Office Depot 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

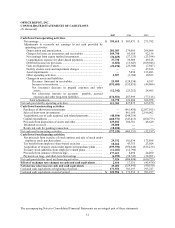

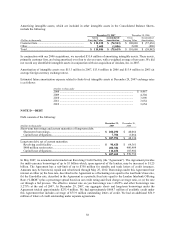

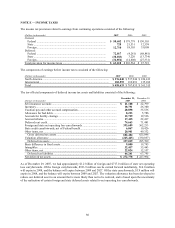

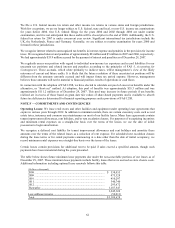

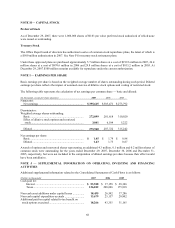

The following is a reconciliation of income taxes at the Federal statutory rate to the provision for income taxes:

(Dollars in thousands) 2007

2006 2005

Federal tax computed at the statutory rate.................................................... $ 160,522 $ 247,462 $ 126,530

State taxes, net of Federal benefit................................................................. 8,217 14,166 7,428

Foreign income taxed at rates other than Federal ......................................... (62,393) (53,762) (15,404)

Repatriation of foreign earnings ................................................................... — — 5,204

Increase (reduction) in valuation allowance ................................................. (34,514) 2,010 (6,042)

Settlement of tax audits ................................................................................ (941) (3,875) (25,682)

Change in accrual estimates relating to uncertain tax positions ................... (9,097) (923) (1,444)

Other items, net ............................................................................................ 1,224 (1,514) (2,867)

Provision for income taxes ........................................................................... $ 63,018 $ 203,564 $ 87,723

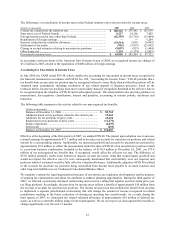

In accordance with provisions of the American Jobs Creation Action of 2004, we recognized income tax charges of

$5.2 million in 2005, related to the repatriation of $400 million of foreign earnings.

Accounting for Uncertainty in Income Taxes

In July 2006, the FASB issued FIN 48, which clarifies the accounting for uncertainty in income taxes recognized in

the financial statements in accordance with SFAS No. 109, “Accounting for Income Taxes.” FIN 48 provides that a

tax benefit from an uncertain tax position may be recognized when it is more likely than not that the position will be

sustained upon examination, including resolutions of any related appeals or litigation processes, based on the

technical merits. Income tax positions must meet a more-likely-than-not recognition threshold at the effective date to

be recognized upon the adoption of FIN 48 and in subsequent periods. This interpretation also provides guidance on

measurement, derecognition, classification, interest and penalties, accounting in interim periods, disclosure and

transition.

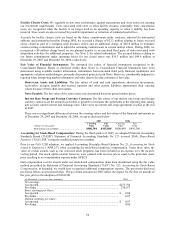

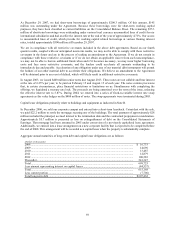

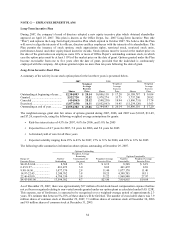

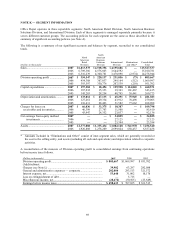

The following table summarizes the activity related to our unrecognized tax benefits:

(Dollars in thousands)

Balance at December 31, 2006 ................................................... $ 89,762

Additions based on tax positions related to the current year ...... 15,463

Additions for tax positions of prior years................................... 19,651

Reductions for tax positions of prior years................................. (11,279)

Statute expirations ...................................................................... (2,497)

Settlements ................................................................................. (693)

Balance at December 29, 2007 ................................................... $ 110,407

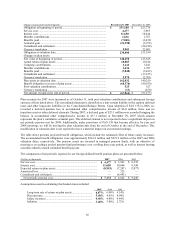

Effective at the beginning of the first quarter of 2007, we adopted FIN 48.The impact upon adoption was to increase

retained earnings by approximately $17.7 million and to decrease our accruals for uncertain tax positions and related

interest by a corresponding amount. Additionally, we increased goodwill and accruals for uncertain tax positions by

approximately $3.8 million to reflect the measurement under the rules of FIN 48 of an uncertain tax position related

to a previous business combination. Included in the balance of $110.4 million at December 29, 2007, are $75.4

million of net unrecognized tax benefits that, if recognized, would affect the effective tax rate. The difference of

$35.0 million primarily results from federal tax impacts on state tax issues, items that would impact goodwill and

would not impact the effective rate if it were subsequently determined that such liability were not required, and

positions which if sustained would be fully offset by valuation allowance. Additionally, adoption of FIN 48 resulted

in the accruals for uncertain tax positions being reclassified from Income taxes payable to Accrued expenses and

other long-term liabilities in our Condensed Consolidated Balance Sheet.

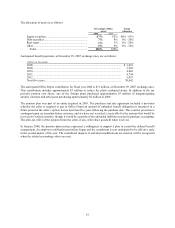

We regularly evaluate the legal organizational structure of our entities, tax regulatory developments and the progress

of ongoing tax examinations and adjust tax attributes to enhance planning opportunities. During the third quarter of

2007, we effected a previously-disclosed restructuring and received a ruling that together secured certain prior year

tax filing positions. Accordingly, the provision for income taxes reflects a benefit of approximately $10 million from

the reversal of accruals for uncertain tax positions. The income tax provision also includes the benefit from our plan

to implement a separate jurisdictional restructuring that will change the amount of income recognized in related

jurisdictions resulting in the future realization of existing net operating loss carryforwards. As a result, during the

third quarter of 2007, we eliminated the related valuation allowance of approximately $19 million of deferred tax

assets, as well as a related $6 million impact in the fourth quarter. We do not expect our unrecognized tax benefits to

change significantly over the next 12 months.