Memorex 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

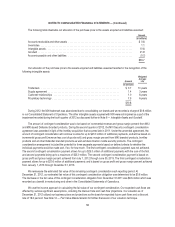

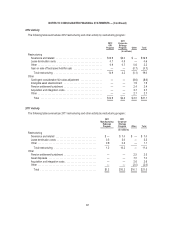

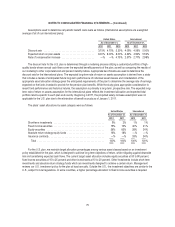

2010 Activity

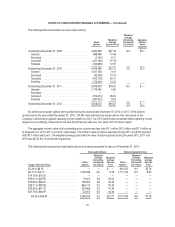

The following table summarizes 2010 restructuring and other activity by restructuring program:

2011

Manufacturing

Redesign

Program

2011

Corporate

Strategy

Program

2008

Corporate

Redesign

Program Other Total

(In millions)

Restructuring

Severance and related ..................... $ 3.2 $3.4 $ 6.4 $ — $13.0

Lease termination costs .................... — — 1.7 — 1.7

Total restructuring ...................... 3.2 3.4 8.1 — 14.7

Other

Pension settlement/curtailment ............... — 0.3 2.5 — 2.8

Asset Impairments ........................ 31.2 — — — 31.2

Other .................................. — — 0.2 2.2 2.4

Total ................................ $34.4 $3.7 $10.8 $2.2 $51.1

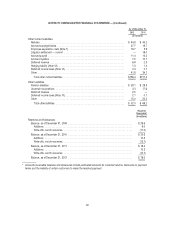

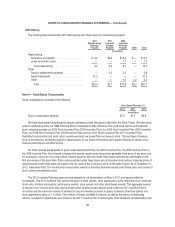

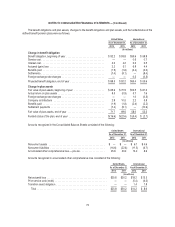

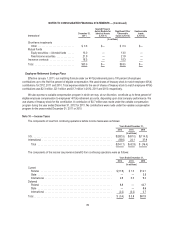

Note 8 — Stock-Based Compensation

Stock compensation consisted of the following:

Years Ended December 31,

2012 2011 2010

(In millions)

Stock compensation expense ......................................... $7.3 $7.5 $6.9

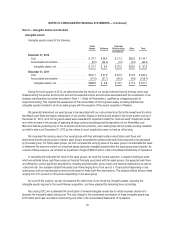

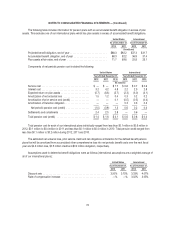

We have stock-based compensation awards outstanding under five plans (collectively, the Stock Plans). We have stock

options outstanding under our 1996 Directors Stock Compensation Plan (Directors Plan) and stock options and restricted

stock outstanding under our 2000 Stock Incentive Plan (2000 Incentive Plan), our 2005 Stock Incentive Plan (2005 Incentive

Plan), our 2008 Stock Incentive Plan (2008 Incentive Plan) and our 2011 Stock Incentive Plan (2011 Incentive Plan).

Restricted stock granted and stock option awards exercised are issued from our treasury stock. The purchase of treasury

stock is discretionary and will be subject to determination by our Board of Directors each quarter following its review of our

financial performance and other factors.

No further shares are available for grant under the Directors Plan, the 2000 Incentive Plan, the 2005 Incentive Plan or

the 2008 Incentive Plan. Stock-based compensation awards issued under these plans generally have terms of ten years and,

for employees, vest over a four-year period. Awards issued to directors under these plans become fully exercisable on the

first anniversary of the grant date. Stock options granted under these plans are not incentive stock options. Exercise prices of

awards issued under these plans are equal to the fair value of the Company’s stock on the date of grant. As of December 31,

2012, there were 4,607,157 stock-based compensation awards outstanding that were issued under these plans and consist of

stock options and restricted stock.

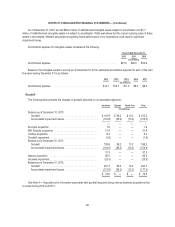

The 2011 Incentive Plan was approved and adopted by our shareholders on May 4, 2011 and became effective

immediately. The 2011 Incentive Plan permits the grant of stock options, stock appreciation rights, restricted stock, restricted

stock units, dividend equivalents, performance awards, stock awards and other stock-based awards. The aggregate number

of shares of our common stock that may be issued under all stock-based awards made under the 2011 Incentive Plan is

4.5 million and the maximum number of shares that may be awarded pursuant to grants of awards other than options and

stock appreciation rights is 1.1 million. The number of shares available for awards, as well as the terms of outstanding

awards, is subject to adjustments as provided in the 2011 Incentive Plan for stock splits, stock dividends, recapitalization and

68