Office Depot 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

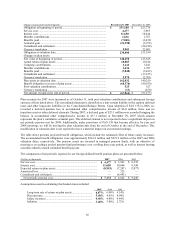

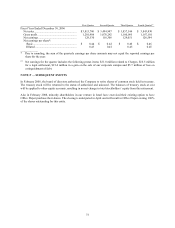

In addition to these exit costs, we recognized approximately $77 million of other charges. We terminated certain

contractual agreements and adjusted surplus lease property accruals, wrote down and accelerated depreciation on

assets based on a decrease in their expected use and accelerated inventory clearance activity in preparation for

implementation of a new inventory management system. Of this total, approximately $12 million was presented as a

charge in cost of goods sold, approximately $48 million in operating and selling expenses and approximately $17

million in general and administrative expenses.

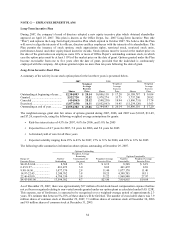

We recognized $63 million and $40 million in 2006 and 2007, respectively, associated with these projects as the

previously-identified plans were implemented and the related accounting recognition criteria were met. We incurred

charges for severance-related expenses, accelerated depreciation and lease obligations associated with the

consolidation of warehouses and distribution centers. We also incurred severance-related charges as plans were

implemented for management restructuring and call center consolidation in Europe. The operating expense

categories are presented in the table below. Some of these activities, such as planned facility closings, will extend

into 2008 and 2009. The costs associated with these activities will be recognized in future periods as incurred, or in

the case of asset utilization, over the period of remaining estimated useful life.

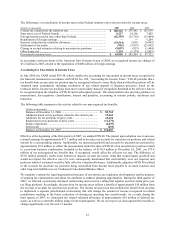

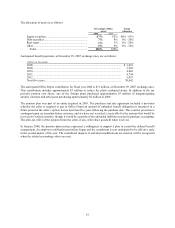

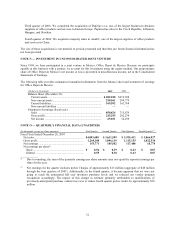

Exit cost accruals and other Charges related to activities described above are as follows:

(Dollars in millions)

Beginning

Balance

Charges

Incurred

Cash

Payments

Non-cash

settlements Adjustments

Ending

Balance

2007

One-time termination benefits ....................... $ 7 $ 19 $ (12) $ (1) $ — $ 13

Asset write offs and accelerated

depreciation ................................................. — 20 — (20) — —

Lease and contract obligations....................... 22 2 (7) (1) 1 17

Other associated costs.................................... 2 (1) 5 (6) — —

Total............................................................... $ 31 $ 40 $ (14) $ (28) $ 1 $ 30

2006

One-time termination benefits ....................... $ 6 $ 22 $ (21) $ — $ — $ 7

Asset write offs and accelerated

depreciation ................................................. — 28 — (28) — —

Lease and contract obligations....................... 23 9 (12) — 2 22

Other associated costs.................................... 2 4 (2) (2) — 2

Total............................................................... $ 31 $ 63 $ (35) $ (30) $ 2 $ 31

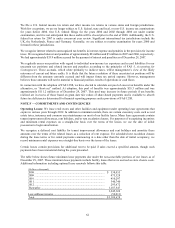

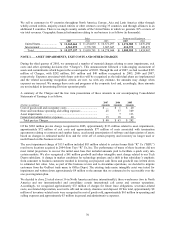

NOTE M — ACQUISITIONS

During 2007, we acquired Axidata, Inc., a Canada-based office products delivery company with annual revenue of

approximately $60 million. Axidata is included in our North American Business Solutions Division. Our integration

plans and our assessment of the value of assets and liabilities acquired are in the process of being implemented and

finalized. Accordingly, the amount initially allocated to goodwill may change as the integration and valuation

processes are completed.

During 2006, we acquired all or a majority ownership position in four companies and increased our investment to

majority ownership in another company. The transactions have been included in our consolidated results since the

dates of acquisition. The cash paid in 2006 for these acquisitions, net of cash acquired, was approximately $248

million. The consideration has been allocated to assets and liabilities, including separate identifiable intangible

assets, based on valuations and internal assessments with approximately $263 million allocated to goodwill. For

those entities that are not wholly owned, Office Depot has the right to acquire or may be required to purchase some

or all of the minority interest shares at various points over the next five years. Certain arrangements will require

additional cash payments of $7 million in 2008 and a minimum of approximately $7 million in 2010; the related

obligations are included in the Consolidated Balance Sheets. The timing of the 2006 acquisitions is as follows:

Second quarter of 2006: We completed the acquisitions of Allied Office Products in North America and Best Office

in South Korea. We also increased our ownership interest to a majority stake in Office Depot Israel, an investment

previously accounted for under the equity method. Allied Office Products is included in our North American

Business Solutions Division. Best Office and Office Depot Israel are included in our International Division.