Office Depot 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

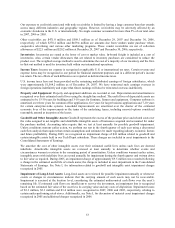

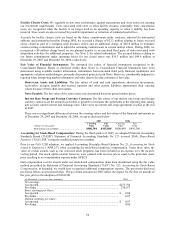

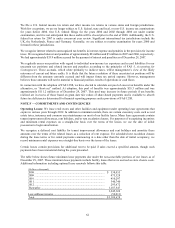

Facility Closure Costs: We regularly review store performance against expectations and close stores not meeting

our investment requirements. Costs associated with store or other facility closures, principally lease cancellation

costs, are recognized when the facility is no longer used in an operating capacity or when a liability has been

incurred. Store assets are also reviewed for possible impairment, or reduction of estimated useful lives.

Accruals for facility closure costs are based on the future commitments under contracts, adjusted for anticipated

sublease and termination benefits. During 2005, we recorded a charge of $23.2 million relating to leases on retail

stores closed as part of a company-wide business review and an additional charge of $28.4 million to terminate

certain existing commitments and to adjust the remaining commitments to current market values. During 2006, we

recognized a $4 million charge based on our planned transfer to an unrelated third party of risks associated with

disposition activities for additional properties. See Note L for related information. The accrued balance relating to

our future commitments under operating leases for our closed stores was $36.3 million and $49.8 million at

December 29, 2007 and December 30, 2006, respectively.

Fair Value of Financial Instruments: The estimated fair values of financial instruments recognized in the

Consolidated Balance Sheets or disclosed within these Notes to Consolidated Financial Statements have been

determined using available market information, information from unrelated third party financial institutions and

appropriate valuation methodologies, primarily discounted projected cash flows. However, considerable judgment is

required when interpreting market information and other data to develop estimates of fair value.

Short-term Assets and Liabilities: The fair values of cash and cash equivalents, short-term investments,

receivables, accounts payable and accrued expenses and other current liabilities approximate their carrying

values because of their short-term nature.

Notes Payable: The fair value of the senior notes was determined based on quoted market prices.

Interest Rate Swaps and Foreign Currency Contracts: The fair values of our interest rate swaps and foreign

currency contracts are the amounts receivable or payable to terminate the agreements at the reporting date, taking

into account current interest and exchange rates. There were no interest rate swap agreements in place at the end

of 2007.

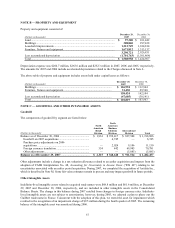

There were no significant differences between the carrying values and fair values of the financial instruments as

of December 29, 2007 and December 30, 2006, except as disclosed below:

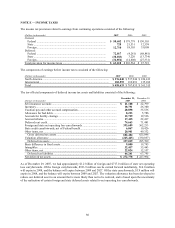

2007 2006

Carrying Fair Carrying Fair

(Dollars in thousands) Value Value Value Value

$400 million senior notes ................................. $400,384 $415,840 $400,489 $410,360

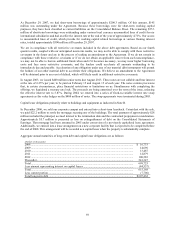

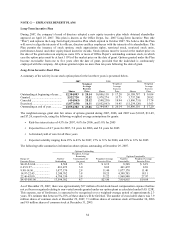

Accounting for Stock-Based Compensation: During the third quarter of 2005, we adopted Financial Accounting

Standards Board (“FASB”) Statement of Financial Accounting Standards No. 123 (revised 2004), Share-Based

Payment, (“FAS 123R”) using the modified prospective method.

Prior to our FAS 123R adoption, we applied Accounting Principles Board Opinion No. 25, Accounting for Stock

Issued to Employees (“APB 25”) when accounting for stock-based employee compensation. Under these rules, the

value of certain awards, such as our restricted stock programs, has been included as an expense over the award’s

vesting period. Our stock option awards, however, were granted with exercise prices equal to the grant date share

price resulting in no compensation expense under APB 25.

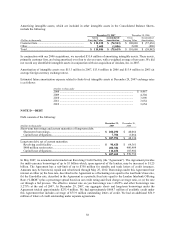

Had compensation cost for awards under our stock-based compensation plans been determined using the fair value

method prescribed by Statement of Financial Accounting Standards (“FAS”) No. 123, Accounting for Stock-Based

Compensation, as amended, we would have recognized additional compensation expense. The previously-disclosed

pro forma effects are presented below. The pro forma amounts for 2005 reflect the impact for the first six months of

the year, prior to the adoption of FAS123R.

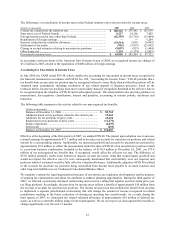

(In thousands, except per share amounts) 2005

Net earnings:

As reported...............................................................................................................

.

$ 273,792

Pro forma .................................................................................................................

.

270,557

Basic earnings per share:

As reported...............................................................................................................

.

$ 0.88

Pro forma .................................................................................................................

.

0.87

Diluted earnings per share:

As reported...............................................................................................................

.

$ 0.87

Pro forma .................................................................................................................

.

0.86