Office Depot 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

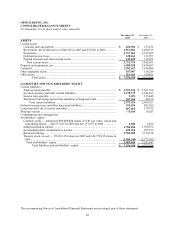

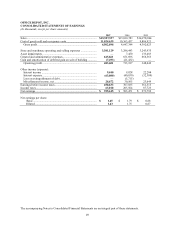

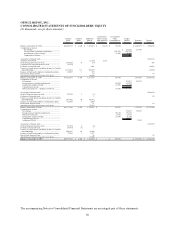

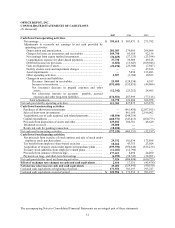

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.

50

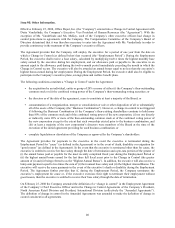

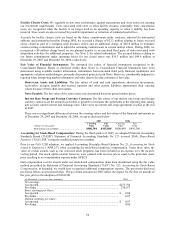

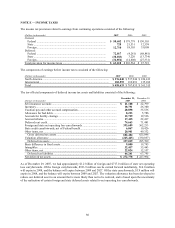

OFFICE DEPOT, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In thousands, except share amounts)

Common

Stock

Shares

Common

Stock

Amount

Additional

Paid-in

Capital

Unamortized

Value of Long-

Term Incentive

Stock Grant

Accumulated

Other

Comprehensive

Income (Loss)

Compre-

hensive

Income

Retained

Earnings

Treasury

Stock

Balance at December 25, 2004 .......................................... 404,925,515 $ 4,049 $ 1,257,619 $ (2,125) $ 339,708 $ 2,593,275 $ (969,478)

Comprehensive income:

Net earnings ............................................................... $ 273,792 273,792

Foreign currency translation adjustment.................... (197,273) (197,273)

Amortization of gain on hedge .................................. (1,690) (1,065)

Comprehensive income.............................................. $ 75,454

Acquisition of treasury stock ............................................. (815,236)

Adoption of FAS123R ....................................................... (2,125) 2,125

Grant of long-term incentive stock .................................... 3,676,229 37 (37) 988

Cancellation of long-term incentive stock ......................... (19,167)

Forfeiture of restricted stock.............................................. 4,491 (4,491)

Exercise of stock options (including income tax benefits

and withholding) .............................................................. 11,118,091 111 206,559 (1,984)

Issuance of stock under employee stock purchase plans ... 112,003 1 969

Direct Stock Purchase Plans .............................................. 57 39

Amortization of long-term incentive stock grant............... 49,840

Balance at December 31, 2005 .......................................... 419,812,671 4,198 1,517,373 — 140,745 2,867,067 (1,790,162)

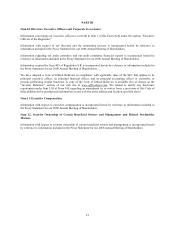

Comprehensive income:

Net earnings ................................................................... 503,471 503,471

Foreign currency translation adjustment........................ 162,222 162,222

Amortization of gain on hedge ...................................... (1,659) (1,659)

Comprehensive income.................................................. $ 664,034

Deferred pension loss —adoption of FAS 158 .............. (6,055)

Acquisition of treasury stock ............................................. (983,436)

Grant of long-term incentive stock .................................... 287,930 3 (3)

Forfeiture of restricted stock.............................................. 2 (2)

Exercise of stock options (including income tax benefits

and withholding) .............................................................. 5,973,420 60 141,892

Issuance of stock under employee stock purchase plans ... 103,598 1 2,064

Direct Stock Purchase Plans .............................................. 51 18

Amortization of long-term incentive stock grant............... 39,597

Balance at December 30, 2006 .......................................... 426,177,619 4,262 1,700,976 $ — 295,253 3,370,538 (2,773,582)

Comprehensive income:.....................................................

Net earnings ................................................................... 395,615 395,615

Foreign currency translation adjustment........................ 179,130 179,130

Deferred pension gain .................................................... 23,192 23,192

Amortization of gain on hedge ...................................... (1,659) (1,659)

Comprehensive income.................................................. $ 596,278

Adoption of FIN 48........................................................ 17,652

Acquisition of treasury stock ............................................. (210,793)

Grant of long-term incentive stock .................................... 765,754 8 (8)

Forfeiture of restricted stock.............................................. (87,861) (1) 1

Exercise of stock options (including income tax benefits

and withholding) .............................................................. 1,849,657 18 43,909

Issuance of stock under employee stock purchase plans ... 72,456 1 1,515

Direct Stock Purchase Plans .............................................. 46 26

Amortization of long-term incentive stock grant............... 37,745

Balance at December 29, 2007 ........................................ 428,777,625 $ 4,288 $ 1,784,184 $ — $ 495,916 $ 3,783,805 $ (2,984,349)