Office Depot 2007 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2007 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

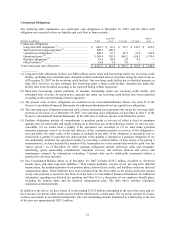

At December 29, 2007, we had short-term borrowings of approximately $200.3 million. Of this amount, $145

million was outstanding under our revolving credit agreement. Because these borrowings were for short-term

working capital purposes, they have been classified as current liabilities on the Consolidated Balance Sheet. The

remaining $55.3 million of short-term borrowings were outstanding under various local currency uncommitted lines

of credit for our international subsidiaries and had an effective interest rate at the end of the year of approximately

4.71%. Our access to uncommitted lines of credit, which provide for working capital related borrowings at various

floating interest rates, totaled approximately $300 million at December 29, 2007.

We are in compliance with all restrictive covenants included in our debt agreements. Based on our fourth quarter

results, coupled with our anticipated near-term results, we may not be able to comply with these restrictive

covenants in the future and are in the process of seeking an amendment to the Agreement. Additionally, we may not

be in compliance in future periods from factors such as those described under Item 1A — Risk Factors in this Form

10-K. If we do not remain in compliance with these restrictive covenants or if we do not obtain an applicable waiver

from such noncompliance, we may not be able to borrow additional funds when and if it becomes necessary, we

may incur higher borrowing costs and face more restrictive covenants, and the lenders could accelerate all amounts

outstanding to be immediately due and payable. Acceleration of any obligation under any of our material debt

instruments will permit the holders of our other material debt to accelerate their obligations. We believe an

amendment to the Agreement will be obtained prior to an event of default, which will likely include additional

restrictive covenants. For further discussion on these restrictive covenants, see “Item 1A — Risk Factors/Financial

Covenants in Existing Credit Facility.”

We have never paid a cash dividend on our common stock. While our board of directors regularly assesses our

dividend policy, there are no current plans to declare a dividend.

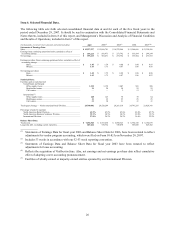

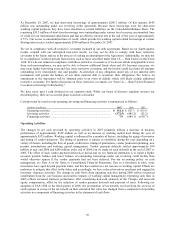

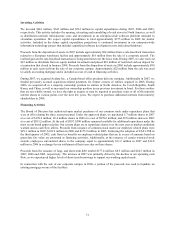

Cash provided by (used in) our operating, investing and financing activities is summarized as follows:

(Dollars in millions) 2007 2006 2005

Operating activities ................................................................................... $ 411.4 $ 827.1 $ 635.9

Investing activities .................................................................................... (372.5) (485.2) (52.2)

Financing activities ................................................................................... 7.9 (889.1) (630.7)

Operating Activities

The changes in net cash provided by operating activities in 2007 primarily reflects a decrease in business

performance of approximately $108 million as well as an increase in working capital used during the year of

approximately $335 million. Working capital is influenced by a number of factors, including the aging of inventory

and timing of vendor payments. The timing of payments is subject to variability during the year depending on a

variety of factors, including the flow of goods, credit terms, timing of promotions, vendor production planning, new

product introductions and working capital management. Vendor payment deferrals totaled approximately $50

million at year end 2006 and $200 million at the end of 2004, but we made no such deferrals at the end of 2007 or

2005. The effect of such vendor payment deferrals at period-end on our financial statements is to report a higher

accounts payable balance and lower balance of outstanding borrowings under our revolving credit facility than

would otherwise appear if the vendor payments had not been deferred. For our accounting policy on cash

management, see Note A of the Notes to Consolidated Financial Statements. Due to a slowdown in sales, some

inventories have aged beyond payment terms, and this has resulted in a net increase in working capital. Efforts are

underway to mitigate this effect in the future and accordingly, we have reduced inventory purchases and engaged in

inventory clearance activities. The change in cash flows from operating activities during 2006 reflects increased

contribution from the core business and positive impacts of working capital management. Operating cash flow in

2005 reflects increased business performance after considering non-cash elements of the Charges and non-cash

equity compensation, offset by the reduction of vendor payment deferrals and payment of taxes. Following our

adoption of FAS 123R in the third quarter of 2005, the presentation of tax benefits received from the exercise of

stock options in excess of the tax benefit on their estimated fair value has changed from a component of operating

activities to a component of financing activities in the statement of cash flows.