Office Depot 2007 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2007 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.21

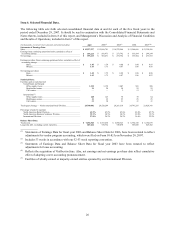

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

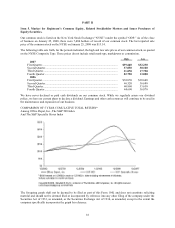

RESULTS OF OPERATIONS

GENERAL

Our fiscal year results are based on a 52- or 53-week retail calendar ending on the last Saturday in December. Fiscal

year 2005 is based on 53 weeks, with a 14-week fourth quarter. Our comparable store sales (or “comp” sales) relate

to stores that have been open for at least one year. For 2005, this comparison has been adjusted to a 52-week basis.

RESTATEMENT OF FINANCIAL STATEMENTS

On October 29, 2007, we announced that our Audit Committee initiated an independent review principally focused

on the accounting for certain vendor program funds. The review, which arose from a whistleblower complaint, was

conducted with the assistance of independent legal counsel and forensic accountants. The investigation revealed

errors in the timing of recognition of certain vendor program funds. The impact of these errors was to reduce

previously reported gross profit, operating profit, net earnings and earnings per share in fiscal 2006 and the first two

quarters of 2007 and defer recognition into future periods. Additionally, inventories and tax accounts were adjusted

on the consolidated balance sheet related to these deferrals.

On November 8, 2007, the Board of Directors of the company approved a decision to restate our 2006 financial

statements including corrections to amounts previously reported in the third and fourth quarters of 2006 and the

interim financial statements for the first and second quarters of 2007.

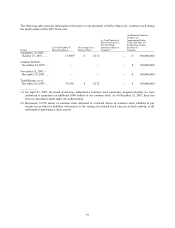

On November 20, 2007, we amended our previously filed Form 10-K for the fiscal year 2006 and our previously

filed Forms 10-Q for the first and second quarters of 2007. The financial statements and related disclosures for the

period ended September 30, 2006 were restated to reflect the impact of the errors discussed above in our Form 10-Q

for the quarter ended September 29, 2007, which was also filed on November 20, 2007. Our amended reports reflect

a reduction in diluted earnings per share of $0.02 in the quarter ended September 30, 2006, $0.03 in the quarter

ended December 30, 2006, $0.01 in the quarter ended March 31, 2007, and $0.02 in the quarter ended June 30, 2007

as compared to amounts previously reported. Because of rounding and changes in share count, the diluted EPS

impact over the period aggregates to $0.04 for fiscal year 2006 and a total of $0.07 per share over the period from

the third quarter of 2006 through the second quarter of 2007. The future impact of the deferrals related to one period

were considered in determining net deferrals in subsequent periods. The net deferral became a positive impact

beginning in the later part of 2007 and extending through the years from 2008 through 2010. The financial

restatements resulted in reductions of previously reported company gross profit of approximately $7 million in the

quarter ended September 30, 2006, $14 million in the quarter ended December 30, 2006 (an aggregate of $20

million for fiscal year 2006), $3 million in the quarter ended March 31, 2007, and $6 million in the quarter ended

June 30, 2007. Approximately $12 million of the amount deferred at the end of the third quarter of 2007 reversed in

the fourth quarter of 2007 and remaining amounts will reverse in the years through 2010.

These restatements related to non-cash items and the reduction in net earnings was offset in the consolidated

statement of cash flows by a change in working capital and other items such that net cash provided by operating

activities did not change for the periods restated. The primary impact to the balance sheet was to reduce inventories

by the amounts deferred and to increase short-term deferred tax assets for the tax impacts of the change in pre-tax

earnings.

OVERVIEW

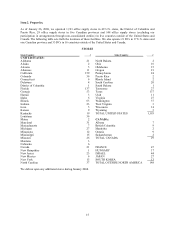

Our business is comprised of three reportable segments. The North American Retail Division includes our retail

office supply stores in the U.S. and Canada, which offer office supplies, computers and business machines and

related supplies, and office furniture. Most stores also offer a design, print and ship center offering graphic design,

printing, reproduction, mailing and shipping. The North American Business Solutions Division sells office supply

products and services in the U.S. and Canada directly to businesses through catalogs, internet web sites and a

dedicated sales force. Our International Division sells office products and services through catalogs, internet web

sites, a dedicated sales force and retail stores.