Office Depot 2007 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2007 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

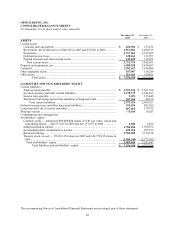

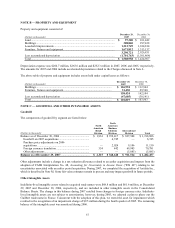

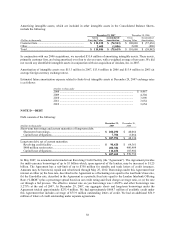

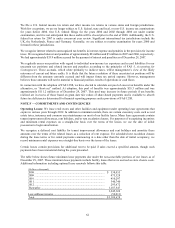

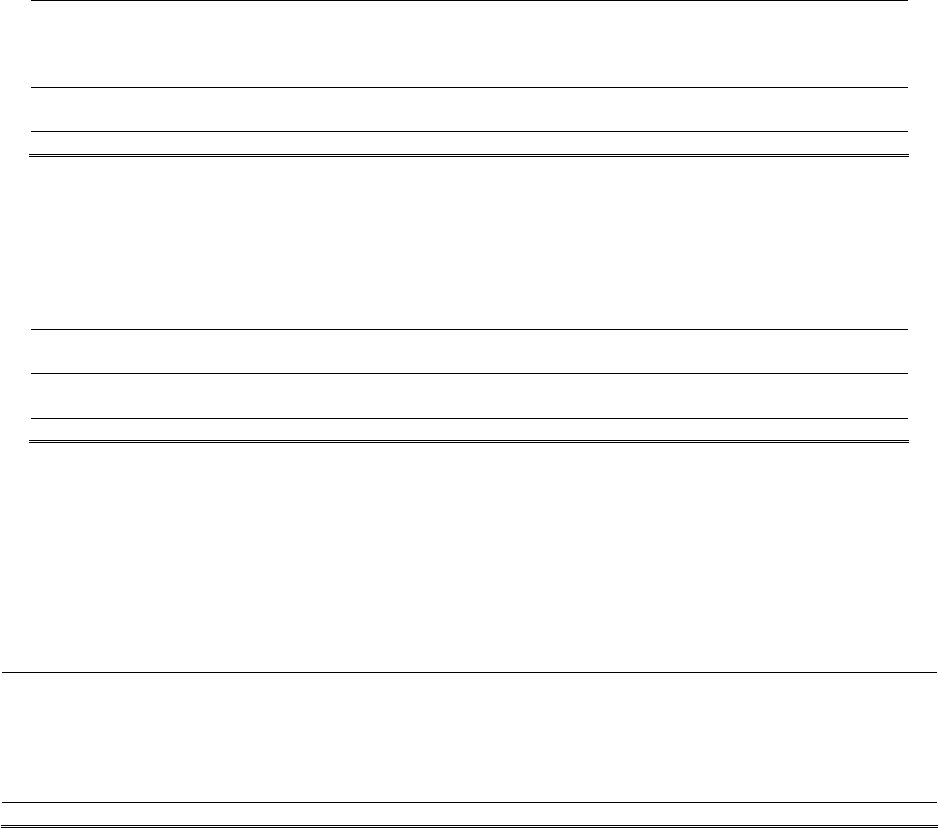

NOTE B — PROPERTY AND EQUIPMENT

Property and equipment consisted of:

(Dollars in thousands)

December 29,

2007

December 30,

2006

Land .................................................................................................................... $ 97,300 $ 101,442

Buildings............................................................................................................. 308,860 297,438

Leasehold improvements .................................................................................... 1,212,749 1,014,814

Furniture, fixtures and equipment....................................................................... 1,671,812 1,513,137

3,290,721 2,926,831

Less accumulated depreciation ........................................................................... (1,701,763) (1,501,864)

Total.................................................................................................................... $ 1,588,958 $ 1,424,967

Depreciation expense was $266.7 million, $265.6 million and $252.3 million in 2007, 2006 and 2005, respectively.

The amounts for 2007 and 2006 include accelerated depreciation related to the Charges discussed in Note L.

The above table of property and equipment includes assets held under capital leases as follows:

(Dollars in thousands)

December 29,

2007

December 30,

2006

Buildings......................................................................................................... $ 126,994 $ 112,544

Furniture, fixtures and equipment................................................................... 31,430 29,560

158,424 142,104

Less accumulated depreciation ....................................................................... (47,605) (38,141)

Total................................................................................................................ $ 110,819 $ 103,963

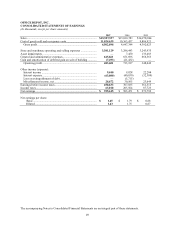

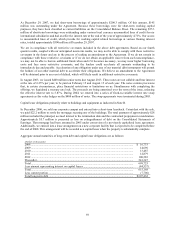

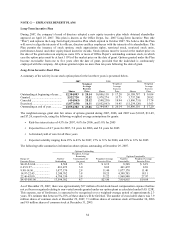

NOTE C — GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill

The components of goodwill by segment are listed below:

(Dollars in thousands)

North

American

Retail

Division

North

American

Business

Solutions

Division

International

Division Total

Balance as of December 30, 2006 ......................................... $ 1,961 $ 359,417 $ 837,508 $ 1,198,886

Goodwill on 2007 acquisitions........................................... — 6,745 — 6,745

Purchase price adjustments on 2006

acquisitions ........................................................................ — 2,024 9,106 11,130

Foreign currency translation .............................................. 354 442 69,985 70,781

Other adjustments.............................................................. — — (5,085) (5,085)

Balance as of December 29, 2007........................................ $ 2,315 $ 368,628 $ 911,514 $ 1,282,457

Other adjustments include a change in a tax valuation allowance related to an earlier acquisition and impacts from the

adoption of FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes (“FIN 48”) relating to tax

uncertainties associated with an earlier period acquisition. During 2007, we completed the acquisition of Axidata Inc.,

which is described in Note M. Some fair value estimates remain in process and may impact goodwill in future periods.

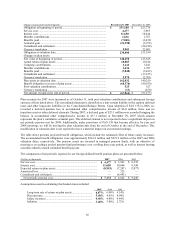

Other Intangible Assets

Indefinite-lived intangible assets related to acquired trade names were $68.8 million and $61.6 million, at December

29, 2007 and December 30, 2006, respectively, and are included in other intangible assets in the Consolidated

Balance Sheets. The change in this balance during 2007 resulted from changes in foreign currency rates. Indefinite-

lived intangible assets are not subject to amortization, however, during 2005, we adopted a plan to phase out the

Guilbert trade name in France. Concurrent with the adoption of this plan, we tested the asset for impairment which

resulted in the recognition of an impairment charge of $9.5 million during the fourth quarter of 2005. The remaining

balance of the intangible asset was amortized during 2006.