Office Depot 2007 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2007 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

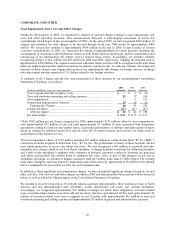

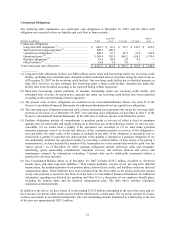

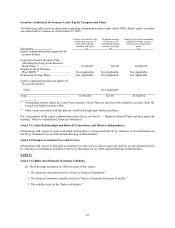

Contractual Obligations

The following table summarizes our contractual cash obligations at December 29, 2007, and the effect such

obligations are expected to have on liquidity and cash flow in future periods:

(Dollars in millions) Total

Less than

1 year 1-3 years 4-5 years

After 5

years

Contractual Obligations

Long-term debt obligations (1).......................................... $ 646.3 $ 26.3 $ 52.7 $ 142.3 $ 425.0

Short-term borrowings and other (2) ................................. 200.3 200.3 — — —

Capital lease obligations (3) .............................................. 208.9 16.7 28.2 23.0 141.0

Operating leases (4)........................................................... 3,189.6 526.9 868.2 620.1 1,174.4

Purchase obligations (5) .................................................... 66.6 64.4 2.0 0.2 —

Other liabilities (6) ............................................................ 14.0 7.0 7.0 — —

Total contractual cash obligations ....................................... $ 4,325.7 $ 841.6 $ 958.1 $ 785.6 $ 1,740.4

____________

(1) Long-term debt obligations include our $400 million senior notes and borrowings under our revolving credit

facility, excluding any related discount. Amounts include contractual interest payments (using the interest rate as

of December 29, 2007 for the revolving credit facility). Our revolving credit facility has a scheduled maturity in

May 2012; however, we may refinance this borrowing under a future credit facility. Amounts due under this

facility have been classified according to the expected timing of their repayment.

(2) Short-term borrowings consist primarily of amounts outstanding under our revolving credit facility and

subsidiary lines of credit. As stated above, amounts due under our revolving credit facility have been classified

according to the expected timing of their repayment.

(3) The present value of these obligations are included on our Consolidated Balance Sheets. See Note D of the

Notes to Consolidated Financial Statements for additional information about our capital lease obligations.

(4) The operating lease obligations presented reflect future minimum lease payments due under the non-cancelable

portions of our leases as of December 29, 2007. Our operating lease obligations are described in Note F of the

Notes to Consolidated Financial Statements. In the table above, sublease income is distributed by period.

(5) Purchase obligations include all commitments to purchase goods or services of either a fixed or minimum

quantity that are enforceable and legally binding on us that meet any of the following criteria: (1) they are non-

cancelable, (2) we would incur a penalty if the agreement was cancelled, or (3) we must make specified

minimum payments even if we do not take delivery of the contracted products or services. If the obligation is

non-cancelable, the entire value of the contract is included in the table. If the obligation is cancelable, but we

would incur a penalty if cancelled, the dollar amount of the penalty is included as a purchase obligation. If we

can unilaterally terminate the agreement simply by providing a certain number of days notice or by paying a

termination fee, we have included the amount of the termination fee or the amount that would be paid over the

“notice period.” As of December 29, 2007, purchase obligations include television, radio and newspaper

advertising, sports sponsorship commitments, telephone services, and software licenses and service and

maintenance contracts for information technology. Contracts that can be unilaterally terminated without a

penalty have not been included.

(6) Our Consolidated Balance Sheet as of December 29, 2007 includes $576.3 million classified as “Deferred

income taxes and other long-term liabilities.” This caption primarily consists of our net long-term deferred

income taxes, the unfunded portion of our pension plans, deferred lease credits, and liabilities under our deferred

compensation plans. These liabilities have been excluded from the above table as the timing and/or the amount

of any cash payment is uncertain. See Note E of the Notes to Consolidated Financial Statements for additional

information regarding our deferred tax positions and Note G for a discussion of our employee benefit plans,

including the pension plans and the deferred compensation plan. The table above includes scheduled,

acquisition-related payments.

In addition to the above, we have letters of credit totaling $132.8 million outstanding at the end of the year, and we

have recourse for private label credit card receivables transferred to a third party. We record an estimate for losses

on these receivables in our financial statements. The total outstanding amount transferred to a third party at the end

of the year was approximately $207.5 million.