Office Depot 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

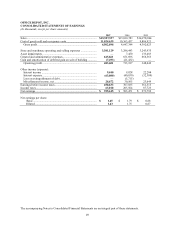

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.

51

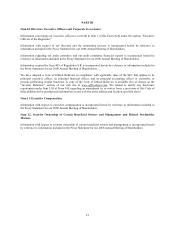

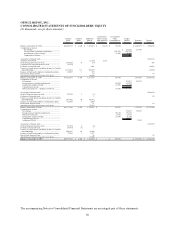

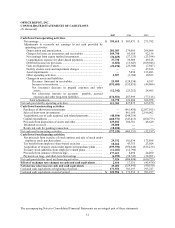

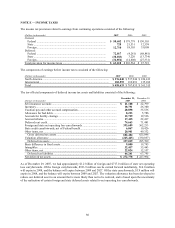

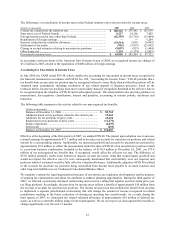

OFFICE DEPOT, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

2007 2006 2005

Cash flows from operating activities:

Net earnings......................................................................................... $ 395,615 $ 503,471 $ 273,792

Adjustments to reconcile net earnings to net cash provided by

operating activities:

Depreciation and amortization......................................................... 281,383 279,005 268,098

Charges for losses on inventories and receivables........................... 109,798 85,610 92,136

Net earnings from equity method investments ................................ (34,825) (27,125) (23,394)

Compensation expense for share-based payments........................... 37,738 39,889 49,328

Deferred income tax provision ........................................................ (1,022) (15,847) (109,946)

Gain on disposition of assets ........................................................... (25,190) (23,948) (7,947)

Facility closure costs and impairment charges ................................ — — 47,166

Asset impairments ........................................................................... — 7,450 133,483

Other operating activities................................................................. 2,927 (1,704) 10,563

Changes in assets and liabilities:

Decrease (increase) in receivables.......................................... 25,909 (128,558) 4,397

Increase in inventories............................................................. (191,685) (155,955) (49,096)

Net (increase) decrease in prepaid expenses and other

assets...................................................................................... (12,342) (23,212) 24,605

Net (decrease) increase in accounts payable, accrued

expenses and other long-term liabilities ................................ (176,921) 287,999 (77,315)

Total adjustments......................................................................... 15,770 323,604 362,078

Net cash provided by operating activities................................................ 411,385 827,075 635,870

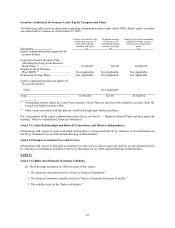

Cash flows from investing activities:

Purchases of short-term investments ................................................... — (961,450) (2,037,015)

Sales of short-term investments........................................................... — 961,650 2,196,962

Acquisitions, net of cash acquired, and related payments ................... (48,036) (248,319) —

Capital expenditures ............................................................................ (460,571) (343,415) (260,773)

Proceeds from disposition of assets and other ..................................... 129,182 106,381 48,629

Dividends received.............................................................................. 25,000 — —

Restricted cash for pending transaction ............................................... (18,100) — —

Net cash used in investing activities........................................................ (372,525) (485,153) (52,197)

Cash flows from financing activities:

Net proceeds from exercise of stock options and sale of stock under

employee stock purchase plans ......................................................... 29,332 101,034 175,898

Tax benefit from employee share-based exercises .............................. 18,266 43,355 23,024

Acquisition of treasury stock under approved repurchase plans ......... (199,592) (970,640) (815,236)

Treasury stock additions from employee related plans........................ (11,201) (12,796) —

Proceeds from issuance of borrowings ................................................ 177,413 8,494 24,490

Payments on long- and short-term borrowings.................................... (6,292) (58,545) (38,901)

Net cash provided by (used in) financing activities................................. 7,926 (889,098) (630,725)

Effect of exchange rate changes on cash and cash equivalents.......... 2,616 17,531 (43,478)

Net increase (decrease) in cash and cash equivalents ......................... 49,402 (529,645) (90,530)

Cash and cash equivalents at beginning of period ................................... 173,552 703,197 793,727

Cash and cash equivalents at end of period ............................................. $ 222,954 $ 173,552 $ 703,197