Office Depot 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

NOTE H — CAPITAL STOCK

Preferred Stock

As of December 29, 2007, there were 1,000,000 shares of $0.01 par value preferred stock authorized of which none

were issued or outstanding.

Treasury Stock

The Office Depot board of directors has authorized a series of common stock repurchase plans, the latest of which is

a $500 million authorization in 2007. See Note P for treasury stock retirement plans.

Under these approved plans we purchased approximately 5.7 million shares at a cost of $199.6 million in 2007, 26.4

million shares at a cost of $970.6 million in 2006 and 29.8 million shares at a cost of $815.2 million in 2005. At

December 29, 2007 $500 million remains available for repurchase under the current authorization.

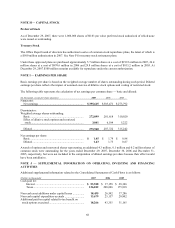

NOTE I — EARNINGS PER SHARE

Basic earnings per share is based on the weighted average number of shares outstanding during each period. Diluted

earnings per share reflects the impact of assumed exercise of dilutive stock options and vesting of restricted stock.

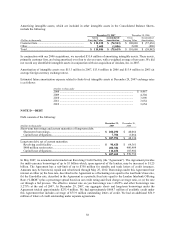

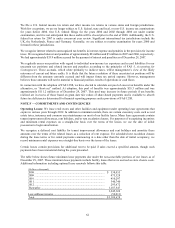

The following table represents the calculation of net earnings per common share — basic and diluted:

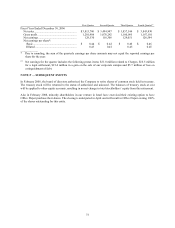

(In thousands, except per share amounts) 2007 2006 2005

Numerator:

Net earnings............................................................... $ 395,615 $ 503,471 $ 273,792

Denominator:

Weighted average shares outstanding:

Basic .......................................................................... 272,899 281,618 310,020

Effect of dilutive stock options and restricted

stock......................................................................... 3,041 6,104 5,222

Diluted ....................................................................... 275,940 287,722 315,242

Net earnings per share:

Basic .......................................................................... $ 1.45 $ 1.79 $ 0.88

Diluted ....................................................................... 1.43 1.75 0.87

Awards of options and nonvested shares representing an additional 4.3 million, 0.1 million and 0.2 million shares of

common stock were outstanding for the years ended December 29, 2007, December 30, 2006 and December 31,

2005, respectively, but were not included in the computation of diluted earnings per share because their effect would

have been antidilutive.

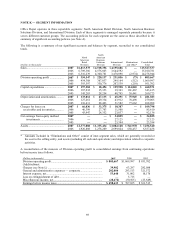

NOTE J — SUPPLEMENTAL INFORMATION ON OPERATING, INVESTING AND FINANCING

ACTIVITIES

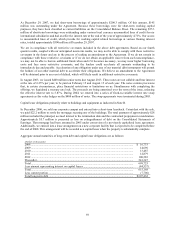

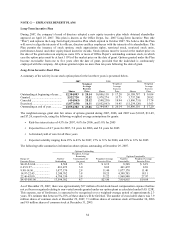

Additional supplemental information related to the Consolidated Statements of Cash Flows is as follows:

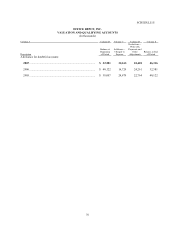

(Dollars in thousands) 2007 2006 2005

Cash paid for:

Interest .................................................................... $ 53,948 $ 37,158 $ 28,346

Taxes....................................................................... 126,182 208,606 175,818

Non-cash asset additions under capital leases ................ 18,435 26,542 37,286

Non-cash capital expenditure accruals ........................... 13,679 25,157 20,802

Additional paid-in capital related to tax benefit on

stock options exercised................................................. 18,266 43,355 31,165