Office Depot 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

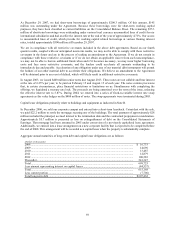

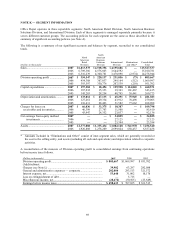

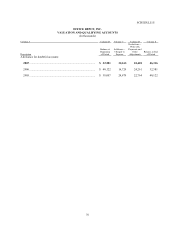

NOTE K — SEGMENT INFORMATION

Office Depot operates in three reportable segments: North American Retail Division, North American Business

Solutions Division, and International Division. Each of these segments is managed separately primarily because it

serves different customer groups. The accounting policies for each segment are the same as those described in the

summary of significant accounting policies (see Note A).

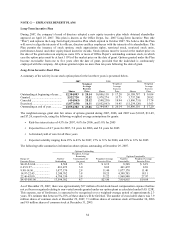

The following is a summary of our significant accounts and balances by segment, reconciled to our consolidated

totals.

(Dollars in thousands)

North

American

Retail

Division

North

American

Business

Solutions

Division

International

Division

Eliminations

and Other*

Consolidated

Total

Sales................................................... 2007 $ 6,813,575 $ 4,518,356 $ 4,195,606 $ — $ 15,527,537

2006 6,789,386 4,576,803 3,644,592 — 15,010,781

2005 6,510,239 4,300,781 3,470,898 (2,974) 14,278,944

Division operating profit ................... 2007 $ 354,547 $ 220,137 $ 231,056 $ (73) $ 805,667

2006 454,308 367,037 249,164 (512) 1,069,997

2005 393,597 350,776 207,539 (210) 951,702

Capital expenditures .......................... 2007 $ 197,284 $ 18,494 $ 129,928 $ 114,865 $ 460,571

2006 187,232 15,353 39,363 101,467 343,415

2005 145,283 28,254 48,795 38,441 260,773

Depreciation and amortization........... 2007 $ 133,012 $ 27,135 $ 45,291 $ 75,945 $ 281,383

2006 127,261 29,334 43,912 78,498 279,005

2005 110,431 28,423 51,582 77,662 268,098

Charges for losses on 2007 $ 66,036 $ 33,375 $ 10,387 —$ 109,798

receivables and inventories............ 2006 46,399 27,703 11,508 — 85,610

2005 43,947 24,352 23,837 — 92,136

Net earnings from equity method 2007 — — $ 34,825 —$ 34,825

investments ................................ 2006 ——

27,125 — 27,125

2005 ——

23,394 — 23,394

Assets................................................. 2007 $ 2,377,008 $ 1,335,434 $ 3,002,128 $ 541,970 $ 7,256,540

2006 1,920,888 1,278,289 2,699,824 658,437 6,557,438

____________

* Amounts included in “Eliminations and Other” consist of inter-segment sales, which are generally recorded at

the cost to the selling entity, and assets (including all cash and equivalents) and depreciation related to corporate

activities.

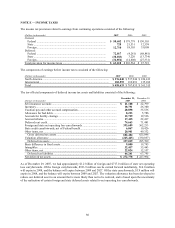

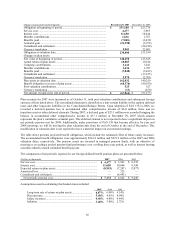

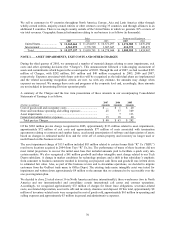

A reconciliation of the measure of Division operating profit to consolidated earnings from continuing operations

before income taxes follows.

(Dollars in thousands) 2007 2006 2005

Division operating profit....................................................................... $ 805,667 $ 1,069,997 $ 951,702

(Add)/subtract:

Charges (see Note L) ............................................................................ 39,982 63,297 282,088

General and administrative expenses — corporate............................... 282,084 293,513 321,572

Interest expense, net.............................................................................. 53,640 31,002 10,176

Loss on extinguishment of debt............................................................ — 5,715 —

Miscellaneous income, net.................................................................... (28,672) (30,565) (23,649)

Earnings before income taxes............................................................... $ 458,633 $ 707,035 $ 361,515