Office Depot 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

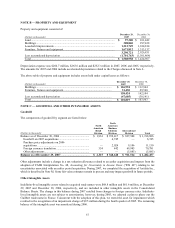

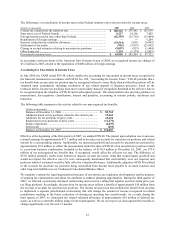

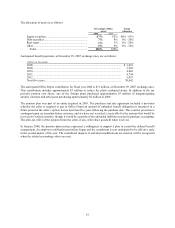

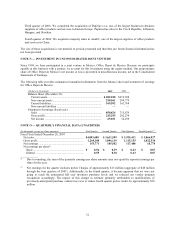

The allocation of assets is as follows:

Percentage of Plan

Assets

Target

Allocation

2007 2006

Equity securities......................................................... 87% 82% 60% - 95%

Debt securities............................................................ 7% 8% 0% - 20%

Real estate .................................................................. 1% 1% 0% - 20%

Other .......................................................................... 5% 9% 0% - 10%

Total ....................................................................... 100% 100%

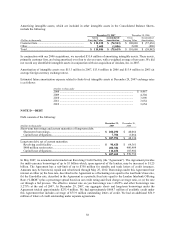

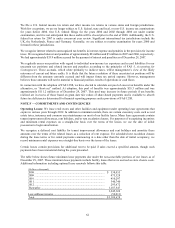

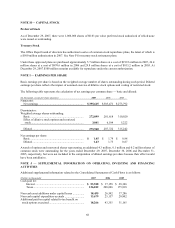

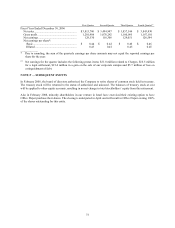

Anticipated benefit payments, at December 29, 2007 exchange rates, are as follows:

(Dollars in thousands)

2008 ........................................................................................................................... $ 3,091

2009 ........................................................................................................................... 3,205

2010 ........................................................................................................................... 4,403

2011 ........................................................................................................................... 4,794

2012 ........................................................................................................................... 5,457

Next five years........................................................................................................... 30,662

The anticipated Office Depot contribution for fiscal year 2008 is $11 million, at December 29, 2007 exchange rates.

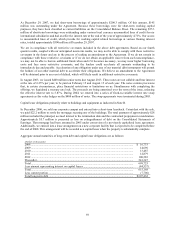

This contribution includes approximately $7 million to reduce the plan’s unfunded status. In addition to the net

periodic pension cost above, one of the foreign plans purchased approximately $3 million of nonparticipating

annuity contracts and anticipates purchasing approximately $2 million in 2008.

The pension plan was part of an entity acquired in 2003. The purchase and sale agreement included a provision

whereby the seller is required to pay to Office Depot an amount of unfunded benefit obligation as measured in a

future period at the seller’s option, but no later than five years following the purchase date. This contract provision is

contingent upon an uncertain future outcome, and we have not recorded a receivable for the amount that would be

recovered if settled currently, though it would be a portion of the unfunded liability recorded in purchase accounting.

The after-tax effect of the payment from the seller, if any, will reduce goodwill when received.

In January 2008, the pension plan trustees expressed a willingness to support a plan to curtail the defined benefit

arrangement. An employee notification period has begun and the curtailment is now anticipated to be effective early

in the second quarter of the year. The curtailment impacts, if and when modifications are enacted, will be recognized

when the related accounting criteria are met.