Memorex 2012 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2012 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Consequently, as of December 31, 2012, we are unable to reasonably estimate the ultimate aggregate amount of any

monetary liability or financial impact that we may incur with respect to these matters. It is reasonably possible that the ultimate

resolution of these matters could materially affect our operating results.

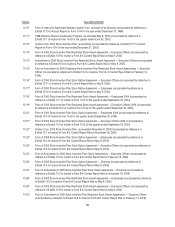

On January 11, 2011, we signed a patent cross-license agreement with SanDisk Corporation (SanDisk) to settle two

patent cases filed by SanDisk in Federal District Court against our flash memory products, including USB drives and solid

state disk (SSD) drives. Under the terms of the cross-license, we will pay SanDisk royalties on certain flash memory products

that were previously not licensed. The specific terms of the cross-license are confidential. The cross-license agreement

required us to make a one-time payment of $2.6 million in 2011, which was included in litigation settlement expense in the

Consolidated Statements of Operations during 2010.

On June 19, 2009 Advanced Research Corp. (ARC) sued Imation in Ramsey County District Court for breach of contract

relating to a supply agreement under which we purchased magnetic heads to write servo patterns on magnetic tape,

requesting the court to order that Imation pay damages and return the purchased heads to ARC. In September 2011 we

agreed to a settlement of $2.0 million, which is included in litigation settlement expense in the Consolidated Statements of

Operations as of December 31, 2011 and was paid during 2012.

In 2009 we entered into a confidential settlement agreement ending all legal disputes with Philips Electronics N.V.,

U.S. Philips Corporation and North American Philips Corporation (collectively, Philips). We had been involved in a complex

series of disputes in multiple jurisdictions regarding cross-licensing and patent infringement related to recordable optical

media. The settlement provided resolution of all claims and counterclaims filed by the parties without any finding or admission

of liability or wrongdoing by any party. As a term of the settlement, we agreed to pay Philips $53.0 million over a period of

three years. Based on the present value of these settlement payments, we recorded a charge of $49.0 million in 2009. We

made payments of $16.5 million, $8.3 million, $8.2 million and $20.0 million in 2012, 2011, 2010 and 2009, respectively, in full

satisfaction of this settlement. Interest accretion of $0.5 million, $1.2 million and $1.5 million was recorded in 2012, 2011 and

2010, respectively. The interest accretion is included in the interest expense on our Consolidated Statements of Operations.

At December 31, 2012, the settlement was paid in full.

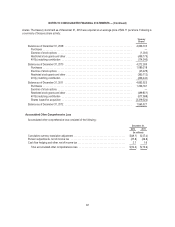

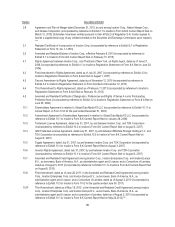

Operating Leases

We incur rent expense under operating leases, which primarily relate to equipment and office space. Most long-term

leases include one or more options to renew at the then fair rental value for a period of approximately one to three years. The

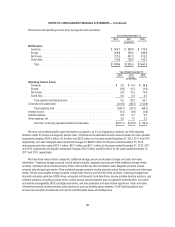

following table sets forth the components of net rent expense for the years ended December 31:

2012 2011 2010

(In millions)

Minimum lease payments ............................................. $6.1 $8.7 $ 9.6

Contingent rentals ................................................... 6.1 4.5 7.2

Rental income ...................................................... (3.4) (3.1) (2.9)

Sublease income .................................................... (0.7) (0.8) (0.5)

Total rental expense ................................................. $8.1 $9.3 $13.4

Minimum lease payments and contingent rental expenses associated with agreements with warehouse providers are

included as a component of cost of goods sold in the Consolidated Statements of Operations. The minimum lease payments

under such arrangements were $0.8 million, $0.8 million and $2.0 million in 2012, 2011 and 2010, respectively. The contingent

rental expenses under such arrangements were $1.8 million, $1.7 million and $3.6 million in 2012, 2011 and 2010, respectively.

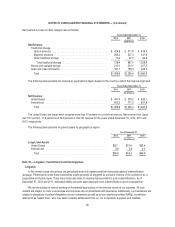

The following table sets forth the minimum rental payments under operating leases with non-cancelable terms in excess

of one year as of December 31, 2012:

2013 2014 2015 2016 2017 Thereafter Total

(In millions)

Minimum lease payments ...................... $8.0 $4.9 $2.1 $1.3 $0.9 $1.6 $18.8

91