Office Depot 2007 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2007 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

During 2008, we anticipate continued negative margin impacts, partially offset by continued positive operating

expense comparisons as we benefit from operational actions taken in 2007.

INTERNATIONAL DIVISION

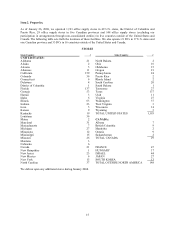

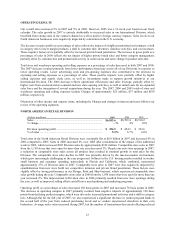

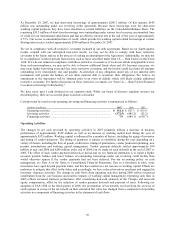

(Dollars in millions) 2007 2006 2005

Sales .............................................................................................. $4,195.6 $3,644.6 $3,470.9

% change ....................................................................................... 15% 5% (3)%

Division operating profit ............................................................... $ 231.1 $ 249.2 $ 207.5

% of sales ...................................................................................... 5.5% 6.8% 6.0%

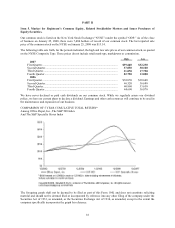

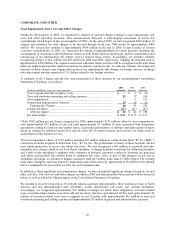

Sales in our International Division increased 15% in 2007, 5% in 2006 and declined 3% in 2005. Local currency

sales increased 6% in 2007 and 7% in 2006 after considering the impact of the additional week in 2005, which

increased 2005 Division sales by approximately $68 million. The contract channel displayed the strongest

performance by increasing sales in local currencies by 12% in 2007. Local currency sales in the direct channel were

slightly negative, reflecting a 5% decline in our business in the UK. The UK historically has accounted for about a

third of Division sales and about half of Division operating profit. During the second half of 2007, the operating

profit contribution of the UK decreased significantly. We see continuing signs of an economic slowdown in the UK,

which, if it persists, could provide additional challenges to our operations. We have identified some controllable

issues to improve delivery service levels which we expect will mitigate performance risks in the UK. The retail

channel, while a smaller part of our offering in this Division, increased sales in local currencies. The increase in

sales in 2006 reflects improved performance in all channels and the impact of acquisitions. During 2006, we

acquired all or a majority interest in entities headquartered in South Korea, the Czech Republic and China, and

increased our previous investment to a majority position in an entity in Israel. Results of those entities have been

consolidated in our financial statements since the dates of acquisition.

Operating profit as a percentage of sales decreased 130 basis points in 2007 and increased 80 basis points in 2006.

The 2007 decrease reflects lower performance of approximately 80 basis points, primarily from the UK, and to a

lesser extent, a greater percentage of contract sales in our sales mix. To support growth initiatives, the Division has

established regional offices in Asia and Latin America, centralized certain support functions in Europe, expanded

into Poland and consolidated certain warehouse facilities. While these investments are expected to provide operating

margin expansion over the longer term, they lowered 2007 operating margin by approximately 80 basis points.

Partially offsetting the decrease in operating margin in 2007 were positive impacts totaling approximately 30 basis

points, which resulted primarily from lower performance-based variable pay as a result of lower Division

performance. The 2006 increase in operating profit reflects primarily operational efficiencies from streamlining

activities initiated in 2005 and continuing in 2006. The addition of lower margin business, as well as an increase in

the relative proportion of contract sales in 2006 was partially offset by increased private brand sales. During 2006,

we increased the size of our contract sales force across Europe and increased the use of telephone account managers

to drive account penetration.

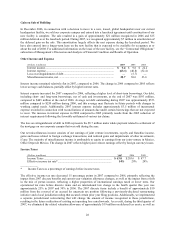

For U.S. reporting, the International Division’s sales are translated into U.S. dollars at average exchange rates

experienced during the year. The Division’s reported sales were positively impacted by foreign currency exchange

rates in 2007 by $322 million and in 2006 by $23 million. Division operating profit was also positively impacted

from changes in foreign exchange rates by $20 million in 2007 and $2 million in 2006. Internally, we analyze our

international operations in terms of local currency performance to allow focus on operating trends and results.

Barring a change in economic conditions, we expect continued challenges in the first half of 2008, with stronger

performance in the second half of the year as we anticipate improvement in the UK and as we more fully realize the

benefits of the investments we have made in our businesses in Europe and Asia.