Memorex 2012 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2012 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity

Securities.

(a) — (b)

As of March 6, 2013, there were 41,508,767 shares of our common stock, $0.01 par value (common stock), outstanding

and held by 20,009 shareholders of record. Our common stock is listed on the New York Stock Exchange and the Chicago

Stock Exchange under the symbol “IMN.” No dividends were declared or paid during 2012 or 2011. Future dividend payments

will depend on our earnings, capital requirements, financial condition and other factors considered relevant by our Board of

Directors.

Unregistered Sales of Equity Securities

On December 31, 2012, Imation Corp. entered into an agreement to purchase Nexsan. A portion of the consideration

paid to Nexsan consisted of 3,319,324 shares of our common stock. The issuance of such shares was exempt from

registration under the Securities Act of 1933, as amended (Securities Act), pursuant to Section 4 (2) of the Securities Act. The

Company filed a registration statement on Form S-3 under the Securities Act for the resale of such shares.

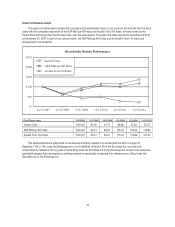

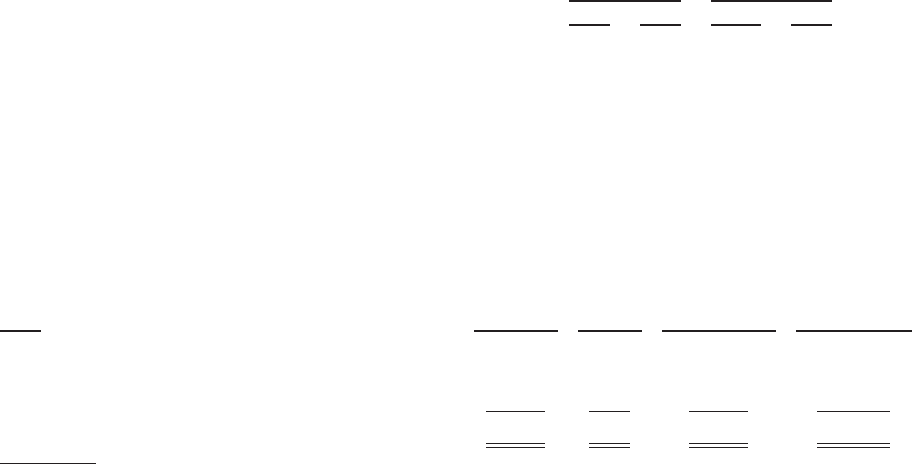

The following table sets forth, for the periods indicated, the high and low sales prices of common stock as reported on

the New York Stock Exchange.

2012 Sales Prices 2011 Sales Prices

High Low High Low

First quarter ..................................... $6.42 $5.67 $12.36 $9.81

Second quarter ................................... $6.30 $5.54 $11.97 $8.50

Third quarter ..................................... $5.98 $5.40 $ 9.98 $6.64

Fourth quarter .................................... $5.69 $3.95 $ 8.00 $5.40

(c)

Issuer Purchases of Equity Securities

Period

(a)

Total Number

of Shares

Purchased

(b)

Average

Price Paid

per Share

Total Number of

Shares Purchased

as Part of Publicly

Announced Plans

or Programs

(c)

Maximum Number

of Shares that May

Yet Be Purchased

Under the Plan or

Programs

October 1, 2012—October 31, 2012 .................... — $ — — 4,159,830

November 1, 2012—November 30, 2012 ................ 295,242 4.12 291,506 3,868,324

December 1, 2012—December 31, 2012 ................ 106,124 4.37 104,485 3,763,839

Total ........................................... 401,366 $4.19 395,991 3,763,839

(a) The purchases in this column include shares repurchased as part of our publicly announced programs and include 5,375

shares that were surrendered to Imation by participants in our stock-based compensation plans (the Plans) to satisfy the

tax obligations related to the vesting of restricted stock awards.

(b) The average price paid in this column includes shares repurchased as part of our publicly announced programs and

shares that were surrendered to Imation by participants in the Plans to satisfy the tax obligations related to the vesting of

restricted stock awards.

(c) On May 3, 2012, the Company announced that on May 2, 2012 our Board of Directors authorized a share repurchase

program of 5 million shares of common stock. The authorization has no expiration date. The Company’s previous

authorization, which had 1.2 million shares remaining for purchase, was canceled with the new authorization.

18