Office Depot 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

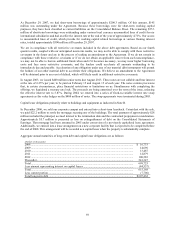

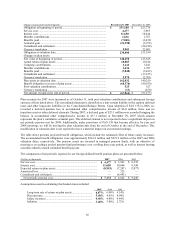

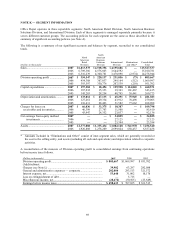

We determine the lease term at inception to be the non-cancellable rental period plus any renewal options that are

considered reasonably assured. Leasehold improvements are depreciated over the shorter of their estimated useable

lives or the identified lease term. Lease payments for the next five years and thereafter that include both the non-

cancellable amounts from above, plus the renewal options included in our projected lease term are, $541 million for

2008; $495 million for 2009; $448 million for 2010; $404 million for 2011; $374 million for 2012 and $2,552

million thereafter, for a total of $4,814 million, $4,759 million net of sublease income.

Rent expense, including equipment rental, was $519.1 million, $477.8 million and $444.8 million in 2007, 2006, and

2005, respectively. Rent expense was reduced by sublease income of $2.8 million in 2007, $3.2 million in 2006 and

$3.6 million in 2005.

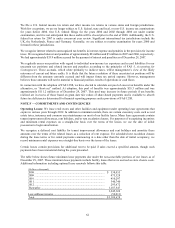

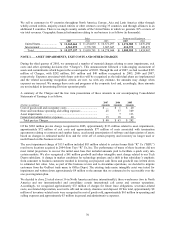

Guarantee of Private Label Credit Card Receivables: Office Depot has private label credit card programs that

are managed by a third-party financial services company. We act as the guarantor of all loans between our

commercial customers and the financial services company. The difference between the transfer amount and the

amount received is recognized in store and warehouse operating and selling expense. Maximum exposure to off-

balance sheet credit risk is represented by the outstanding balance of private label credit card receivables, less

reserves held by the financial services company which we fund. At December 29, 2007, the outstanding balance of

credit card receivables sold was approximately $207.5 million. The estimated liability associated with risk of loss is

included in accrued expenses.

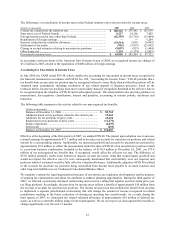

Legal Matters: During 2006, we recorded a charge in anticipation of settling a case styled Birch et al. v. Office

Depot, Inc. pending in United States District Court in San Diego, CA. This case was brought as a class action by

certain current and former employees of the company, alleging that they and other current and former employees

were not properly compensated for meal breaks and rest breaks in accordance with California law. Without

admitting any liability, during 2007, the company has agreed in principle to settle this matter for a total payment of

approximately $16 million. The final settlement occurred during 2007 for approximately $1 million less than

previously anticipated. The charge in 2006 and credit in 2007 related to this settlement is included in general and

administrative expenses.

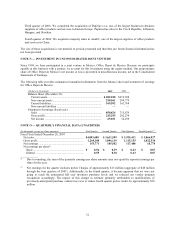

We are involved in litigation arising in the normal course of our business. While, from time to time, claims are

asserted that make demands for a large sum of money (including, from time to time, actions which are asserted to be

maintainable as class action suits), we do not believe that any of these matters, either individually or in the

aggregate, will materially affect our financial position or the results of our operations.

We have been cooperating with the staff of the United States Securities and Exchange Commission (“SEC”) in an

inquiry that commenced in July 2007 when the SEC initiated a review of our contacts and communications with

financial analysts. The SEC is also reviewing certain other matters, including inventory receipt, timing of vendor

payments, timing of recognition of vendor program funds and certain intercompany loans. Prior to filing its

quarterly report on Form 10-Q for the quarter ended June 30, 2007, the company completed a review of the

accounting matters related to inventory receipt, timing of vendor payments and certain intercompany loans, with the

assistance of external forensic accountants. Prior to filing the quarterly report on Form 10-Q for the quarter ended

September 29, 2007, the Audit Committee completed a review of the timing of vendor program funds, and the

Company amended and restated certain prior period financial statements. In January 2008, the SEC issued a formal

order of investigation.

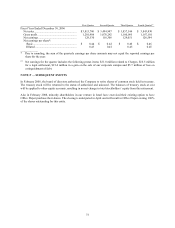

In early November 2007, two putative class action lawsuits were filed against the company and certain of its

executive officers alleging violations of the Securities Exchange Act of 1934. In addition, two putative shareholder

derivative actions were filed against the company and its directors alleging various state law claims including breach

of fiduciary duty. The allegations in all four lawsuits primarily relate to the accounting for vendor program funds.

On November 26, 2007, the Southern District of Florida court ordered a consolidation of the two shareholder

derivative lawsuits for discovery purposes. On January 4, 2008, certain parties moved to consolidate the two class

action lawsuits. These lawsuits are in their early stages and we do not currently believe that they will have a material

adverse impact on the company or its results of operations. We intend to vigorously defend against these claims.