Office Depot 2007 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2007 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

CORPORATE AND OTHER

Asset Impairments, Exit Costs and Other Charges

During the third quarter of 2005, we announced a number of material charges relating to asset impairments, exit

costs and other operating decisions. This announcement followed a wide-ranging assessment of assets and

commitments which began in the second quarter of 2005. At the end of 2005, we had recognized $282 million of

charges and estimated the total charges to be incurred through fiscal year 2008 would be approximately $406

million. We revised that estimate to approximately $454 million at the end of 2006. In part because of current

economic considerations, in 2007, we reassessed the timing of implementation of certain projects, including the

consolidation of warehouses and distribution centers in both North America and Europe and the consolidation and

outsourcing of our International call centers, and we delayed those actions. Accordingly, we currently estimate

recognizing charges of $62 million and $23 million in 2008 and 2009, respectively, bringing the program total to

approximately $470 million. The expenses associated with these future activities will be recognized as the individual

plans are implemented and the related accounting recognition criteria are met. As with any estimate, the timing and

amounts of these charges may change when projects are implemented, and changes in foreign currency exchange

rates may impact amounts reported in U.S. dollars related to our foreign activities.

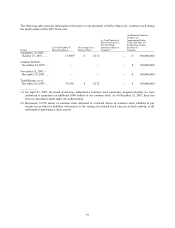

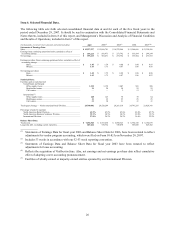

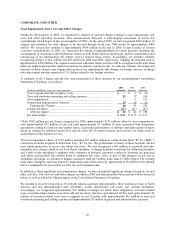

A summary of the Charges and the line item presentation of these amounts in our accompanying Consolidated

Statements of Earnings is as follows.

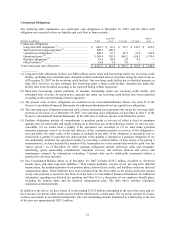

(Dollars in millions, except per share amounts)

2007

Amounts

2006

Amounts

2005

Amounts

Cost of goods sold and occupancy costs ...................................................... $ — $ 1 $ 20

Store and warehouse operating and selling expenses................................... 25 37 109

Asset impairments........................................................................................ — 7 133

General and administrative expenses ........................................................... 15 18 20

Total pre-tax Charges ............................................................................... 40 63 282

Income tax effect.......................................................................................... (11) (21) (97)

After-tax impact........................................................................................ $ 29 $ 42 $ 185

Per share impact ........................................................................................... $ 0.11 $ 0.15 $ 0.59

Of the $282 million pre-tax charge recognized in 2005, approximately $133 million related to asset impairments,

with approximately $72 million of exit costs and approximately $77 million of costs associated with termination

agreements relating to contracts and surplus leases, accelerated amortization of software and depreciation of assets

based on changes in estimated useful lives and the write off of certain property and inventory no longer used or

useful based on this business review.

The asset impairment charge of $133 million included $83 million related to certain former Kids “R” Us (“KRU”)

retail store locations acquired in 2004 from Toys “R” Us, Inc. The performance of many of these locations did not

meet initial projections to recover the initial asset base. We also recognized a $41 million in goodwill and other

intangible asset charge related to our Tech Depot subsidiary. A change in market conditions for technology products

and a shift in that subsidiary’s emphasis from consumer to business customers resulted in lowering our projected

cash flows and goodwill was written down to estimated fair value. Also, as part of this business review and to

streamline operations, we decided to migrate customers from the Guilbert trade name to Office Depot. The existing

trade name intangible asset was tested for impairment and written down by approximately $9 million to the amount

that we estimated to be recoverable over the one-year migration plan.

In addition to these significant asset impairment charges, we also recognized significant charges related to exit and

other activities. The total exit and other charges recorded in 2005 and anticipated for future periods will be discussed

below, as well as where the Charges appear in the Consolidated Statement of Earnings.

We decided to close 25 retail stores (16 in North America and nine internationally), three warehouses (two in North

America and one internationally) and consolidate certain international call center and contract operations.

Accordingly, we recognized approximately $72 million of charges for future lease obligations, severance-related

costs, accelerated depreciation, asset write offs and inventory clearance and disposal. Of this total, approximately $8

million of inventory-related costs were recognized in cost of goods sold, approximately $61 million in store and

warehouse operating and selling expenses and approximately $3 million in general and administrative expenses.