Office Depot 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.55

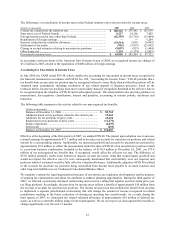

With our adoption of FAS 123R, we decided to use both the Black-Scholes valuation model and straight-line

amortization of compensation expense over the requisite service period of the grant. We will reconsider use of this

model if additional information becomes available in the future that indicates another model would be more

appropriate for us, or if grants issued in future periods have characteristics that cannot be reasonably estimated using

this model. We have previously estimated forfeitures in our expense calculation for pro forma footnote disclosure

and no change in that methodology was made upon adoption of FAS 123R.

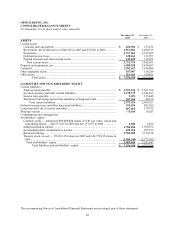

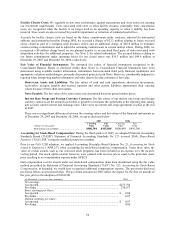

Accrued Expenses: Included in accrued expenses and other current liabilities in our Consolidated Balance Sheets

are accrued payroll-related amounts of approximately $187 million and $250 million at December 29, 2007 and

December 30, 2006, respectively.

Revenue Recognition: Revenue is recognized at the point of sale for retail transactions and at the time of successful

delivery for contract, catalog and internet sales. Sales taxes collected are not included in reported sales. We use

judgment in estimating sales returns, considering numerous factors such as current overall and industry-specific

economic conditions and historical sales return rates. Although we consider our sales return accruals to be adequate

and proper, changes in historical customer patterns could require adjustments to the provision for returns. We also

record reductions to our revenues for customer programs and incentive offerings including special pricing

agreements, certain promotions and other volume-based incentives. Revenue from sales of extended warranty

service plans is either recognized at the point of sale or over the warranty period, depending on the determination of

legal obligor status. All performance obligations and risk of loss associated with such contracts are transferred to an

unrelated third-party administrator at the time the contracts are sold. Costs associated with these contracts are

recognized in the same period as the related revenue.

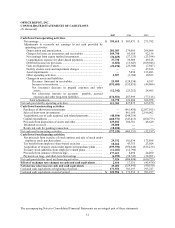

Shipping and Handling Fees and Costs: Income generated from shipping and handling fees is classified as

revenues for all periods presented. Freight costs incurred to bring merchandise to stores and warehouses are included

as a component of inventory and costs of goods sold. Freight costs incurred to ship merchandise to customers are

recorded as a component of store and warehouse operating and selling expenses. Shipping costs, combined with

warehouse handling costs, totaled $963.7 million in 2007, $920.9 million in 2006 and $905.6 million in 2005.

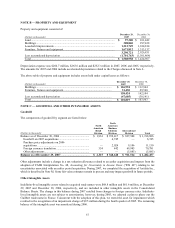

Advertising: Advertising costs are charged either to expense when incurred or, in the case of direct marketing

advertising, capitalized and amortized in proportion to the related revenues over the estimated life of the material,

which range from several months to up to one year.

Advertising expense recognized was $564.9 million in 2007, $575.3 million in 2006 and $549.6 million in 2005.

Prepaid advertising costs were $27.9 million as of December 29, 2007 and $25.0 million as of December 30, 2006.

Pre-opening Expenses: Pre-opening expenses related to opening new stores and warehouses or relocating existing

stores and warehouses are expensed as incurred and included in store and warehouse operating and selling expenses.

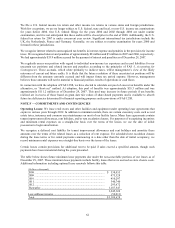

Self-Insurance: Office Depot is primarily self-insured for workers’ compensation, auto and general liability and

employee medical insurance programs. Self-insurance liabilities are based on claims filed and estimates of claims

incurred but not reported. These liabilities are not discounted.

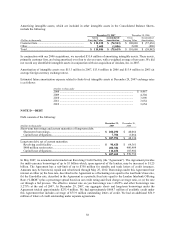

Comprehensive Income: Comprehensive income represents the change in stockholders’ equity from transactions

and other events and circumstances arising from non-stockholder sources. Comprehensive income consists of net

earnings, foreign currency translation adjustments, realized or unrealized gains (losses) on investment securities that

are available-for-sale, deferred pension gains and losses and elements of qualifying cash flow hedges, net of

applicable income taxes. As of December 29, 2007, our Consolidated Balance Sheet reflected accumulated other

comprehensive income in the amount of $495.9 million, which consisted of $469.4 million in foreign currency

translation adjustments, $9.4 million in unamortized gain on hedge and $17.1 million in deferred pension gain.

Derivative Financial Instruments: Certain derivative financial instruments may be used to hedge the exposure to

foreign currency exchange rate, fuel price change and interest rate risks, subject to an established risk management

policy. Financial instruments authorized under this policy include swaps, options, caps, forwards and futures. Use of

derivative financial instruments for trading or speculative purposes is prohibited by company policies.

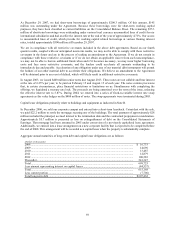

Vendor Arrangements: We enter into arrangements with substantially all of our significant vendors that provide

for some form of consideration to be received from the vendors. Arrangements vary, but generally specify volume

rebate thresholds, advertising support levels, as well as terms for payment and other administrative matters. The

volume-based rebates, supported by a vendor agreement, are estimated throughout the year and reduce the cost of