Office Depot 2007 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2007 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

In addition to these exit costs, we recognized approximately $77 million of other charges. We terminated certain

contractual agreements and adjusted surplus lease property accruals, wrote down and accelerated depreciation on

assets based on a decrease in their expected use and accelerated inventory clearance activity in preparation for

implementing a new inventory management system. Of this total, approximately $12 million was presented as a

charge in cost of goods sold, approximately $48 million in store and warehouse operating and selling expenses and

approximately $17 million in general and administrative expenses.

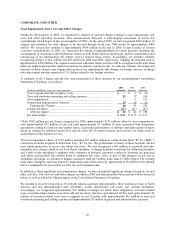

We recognized $63 million and $40 million in 2006 and 2007, respectively, associated with these projects as the

previously-identified plans were implemented and the related accounting recognition criteria were met. We incurred

charges for severance-related expenses, accelerated depreciation and lease obligations associated with the

consolidation of warehouses and distribution centers. We also incurred severance-related charges as plans were

implemented for management restructuring and call center consolidation in Europe. Some of these activities, such as

planned facility closings, will extend into 2008 and 2009. The costs associated with these activities will be

recognized in future periods as incurred, or in the case of asset utilization, over the period of remaining estimated

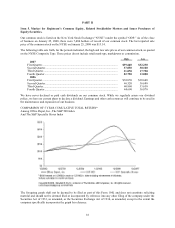

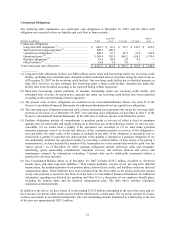

useful life. A summary of past and estimated future charges is presented below.

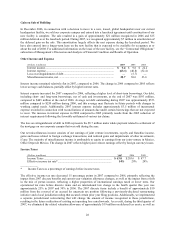

Projected

(Dollars in millions)

2005

Actual

2006

Actual

2007

Actual 2008 2009

Total

Charges

Asset impairments ..................................................................... $ 133 $ 7 $ — $ — $ — $ 140

Cost of goods sold ..................................................................... 20 1 — — — 21

Asset write-offs and accelerated depreciation ........................... 54 21 20 11 1 107

Lease obligations/Contract terminations ................................... 61 9 2 4 5 81

One-time termination benefits ................................................... 11 22 19 34 15 101

Other associated costs................................................................ 3 3 (1) 13 2 20

Total pre-tax charges.............................................................. $ 282 $ 63 $ 40 $ 62 $ 23 $ 470

As with any estimate, the timing and amounts may change when projects are implemented. Additionally, changes in

foreign currency exchange rates may impact amounts reported in U.S. dollars related to our foreign activities.

Of the total Charges, approximately $200 million either has or is expected to require cash settlement, including

longer-term lease obligations that will require cash over multi-year lease terms; approximately $270 million of

Charges are non-cash items.

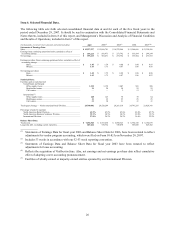

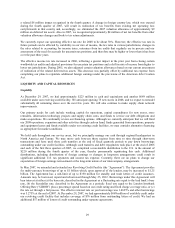

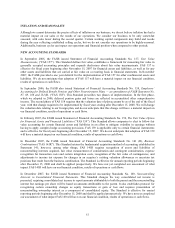

General and Administrative Expenses

(Dollars in millions) 2007 2006 2005

General and administrative expenses ...................................................... $ 645.7 $ 651.7 $ 666.6

% of sales ................................................................................................ 4.2% 4.3% 4.7%

General and administrative (“G&A”) expenses include Charges of approximately $15 million, $18 million and $20

million in 2007, 2006 and 2005, respectively. Additionally in 2006, we recognized a charge of approximately $16

million to resolve a wage and hour litigation in California. After considering these charges and credits, the

remaining change in total G&A expenses in 2007 compared to 2006 reflects lower performance-based pay

commensurate with lower operating results, partially offsetting higher professional fees and outside labor costs. The

remaining change in total G&A expenses in 2006 compared to 2005 reflects the positive impacts of various cost

control measures and consolidating functions.

During 2006, we decided to allocate to our Divisions only those G&A expenses that are directly or closely related to

their operations. Those amounts are included in our determination of each Division’s operating profit. Other

companies may charge more or less G&A expenses and other costs to their segments, and our results therefore may

not be comparable to similarly titled measures used by other entities.