Memorex 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

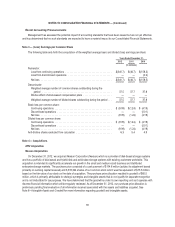

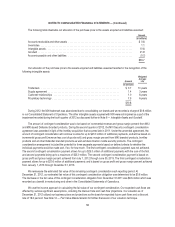

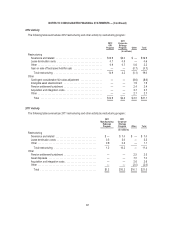

The following table illustrates our allocation of the purchase price to the assets acquired and liabilities assumed:

Amount

(In millions)

Accounts receivable and other assets ............................................... $ 0.8

Inventories ................................................................... 1.1

Intangible assets ............................................................... 10.6

Goodwill ..................................................................... 21.9

Accounts payable and other liabilities ............................................... (0.7)

$33.7

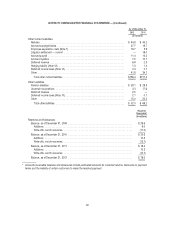

Our allocation of the purchase price to the assets acquired and liabilities assumed resulted in the recognition of the

following intangible assets:

Amount

Weighted

Average

Life

(In millions)

Trademark ......................................................... $ 0.7 10years

Supply agreement .................................................... 1.4 3years

Customer relationships ................................................ 1.0 8years

Proprietary technology ................................................. 7.5 6years

$10.6

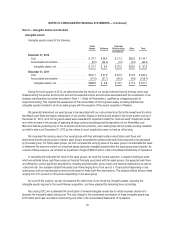

During 2012, the MXI trademark was abandoned due to consolidating our brands and we recorded a charge of $0.6 million

in our Consolidated Statement of Operations. The other intangible assets acquired with MXI were not impaired as a part of the

impairment recorded during the fourth quarter of 2012 as discussed further in Note 6 — Intangible Assets and Goodwill.

The amount of contingent consideration was to be based on incremental revenue and gross margin percent from MXI

and MXI-based Defender branded products. During the second quarter of 2012, the MXI Security contingent consideration

agreement was amended in light of the IronKey acquisition that occurred late in 2011. Under the amended agreement, the

amount of contingent consideration will continue to allow for up to $45.0 million of additional payments, and will be based on

incremental gross profit (revenue less cost of goods sold) and gross margin percent from MXI branded products, IronKey

products and all other Defender branded products as well as future Imation mobile security products. The contingent

consideration arrangement included the potential for three separate payments based on defined criteria for whether the

individual payments would be made and, if so, for how much. The first contingent consideration payment was not achieved.

The second contingent consideration payment allows for up to $25.0 million of additional payments with the sum of the first

and second payments being up to a maximum of $25.0 million. The second contingent consideration payment is based on

gross profit and gross margin percent achieved from July 1, 2012 through June 30, 2013. The third contingent consideration

payment allows for up to $20.0 million of additional payments and is based on gross profit and gross margin percent achieved

from January 1, 2013 through December 31, 2013.

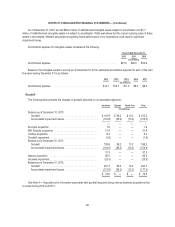

We remeasure the estimated fair value of the remaining contingent consideration each reporting period. At

December 31, 2012, our estimated fair value of this contingent consideration obligation was determined to be $0.6 million.

The decrease in the fair value of this contingent consideration obligation from December 31 2011 was $8.6 million which was

recorded as a benefit in restructuring and other in the Consolidated Statements of Operations.

We use the income approach in calculating the fair value of our contingent consideration. Our expected cash flows are

affected by various significant assumptions, including the discount rate and cash flow projections. Our valuation as of

December 31, 2012 utilized our business plans and projections as the basis for expected future cash flows and a discount

rate of 16.0 percent. See Note 12 — Fair Value Measurements for further discussion of our valuation technique.

58