Memorex 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

strategy. Major components of the program included charges associated with certain benefit plans, improvements to our

global sourcing and distribution network, costs associated with further rationalization of our product lines and evolution of our

skill sets to align with our announced strategy. At December 31, 2012, we had approximately $15 million of authorized

spending amounts remaining related to this program. At December 31, 2012, this remaining authorization was transferred and

added to the GPI program and any future charges, as well as the remaining spend relating to the 2011 Corporate Program,

will be accounted for under the 2012 GPI Program.

During 2012, we recorded restructuring charges of $4.2 million associated with this program. These charges were

primarily associated with severance and were included in restructuring and other in our Consolidated Statements of

Operations. Since the inception of this program, we have recorded a total of $13.4 million of severance and related expenses,

$3.5 million of lease termination and modification costs, $1.6 million of inventory write-offs, $0.3 million related to a pension

curtailment charge and $0.9 million of other charges. Inventory write-offs are included in cost of goods sold in our

Consolidated Statements of Operations.

During 2011, we recorded restructuring charges of $10.2 million primarily related to severance and lease termination

costs. In addition, we also recorded inventory write-offs of $1.6 million related to the planned rationalization of certain product

lines as part of this program, which are included in cost of goods sold in the Consolidated Statements of Operations. During

2010, we recorded restructuring charges of $3.4 million for severance and related expenses.

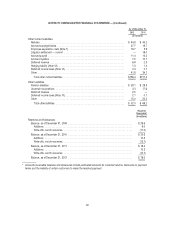

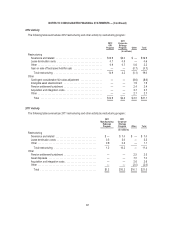

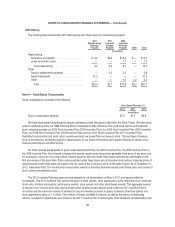

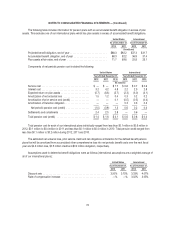

Changes in the 2011 Corporate Program accruals were as follows:

Severance

and Related

Lease

Termination

Costs Other Total

(In millions)

Accrued balance at December 31, 2010 .................... $3.4 $ — $ — $ 3.4

Charges ........................................... 7.0 3.0 0.2 10.2

Usage ............................................. (5.7) (2.3) (0.5) (8.5)

Currency impacts ..................................... (0.1) (0.1) 0.3 0.1

Accrued balance at December 31, 2011 .................... $4.6 $0.6 $ — $ 5.2

Charges ........................................... 3.0 0.5 0.7 4.2

Usage ............................................. (6.1) (0.6) (0.6) (7.3)

Currency impacts ..................................... 0.1 (0.1) 0.1 0.1

Accrued balance at December 31, 2012 .................... $1.6 $0.4 $0.2 $ 2.2

Other Prior Programs Substantially Complete

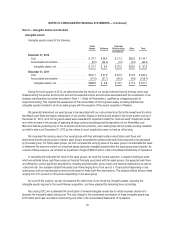

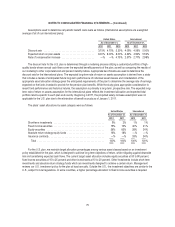

We have had activity related to two additional programs, as described further below, that were initiated in prior years and

are now substantially complete. The 2011 Manufacturing Redesign Restructuring Program (2011 Manufacturing Program)

was initiated during the first quarter of 2011 to rationalize certain product lines and discontinue tape coating operations at our

Weatherford, Oklahoma facility and subsequently close the facility. The 2008 Corporate Redesign Restructuring Program

(2008 Corporate Program) was initiated during the fourth quarter of 2008 and aligned our cost structure by reducing SG&A

expenses. We reduced costs by rationalizing key accounts and products and by simplifying our corporate structure globally.

During 2012, we recorded a gain on the sale of assets from the Weatherford facility of $0.7 million and charges of $0.6

million related to our 2011 Manufacturing Program. These costs were included in restructuring and other in our Consolidated

Statements of Operations.

During 2011, we recorded restructuring charges of $0.3 million for lease termination and modification costs and $0.9

million of site clean-up expenses related to our 2011 Manufacturing Program. These costs were included in restructuring and

65