Memorex 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

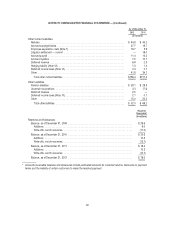

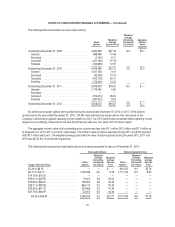

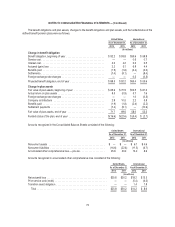

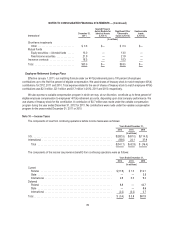

The following table summarizes our stock option activity:

Stock

Options

Weighted

Average

Exercise Price

Weighted

Average

Remaining

Contractual

Life (Years)

Aggregate

Intrinsic

Value

(millions)

Outstanding December 31, 2009 .................. 4,594,838 $27.19 6.2 $0.1

Granted .................................. 889,089 10.46

Exercised ................................. (1,000) 8.11

Canceled ................................. (421,146) 31.19

Forfeited .................................. (145,693) 17.97

Outstanding December 31, 2010 .................. 4,916,088 $24.10 5.6 $0.7

Granted .................................. 1,401,163 9.41

Exercised ................................. (45,429) 10.13

Canceled ................................. (475,703) 35.11

Forfeited .................................. (116,540) 14.34

Outstanding December 31, 2011 .................. 5,679,579 $19.87 6.0 $ —

Granted .................................. 1,178,780 5.80

Exercised ................................. — —

Canceled ................................. (752,415) 26.61

Forfeited .................................. (287,472) 9.24

Outstanding December 31, 2012 .................. 5,818,472 $16.57 5.9 $ —

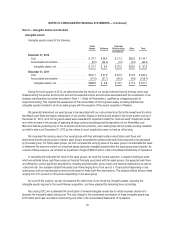

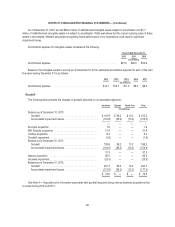

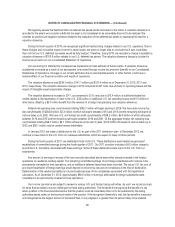

No performance-based options were granted during the years ended December 31, 2012 or 2011. Of the options

granted during the year ended December 31, 2010, 105,397 were performance-based options that vest based on the

Company’s performance against operating income targets for 2010. Our 2010 performance exceeded these operating income

targets and, accordingly, these options will vest 25 percent per year over four years from the date of grant.

The aggregate intrinsic value of all outstanding stock options was less than $0.1 million, $0.0 million and $0.7 million as

of December 31, 2012, 2011 and 2010, respectively. The intrinsic value of options exercised during 2011 and 2010 was less

than $0.1 million each year. The weighted average grant date fair value of options granted during the years 2012, 2011 and

2010 was $2.53, $4.15 and $4.46, respectively.

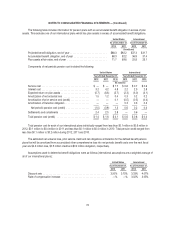

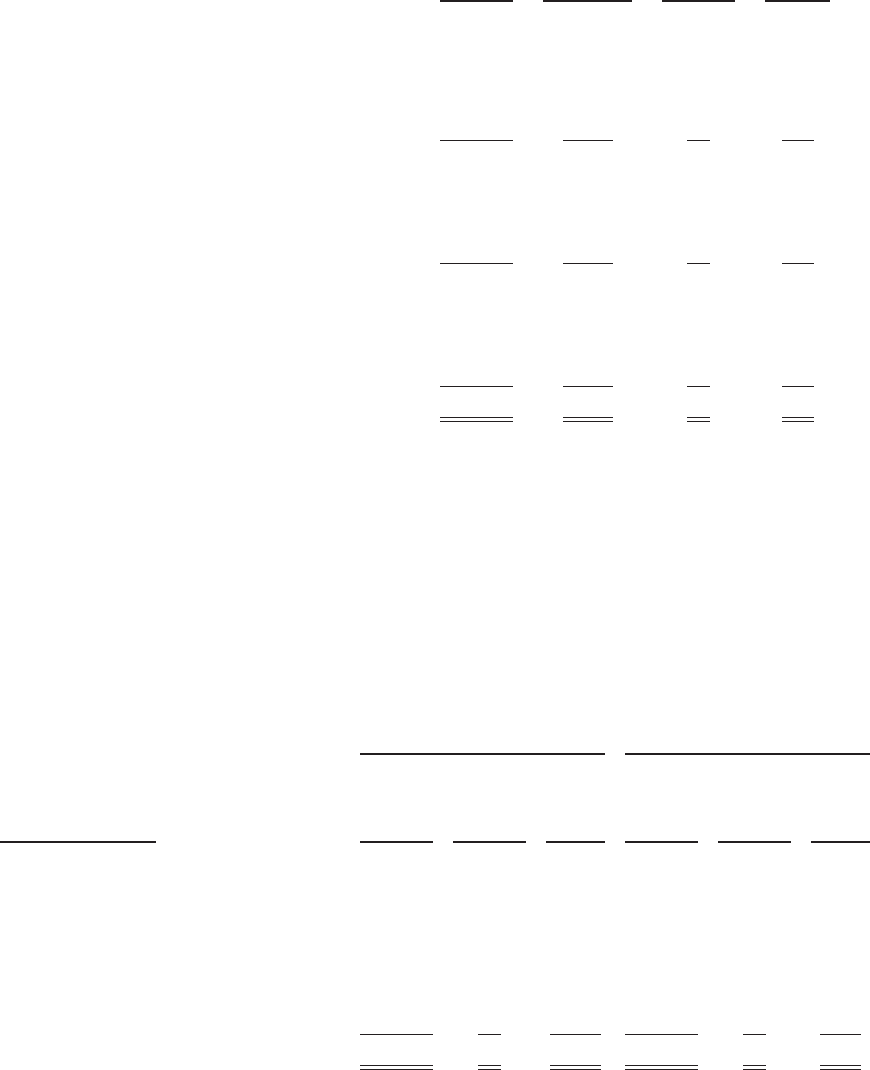

The following table summarizes exercisable options and options expected to vest as of December 31, 2012:

Exercisable Options Options Expected to Vest

Range of Exercise Prices

Stock

Options

Weighted

Average

Remaining

Contractual

Life (Years)

Weighted

Average

Exercise

Price

Stock

Options

Weighted

Average

Remaining

Contractual

Life (Years)

Weighted

Average

Exercise

Price

$4.26 to $6.16 ........................ — — $ — 900,302 9.4 $5.76

$6.17 to $14.15 ....................... 1,578,296 6.0 9.76 1,117,314 8.0 9.43

$14.16 to $19.20 ...................... — — — — — —

$19.21 to $23.95 ...................... 13,000 5.6 20.62 — — —

$23.96 to $28.70 ...................... 749,952 3.8 24.43 — — —

$28.71 to $39.38 ...................... 863,713 2.0 35.33 — — —

$39.39 to $41.75 ...................... 310,965 2.2 41.34 — — —

$41.76 to $46.97 ...................... 33,000 0.6 44.34 — — —

$4.26 to $46.97 ..................... 3,548,926 4.2 $22.21 2,017,616 8.6 $7.79

70