Memorex 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

We are subject to several pending or threatened legal actions by the individual European national levy collecting

societies in relation to private copyright levies under the European Copyright Directive. Those actions generally seek payment

of the commercial and consumer optical levies withheld by Imation. Imation has corresponding claims in those actions

seeking reimbursement of levies improperly collected by those collecting societies. Although these actions are subject to the

uncertainties inherent in the litigation process, based on the information presently available to us, management does not

expect that the ultimate resolution of these actions will have a material adverse effect on our financial condition, results of

operations or cash flows. We anticipate that court decisions may be rendered in 2013 that may directly or indirectly impact our

levy exposure in specific European countries which could trigger a review of our levy exposure in those countries.

Note 16 — Related Party Transactions

As a result of the arrangement to acquire the rights to the TDK Life on Record brand under an exclusive long-term

license from TDK Corporation (TDK), TDK became our largest shareholder and owned approximately 18 percent and 20

percent of our shares as of December 31, 2012 and 2011. In connection with this arrangement we entered into a Supply

Agreement with TDK.

In 2012, 2011 and 2010 we purchased products and services under the Supply Agreement which allows us to purchase

a limited number of LTO Tape media and Blu-ray removable recording media products and accessory products for resale in

the aggregate amounts of approximately $38 million, $50 million and $28 million, respectively, from TDK or its affiliates. We

did not sell products nor provide services to TDK or its affiliates in 2012, 2011 or 2010. Trade payables to TDK or its affiliates

were $9.1 million and $9.8 million at December 31, 2012 and 2011, respectively. No trade receivables from TDK or its

affiliates were outstanding as of December 31, 2012 or December 31, 2011.

On January 13, 2011, the Board of Directors approved a restructuring plan to discontinue our tape coating operations at

our Weatherford, Oklahoma facility by April 2011 and subsequently close the facility. We signed a strategic agreement with

TDK to jointly develop and manufacture magnetic tape technologies. Under the agreement, we will collaborate on the

research and development of future tape formats in both companies’ research centers in the U.S. and Japan, while

consolidating tape coating operations to the TDK Yamanashi manufacturing facility.

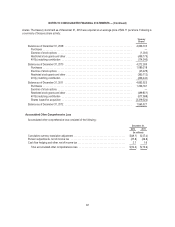

Note 17 — Quarterly Data (Unaudited)

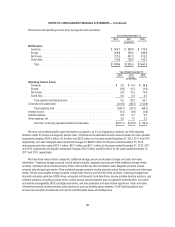

First Second Third Fourth Total(1)

(In millions, except per share amounts)

2011

Net revenue ...................................... $316.5 $323.0 $308.6 $ 342.3 $1,290.4

Gross profit ....................................... 54.0 54.0 57.2 51.5 216.7

Operating loss ..................................... (3.4) (9.3) (8.3) (12.1) (33.1)

Net loss .......................................... (7.2) (12.5) (14.1) (12.9) (46.7)

Loss per common share, net loss:

Basic ......................................... $(0.19) $ (0.33) $ (0.38) $ (0.34) $ (1.24)

Diluted ........................................ (0.19) (0.33) (0.38) (0.34) (1.24)

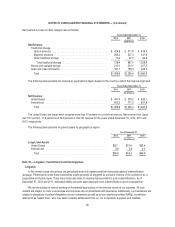

2012

Net revenue ...................................... $281.7 $270.6 $248.2 $ 299.1 $1,099.6

Gross profit ....................................... 56.1 52.4 45.7 48.1 202.3

Operating loss ..................................... (8.9) (10.3) (6.5) (310.4) (336.1)

Net loss .......................................... (12.2) (12.0) (6.3) (310.2) (340.7)

Loss per common share, net loss:

Basic ......................................... $(0.33) $ (0.32) $ (0.17) $ (8.34) $ (9.09)

Diluted ........................................ (0.33) (0.32) (0.17) (8.34) (9.09)

(1) The sum of the quarterly loss per share may not equal the annual loss per share due to changes in average shares

outstanding.

93