Memorex 2012 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2012 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

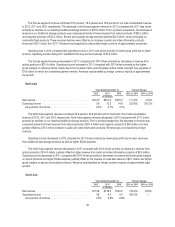

R&D expense increased in 2012 compared with 2011 due to our acquisitions and investment to support growth

initiatives in secure and scalable storage products.

R&D expense increased in 2011 compared with 2010 due to our investment to support growth initiatives in secure and

scalable storage products. During 2011 we refocused our R&D effort to invest in four core product technology areas: secure

storage, scalable storage, wireless/connectivity and magnetic tape. This resulted in an increase in our R&D expense as a

percent of revenue in 2011 compared with 2010.

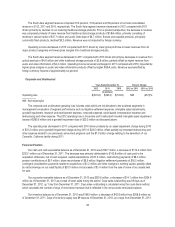

Goodwill Impairment

Years Ended December 31,

2012 2011 2010

(In millions)

Goodwill impairment ............................................................. $23.3 $1.6 $23.5

We test the carrying amount of a reporting unit’s goodwill for impairment on an annual basis during the fourth quarter of

each year or if an event occurs or circumstances change that would warrant impairment testing during an interim period.

During 2011, we acquired the assets of MXI Security, from Memory Experts International Inc., (MXI) and the secure data

storage hardware business of IronKey Systems Inc. (IronKey) which resulted in goodwill of $21.9 million and $9.4 million,

respectively. These businesses, along with our Imation Defender brand, make up our Americas-Mobile Security reporting unit.

The carrying value of our Mobile Security reporting unit included $31.3 million of goodwill prior to our 2012 impairment testing.

During the second and third quarters of 2012, we adjusted our internal financial forecast for our Americas-Mobile

Security reporting unit due to changes in timing of expected cash flows and lower expected short-term revenues and lower

gross margins. As we considered these factors to be an event that warranted an interim test as to whether the goodwill was

impaired, we performed an impairment test as of each of these periods. These impairment tests resulted in no impairment of

goodwill as the estimated fair value of the reporting units exceeded the carrying value in step 1 of the impairment tests by

43.3 percent and 17.7 percent, during the second and third quarter of 2012, respectively. During the fourth quarter of 2012,

our internal financial forecast for our Americas-Mobile Security reporting unit was again adjusted with further declines in our

revenue and gross margin projections resulting from lower expectations in the high-security market segment. In accordance

with our policy, we performed our annual assessment of goodwill in the Americas-Mobile Security reporting unit during the

fourth quarter of 2012 and, as a result of this assessment, it was determined that the fair value of our Mobile Security

reporting unit was impaired. We recorded an impairment charge of $23.3 million to the Americas reporting segment in the

Consolidated Statements of Operations.

In determining the estimated fair value of the reporting unit, we used the income approach, a valuation technique under

which we estimate future cash flows using the reporting unit’s financial forecasts. Our expected cash flows are affected by

various significant assumptions, including the discount rate, revenue and gross margin expectations and terminal value

growth rate. Our analysis utilized discounted forecasted cash flows over a 10 year period with an estimation of residual growth

rates thereafter. We use our business plans and projections as the basis for expected future cash flows. The significant

assumptions used include a discount rate of 16.0 percent to reflect the relevant risks of the higher growth assumed for the

Americas-Mobile Security reporting unit, revenue growth rates, which were forecasted to be significant, and a terminal growth

rate of 2.5 percent.

An increase in the discount rate of one percent would have decreased the reporting unit’s fair value by approximately

4.0 percent while a decrease in the discount rate by one percent would have increased the reporting unit’s fair value by 4.7

percent. The revenue growth rates in 2013 through 2015 are significant assumptions within the projections.

During 2011, we acquired substantially all of the assets of BeCompliant Corporation, doing business as Encryptx

(Encryptx) which resulted in goodwill of $1.6 million. The goodwill was allocated to our existing Americas-Commercial

reporting unit. Based on an interim goodwill impairment test performed at March 31, 2011, we determined that the goodwill in

25