apparent that we were not

going to reach the anticipated full year inventory purchase levels and we reduced our vendor program

recognition accordingly. The impact of this change in estimate primarily attributable to modifications of

previously-anticipated purchase volume tiers was to reduce fourth quarter pretax results by approximately $30

million.