Memorex 2012 Annual Report Download - page 43

Download and view the complete annual report

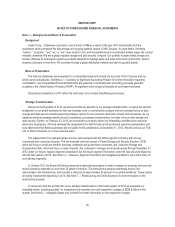

Please find page 43 of the 2012 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.including discounted cash flow analysis. We evaluate assets on our balance sheet, including such intangible assets,

whenever events or changes in circumstances indicate that their carrying value may not be recoverable. Factors such as

unfavorable variances from forecasted cash flows, established business plans or volatility inherent to external markets and

industries may indicate a possible impairment that would require an impairment test. While we believe that the current

carrying value of these assets is not impaired, materially different assumptions regarding future performance of our

businesses, which in many cases require subjective judgments concerning estimates, could result in significant impairment

losses. The test for impairment requires a comparison of the carrying value of the asset or asset group with their estimated

undiscounted future cash flows. If the carrying value of the asset or asset group is considered impaired, an impairment charge

is recorded for the amount by which the carrying value of the asset or asset group exceeds its fair value.

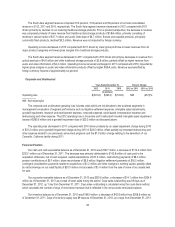

In conjunction with the acceleration of our strategic transformation in the fourth quarter of 2012, we evaluated our

intangible assets for impairment and recorded non-cash impairment charges of $260.5 million in the quarter. The intangible

asset charges are primarily due to an accelerated secular optical market decline. See Intangible Impairments for further

discussion of the impairment test performed. After this impairment loss, and our acquisition of Nexsan, as of December 31,

2012, we had had $80.2 million of definite-lived intangible assets subject to amortization. While we believe that the current

carrying value of these assets is not impaired, materially different assumptions regarding future performance of our

businesses could result in significant impairment losses.

Goodwill. We record all assets and liabilities acquired in purchase acquisitions, including goodwill, at fair value. The

initial recognition of goodwill and subsequent impairment analysis require management to make subjective judgments

concerning estimates of how the acquired assets will perform in the future using valuation methods including discounted cash

flow analysis. Goodwill is the excess of the cost of an acquired entity over the amounts assigned to assets acquired and

liabilities assumed in a business combination. Goodwill is not amortized. We test the carrying amount of a reporting unit’s

goodwill for impairment on an annual basis during the fourth quarter of each year or if an event occurs or circumstances

change that would warrant impairment testing during an interim period.

Goodwill is considered impaired when its carrying amount exceeds its implied fair value. The first step of the impairment

test involves comparing the fair value of the reporting unit to which goodwill was assigned to its carrying amount. The second

step of the impairment test compares the implied fair value of the reporting unit’s goodwill with the carrying amount of the

reporting unit’s goodwill. If the carrying amount of the reporting unit’s goodwill is greater than the implied fair value of the

reporting unit’s goodwill an impairment loss must be recognized for the excess. This involves measuring the fair value of the

reporting unit’s assets and liabilities (both recognized and unrecognized) at the time of the impairment test. The difference

between the reporting unit’s fair value and the fair values assigned to the reporting unit’s individual assets and liabilities is the

implied fair value of the reporting unit’s goodwill.

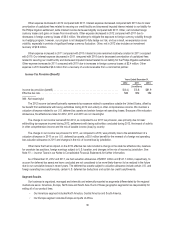

Our reporting units for goodwill are our operating segments (Americas, Europe, North Asia and South Asia) with the

exception of the Americas segment which is further divided between the Americas-Consumer, Americas-Commercial and

Mobile Security reporting units as determined by sales channel.

During 2011, we acquired the assets of MXI Security, from Memory Experts International Inc., (MXI) and the secure data

storage hardware business of IronKey Systems Inc. (IronKey) which resulted in goodwill of $21.9 million and $9.4 million,

respectively. These businesses, along with our Imation Defender brand, make up our Americas-Mobile Security reporting unit.

The carrying value of our Mobile Security reporting unit included $31.3 million of goodwill prior to our 2012 impairment testing.

During the second and third quarters of 2012, we adjusted our internal financial forecast for our Americas-Mobile

Security reporting unit due to changes in timing of expected cash flows and lower expected short-term revenues and lower

gross margins. As we considered these factors to be an event that warranted an interim test as to whether the goodwill was

impaired, we performed an impairment test as of each of these periods. The impairment test resulted in no impairment of

goodwill as there was an excess in fair value over carrying value in step 1 of the impairment test performed for the second

and third quarters of 2012 of 43.3 percent and 17.7 percent, respectively. During the fourth quarter of 2012 our internal

financial forecast for our Americas-Mobile Security reporting unit was again adjusted with further changes in our revenue and

gross margin resulting from lower expectations in the high-security market segment. In accordance with our policy, we

performed an annual assessment of goodwill in the Americas-Mobile Security reporting unit during the fourth quarter of 2012

40